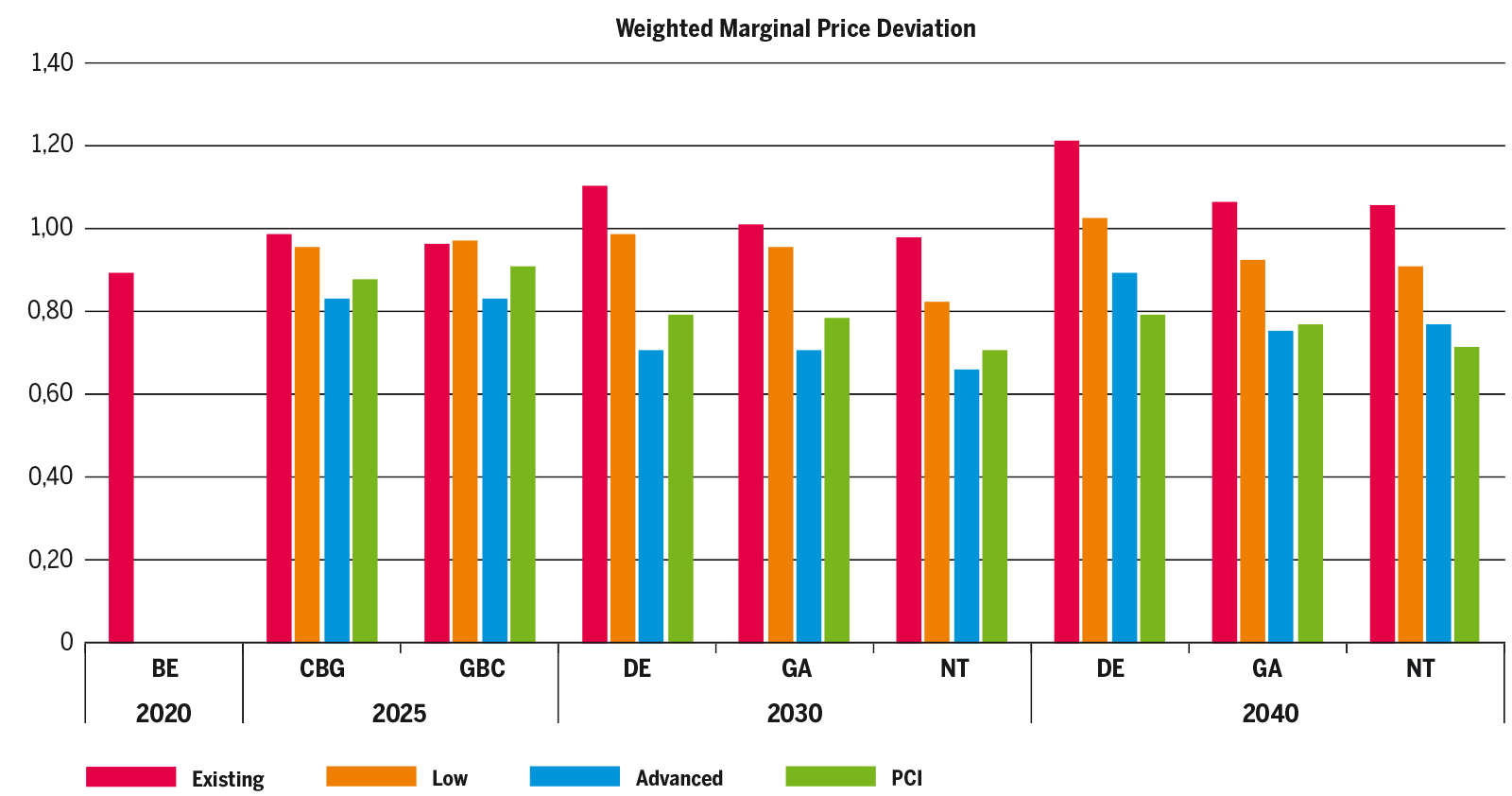

Apart of the maps with presentation how Marginal Price in each country is different than Reference Marginal Price, Weighted Marginal Price Deviation was introduced. It is an average deviation calculated for each specific scenario, year and infrastructure level. Reference price was the same as used for Marginal price results interpretation, which allows to observe and compare increase of convergence between different infrastructure level. For the same reason, this indicator is calculated only for Reference supply price configuration where no specific gas source is significantly cheaper or more expensive than other.

For the results interpretation it is important to remember that demand weighted average deviation is used to measure dispersion between Marginal Prices in European countries and Reference value. Together with additional layer of infrastructure there is possibility to observe how new projects eliminating bottlenecks, creating new capacities between two countries or increasing existing capacity are improving situation. Results of WCF is impacted by the scenarios assumptions such as total demand in EU, demand in specific countries and national production – this is as well influencing different dispersion in comparison of different year and scenario.

The Weighted Marginal Price Deviation measures the dispersion of Marginal Price deltas. The lower Marginal Prices deltas are, the better the Marginal Price convergence. This indicator allows to see direct impact of the infrastructure level, with no interference due to transmission tariffs.

Weighted Marginal Price Deviation results show that successive layers of infrastructure projects (aggregated in infrastructure levels Low, Advanced and PCI) are improving convergence comparing to Existing infrastructure level. New infrastructure projects are decreasing dispersion of Marginal Price deltas (decreasing value of the indicator) around the Europe which is a sign of convergence improvement.

Figure 5.107: Weighted Marginal Price Deviation

Conclusion

The gas infrastructure is key to enable an efficient and competitive gas market. Gas prices generally observed in the EU confirm the efficiency of the European gas infrastructure to ensure price convergence. However, when the European supply flow pattern is oriented from the West to the East or South to North, some regions still experience some misalignment in their marginal price with their neighbouring market areas which are not only reflecting the infrastructure tariffs, but also resulting from infrastructure limitations.

However, the assessment of the different infrastructure level confirm that FID and Advanced projects can further enhance the gas price convergence throughout Europe up to 35 % in Distributed Energy in 2030. The PCI infrastructure projects can improve the convergence of the European gas prices too, however to a lesser extent than the Advanced infrastructure projects.