The Minimum Annual Source Dependence (MASD) should be understood as the minimum share of a given source in the supply mix, being the source share which cannot be substituted by the other supply sources. The analysis is done over the whole year. It has both a European and a country-level dimension. On a European level, it relates to the overall demand and supply volumes that are available. The European level situation therefore reflects a supply gap and not an infrastructure gap. For more details about the demand and supply scenarios, please read the TYNDP2020 Scenario Report.

The MASD is assessed independently for each extra-EU supply under the assumption that countries interact in a cooperative way.

As a consequence of such cooperative behaviour, different levels of dependence between neighbouring countries indicate an infrastructure limitation that can be only mitigated by infrastructure reinforcement.

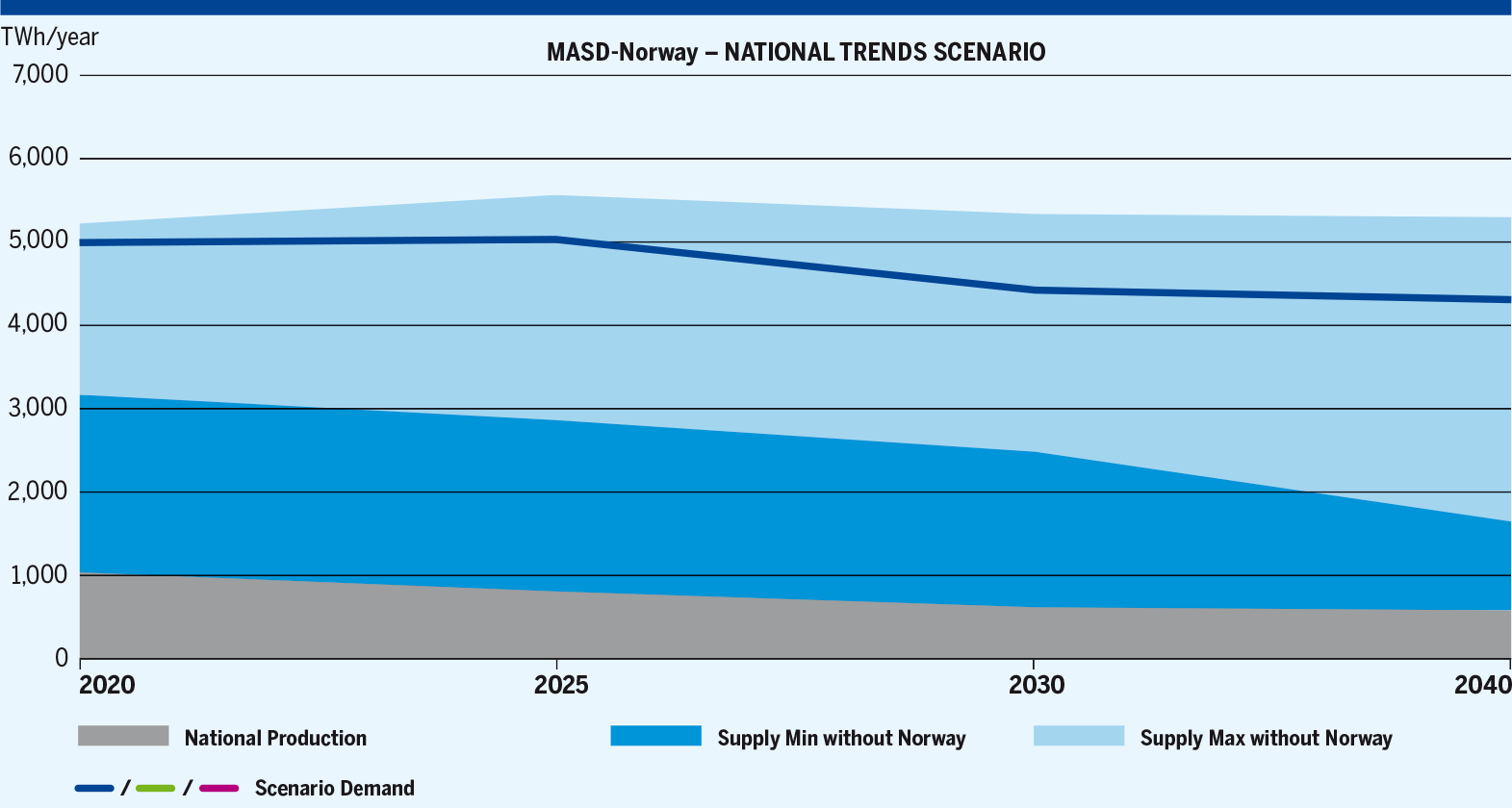

5.2.1 MASD Norway

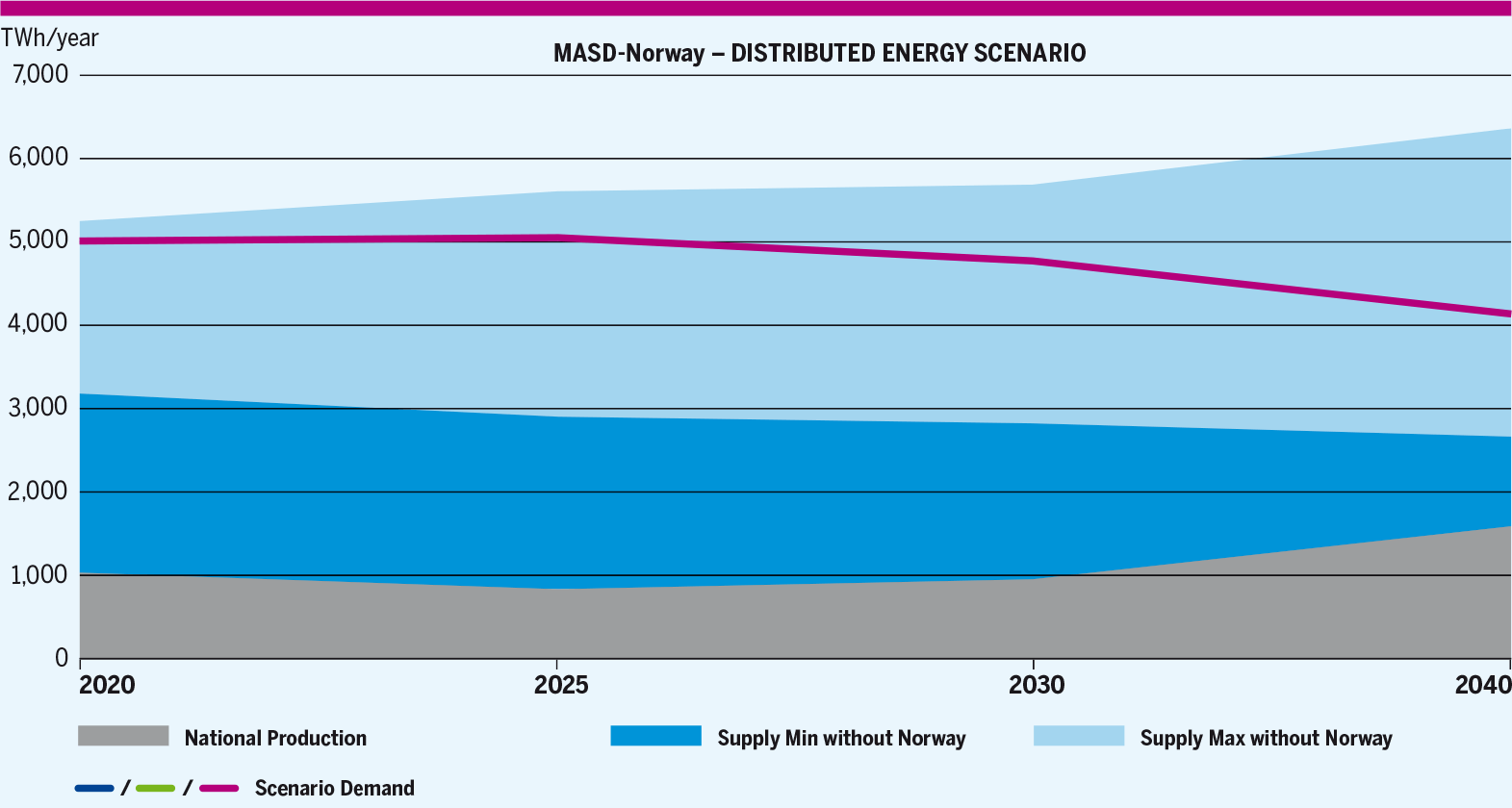

The results for the MASD indicator for Norwegian supply show no dependence for all European countries on Norwegian gas. The other suppliers can satisfy the European demand and the infrastructure is sufficient to provide gas.

The maximum supply potential without considering Norwegian supply can cover the evolution of demand in all scenarios. Results show that Europe is generally not dependent on Norwegian gas and, at country level, the infrastructure network is well developed for all countries to access alternative sources. See Figure 5.3.

- MASD-Norway – NATIONAL TREND SCENARIO

- MASD-Norway – GLOBAL AMBITION SCENARIO

- MASD-Norway – DISTRIBUTED ENERGY SCENARIO

Figure 5.3: European Level Supply and Demand Adequacy with no supply from Norway.

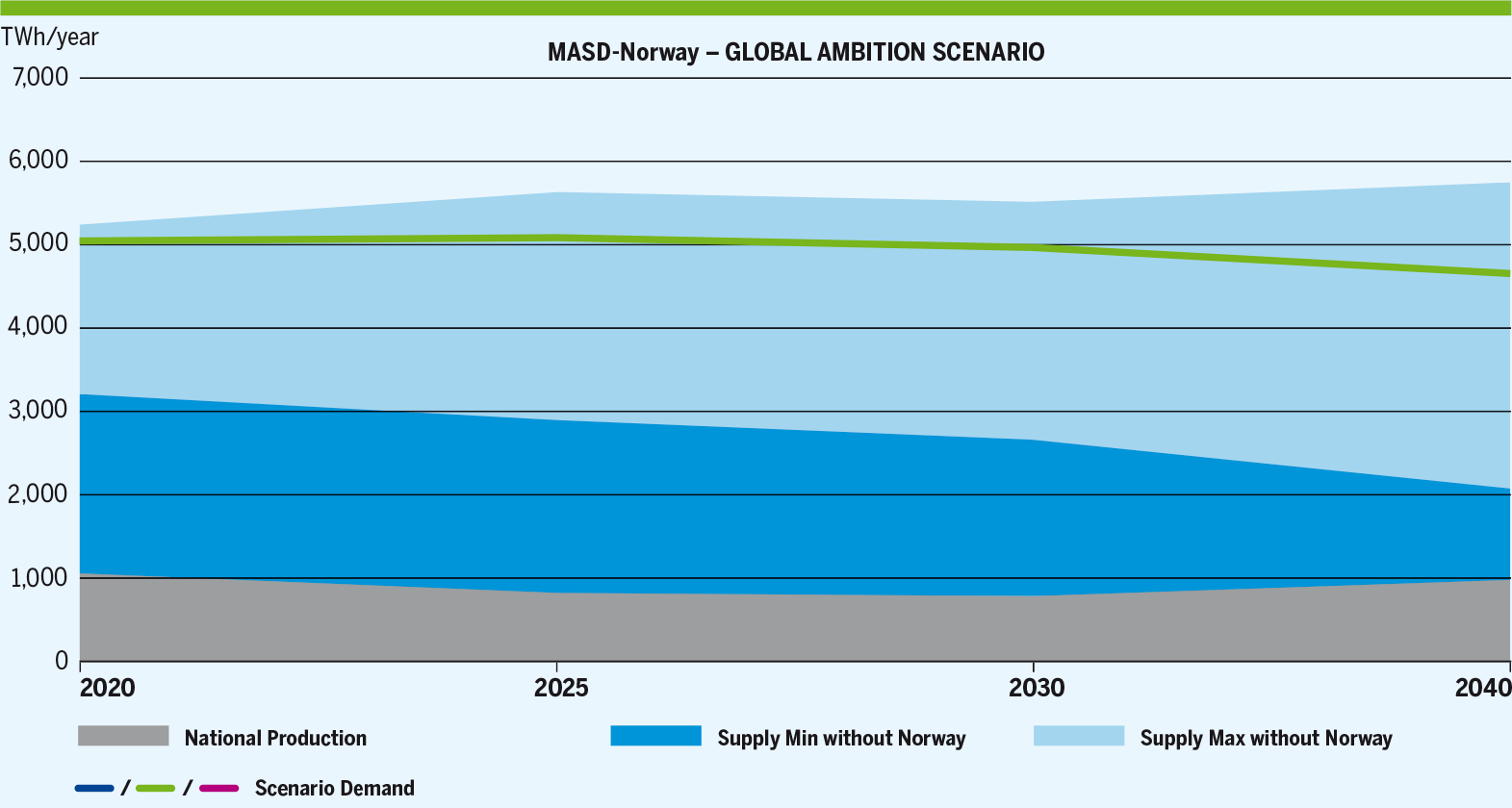

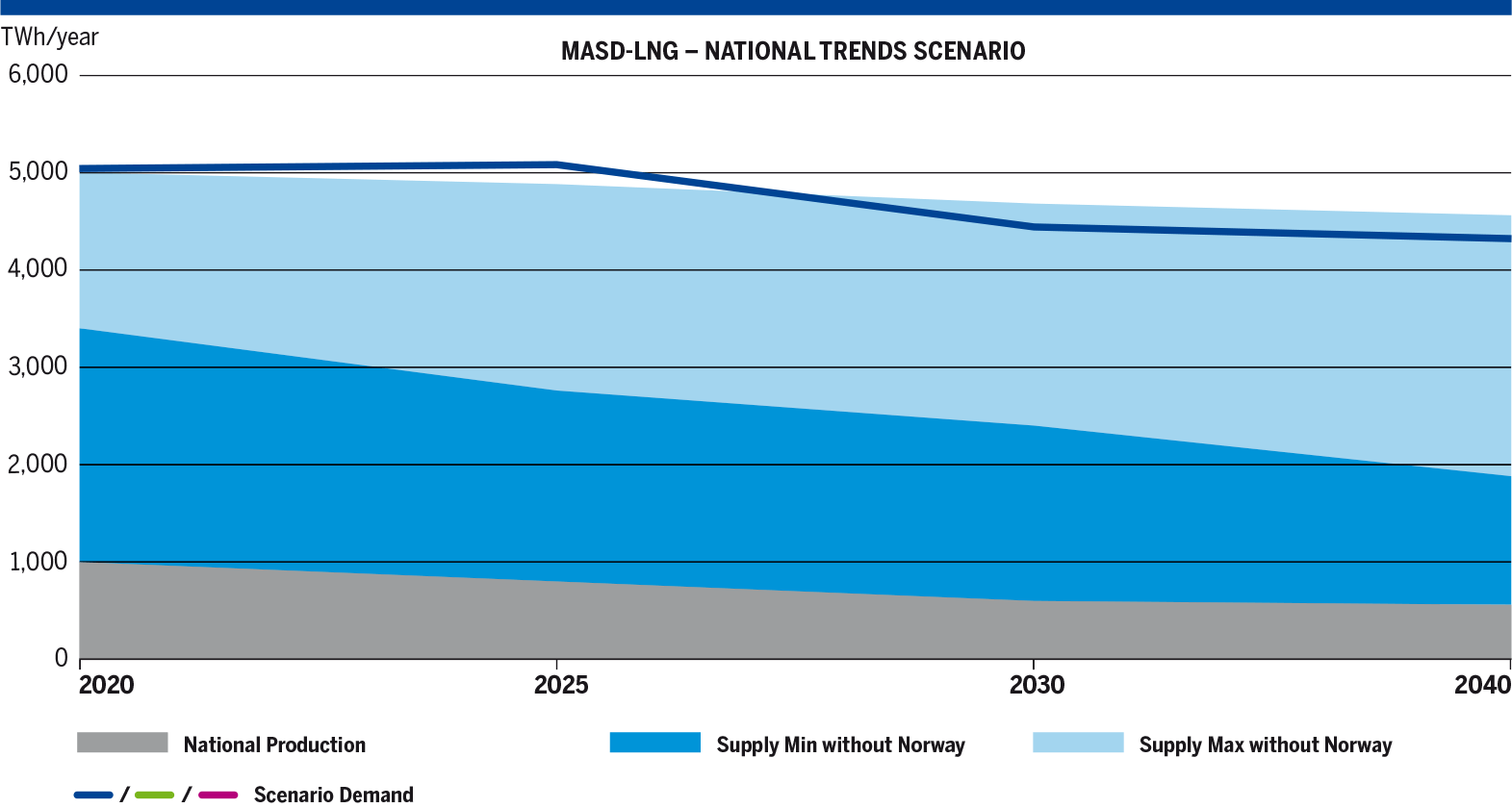

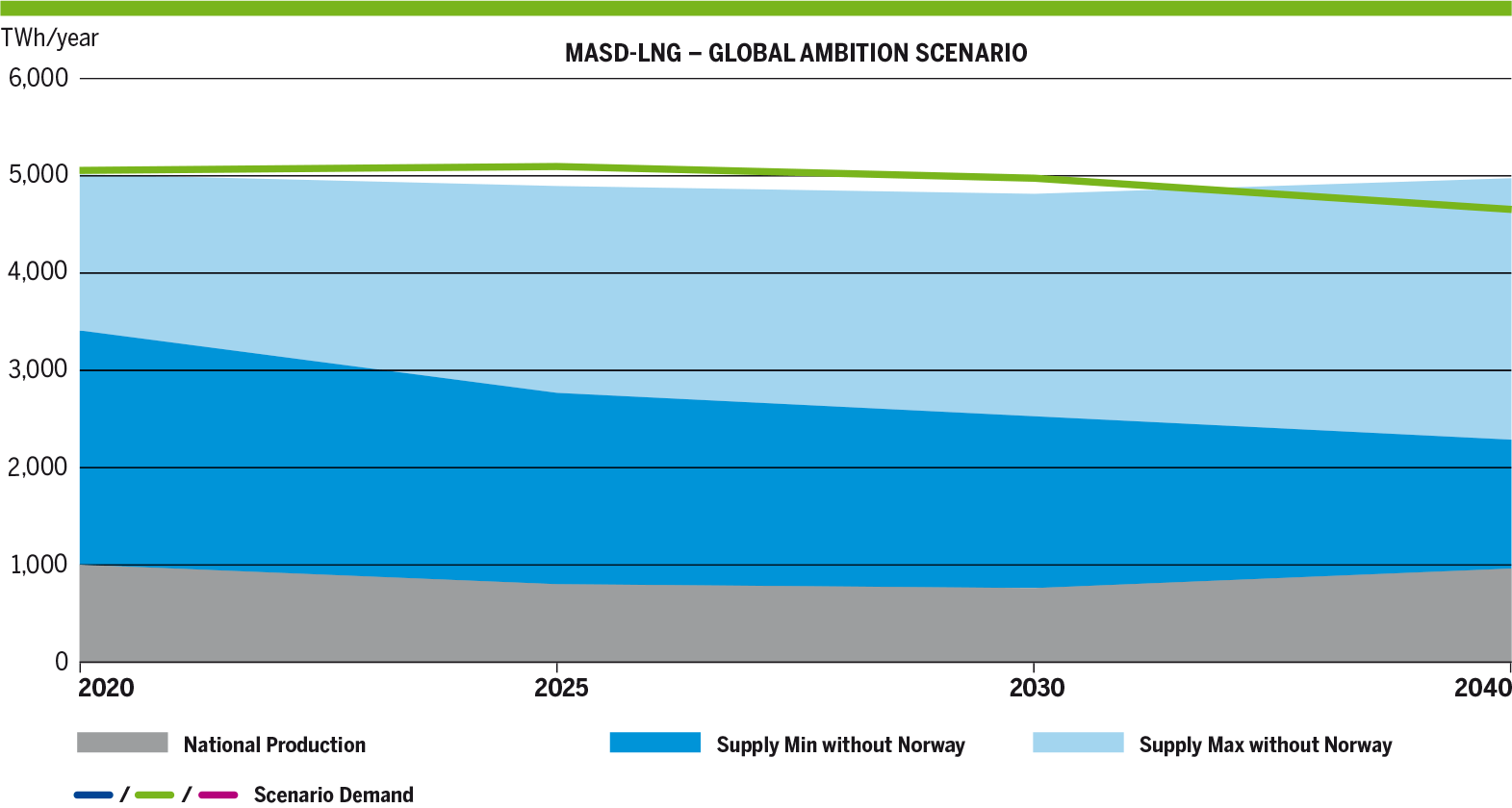

5.2.2 MASD-LNG

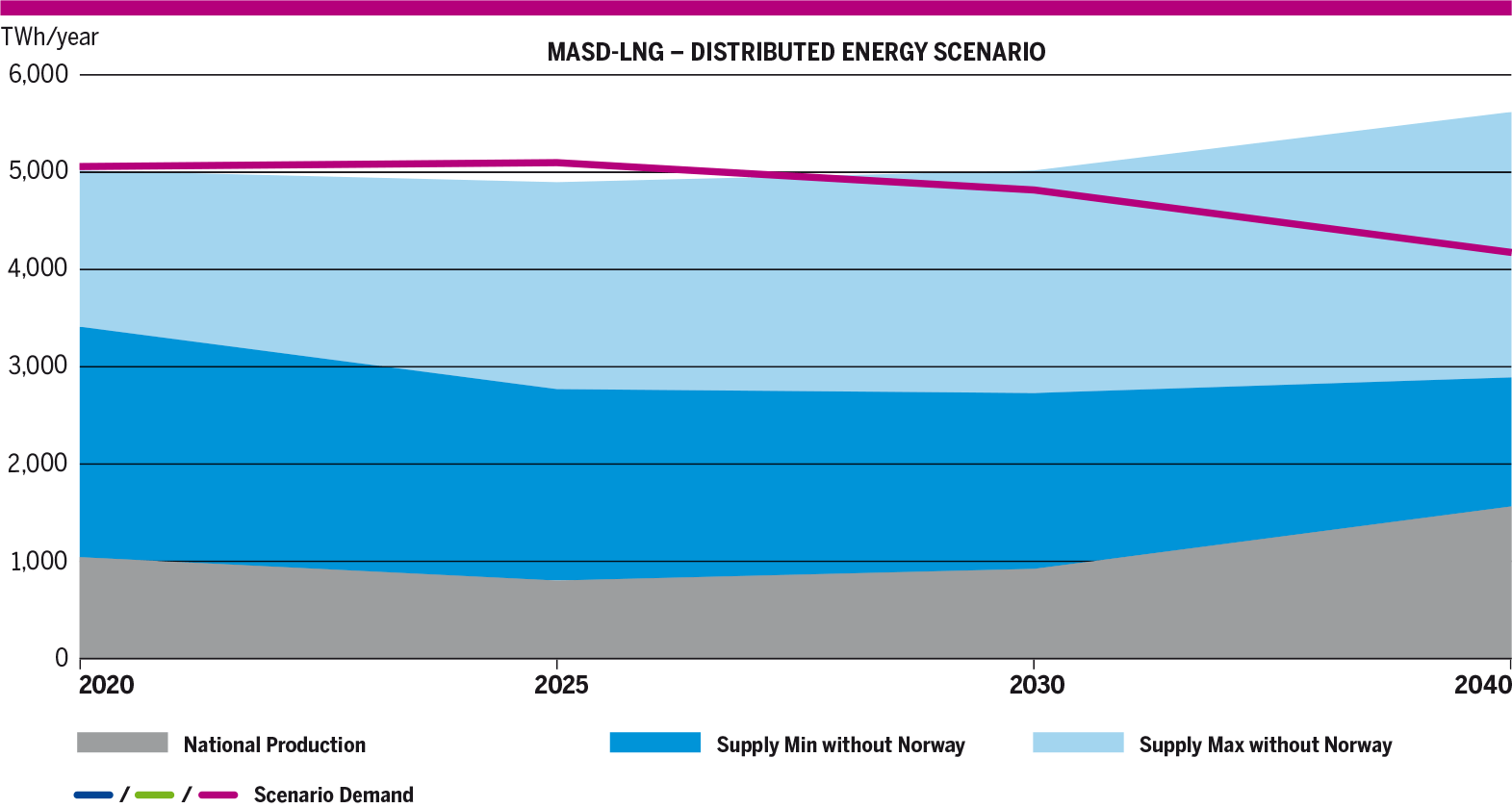

The results of the MASD indicator for LNG supply show dependence for most of Europe on LNG.

At EU-level, the assessment shows that gas infrastructure allows to make use of the maximum supply potential of all the other gas sources. However, this is not enough to cover the overall EU gas demand. This indicates that Europe relies on LNG to achieve its balance between supply and demand.

This evolution of the LNG dependence generally reflects that the LNG supply has a high potential and therefore can offer a significant level of flexibility to compensate with the decline of the indigenous conventional production.

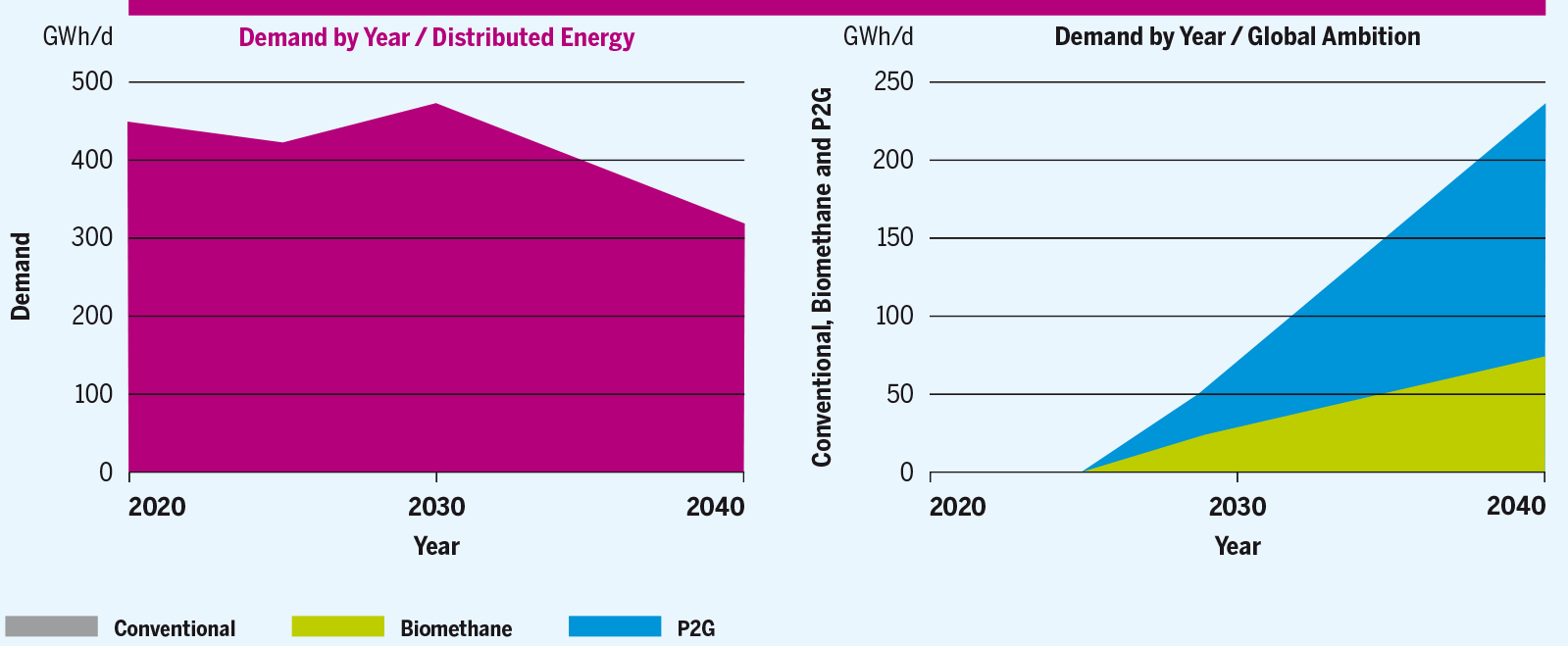

The assessment shows that between 2030 and 2040, in Distributed Energy and Global Ambition scenarios, whilst the share of gas demand is increasing in transport and industrial sectors as gas keeps on decreasing its carbon intensity and therefore replaces more carbon intensive alternatives, the combined effect of the development of renewable gases and energy efficiency improvement puts the overall dependence of the EU on imports on a decreasing trend, including LNG imports.

Yet, some country-level limitations exist and are detailed hereafter. See Figure 5.4.

- MASD-LNG – NATIONAL TREND SCENARIO

- MASD-LNG – GLOBAL AMBITION SCENARIO

- MASD-LNG – DISTRIBUTED ENERGY SCENARIO

Figure 5.4: European Level Supply and Demand Adequacy with no supply from LNG.

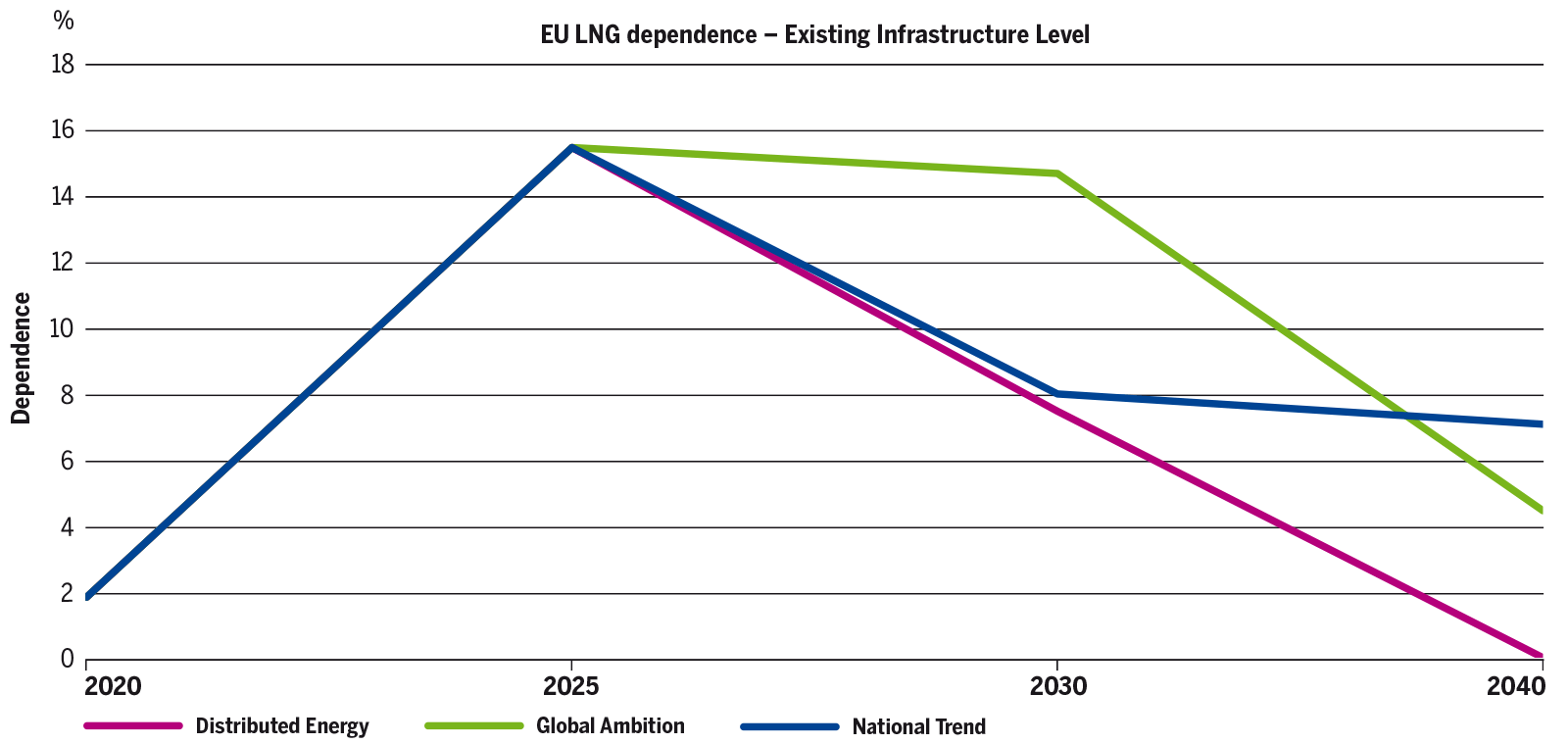

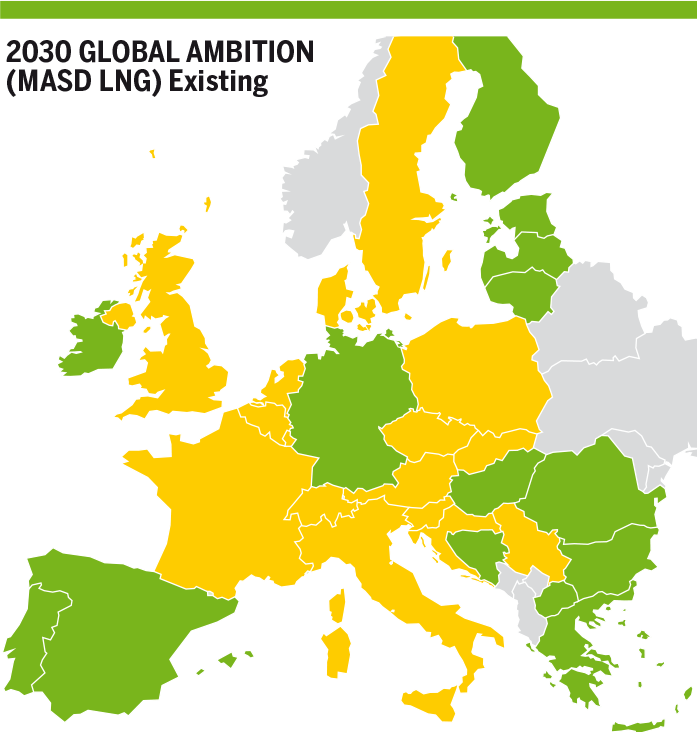

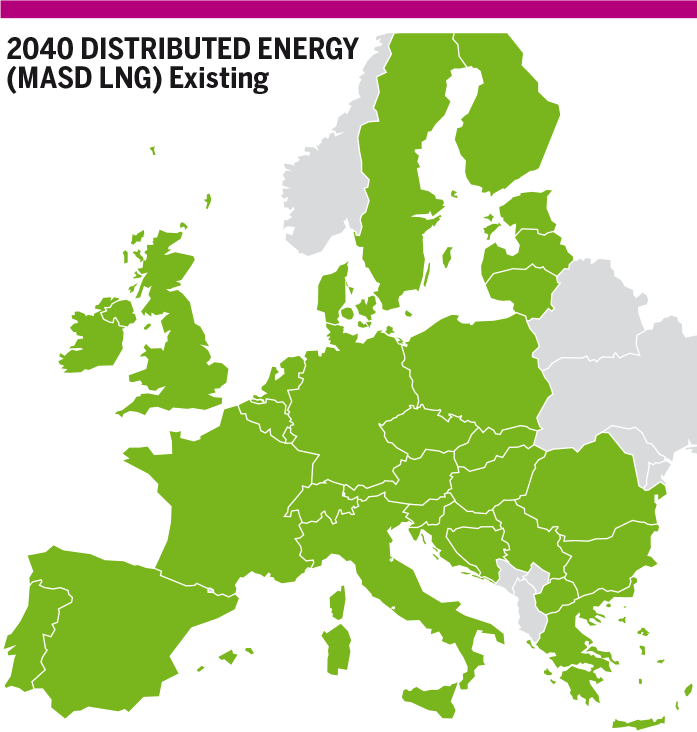

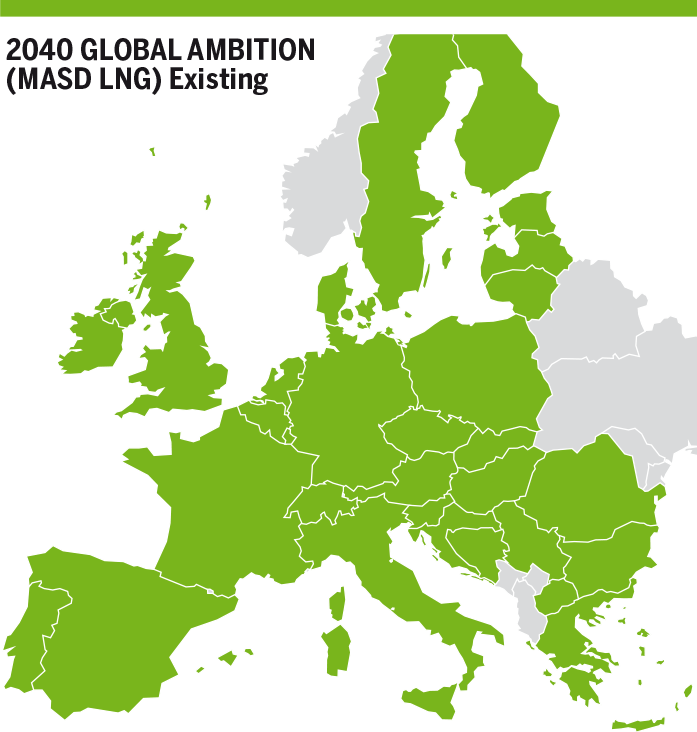

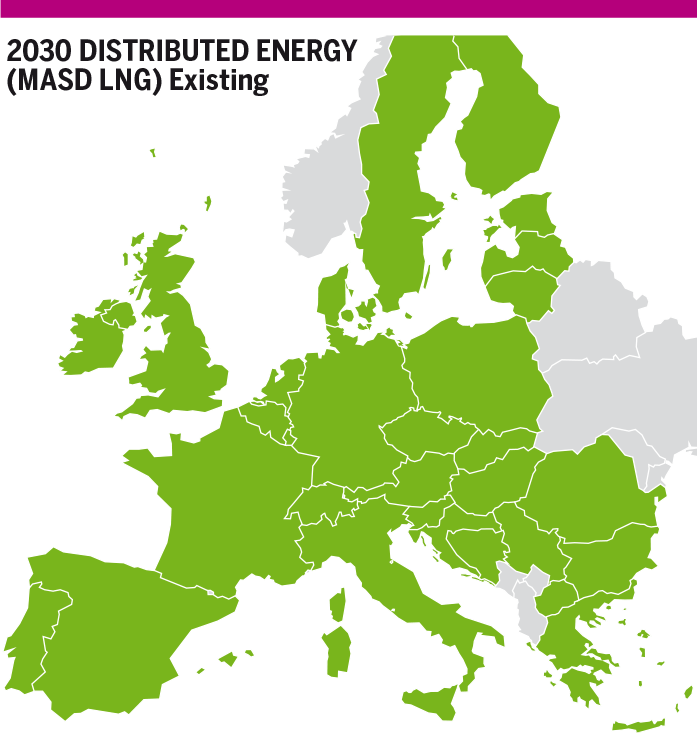

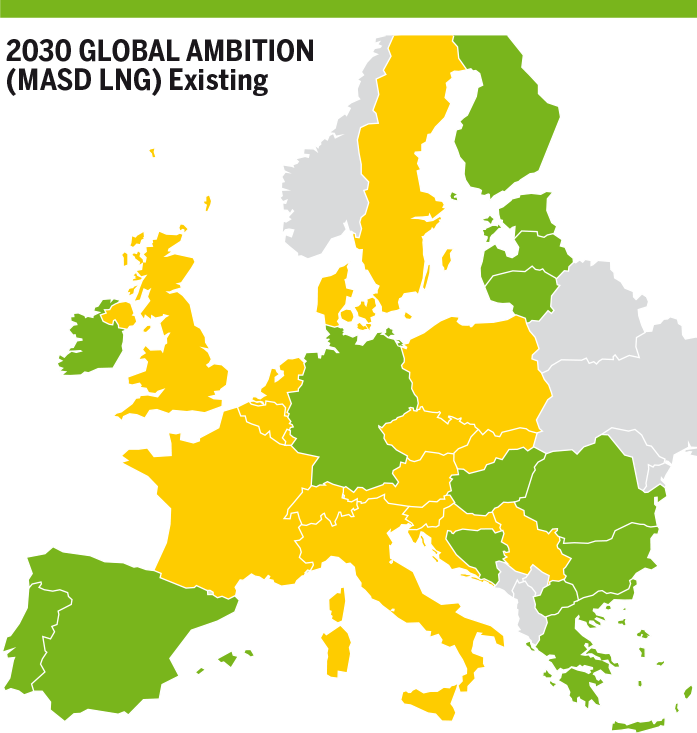

5.2.2.1 Existing Infrastructure level

At European level, the existing infrastructure enables the different countries to benefit from the overall reduction of dependence on the LNG supply. However, the dependence on LNG is fully mitigated in the Distributed Energy scenario in 2040 only. In all the other years and scenarios, Europe remains dependent on LNG for around 10 % of its supply.

Figure 5.5: Overall EU dependence on LNG supply in Existing infrastructure level.

However, at country level, the situation is more contrasted:

2020

Only Greece and Iberian Peninsula (Portugal, Spain) are showing dependence due to bottlenecks (import from Turkey for Greece, import from Algeria and interconnection with France for Iberian Peninsula) with 13 %, 22 % respectively.

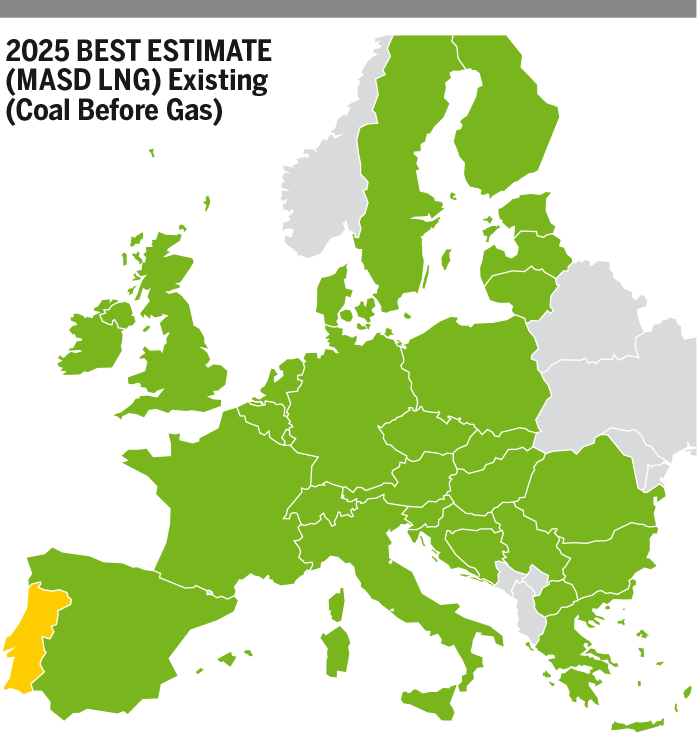

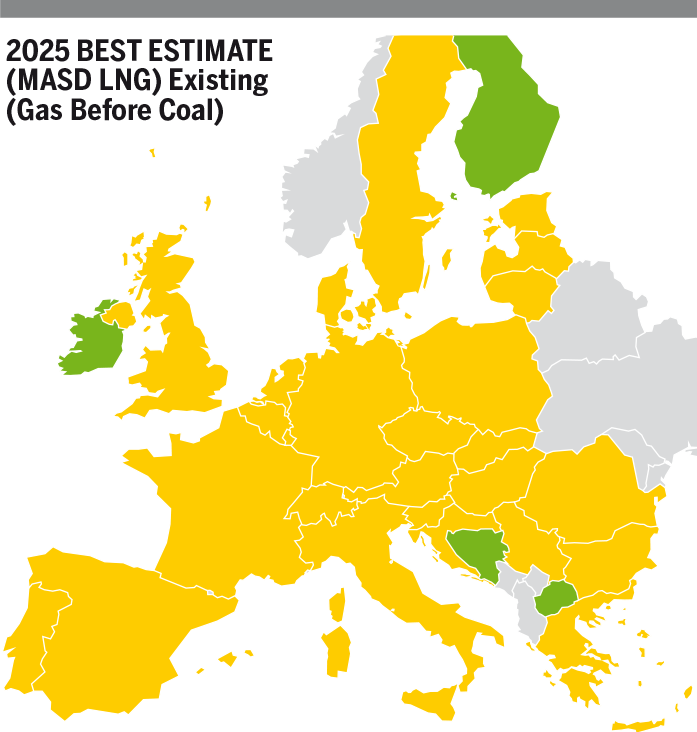

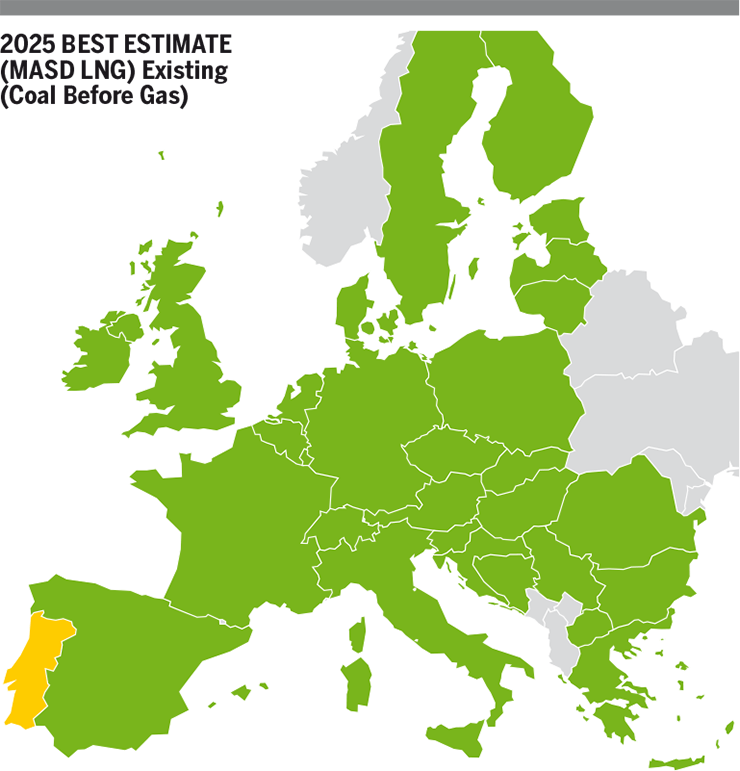

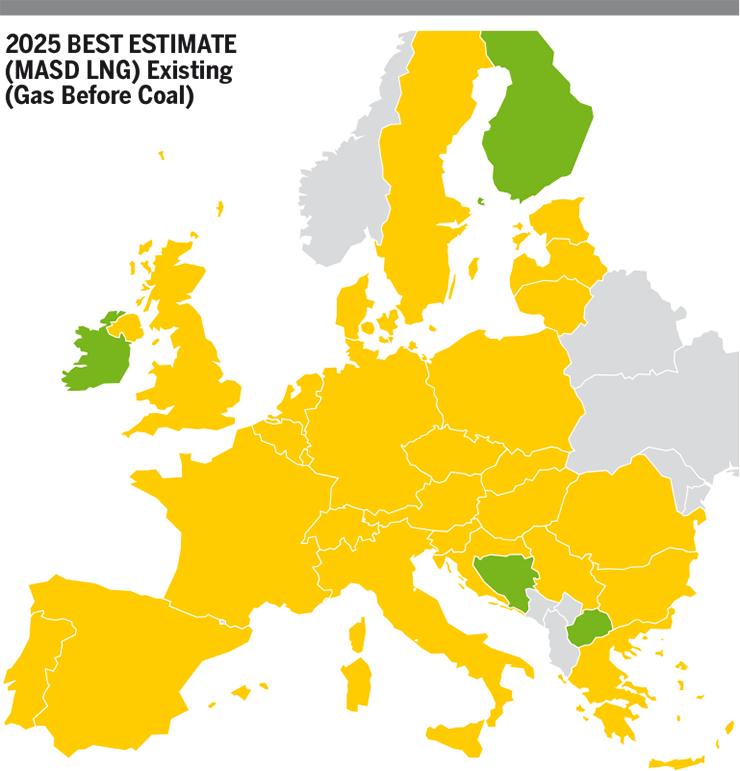

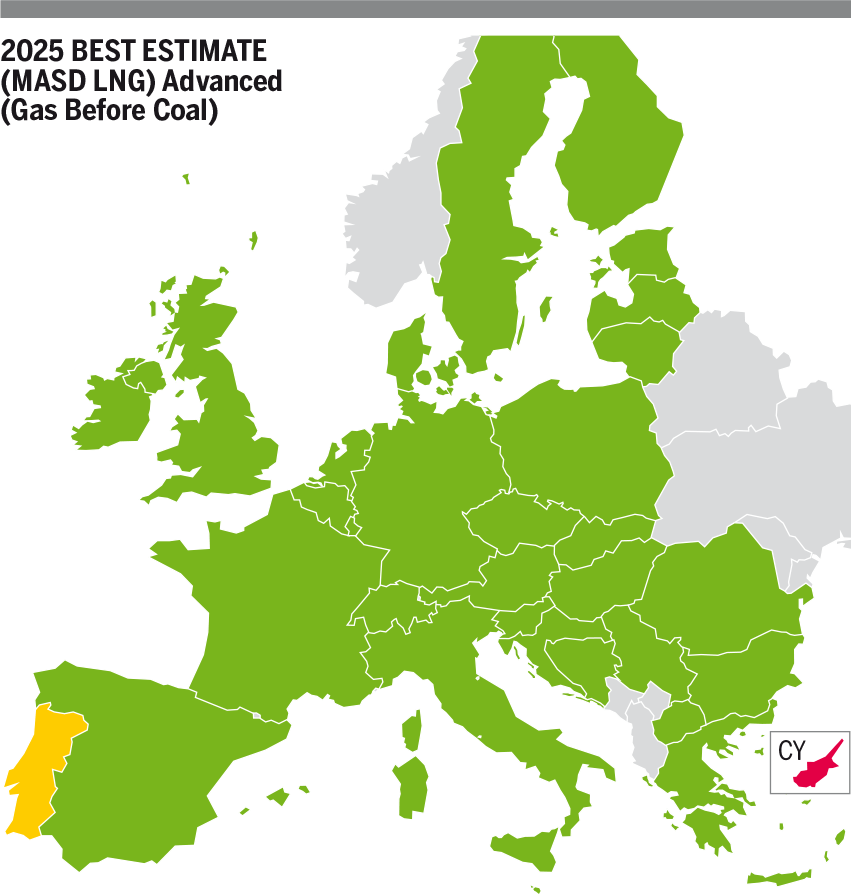

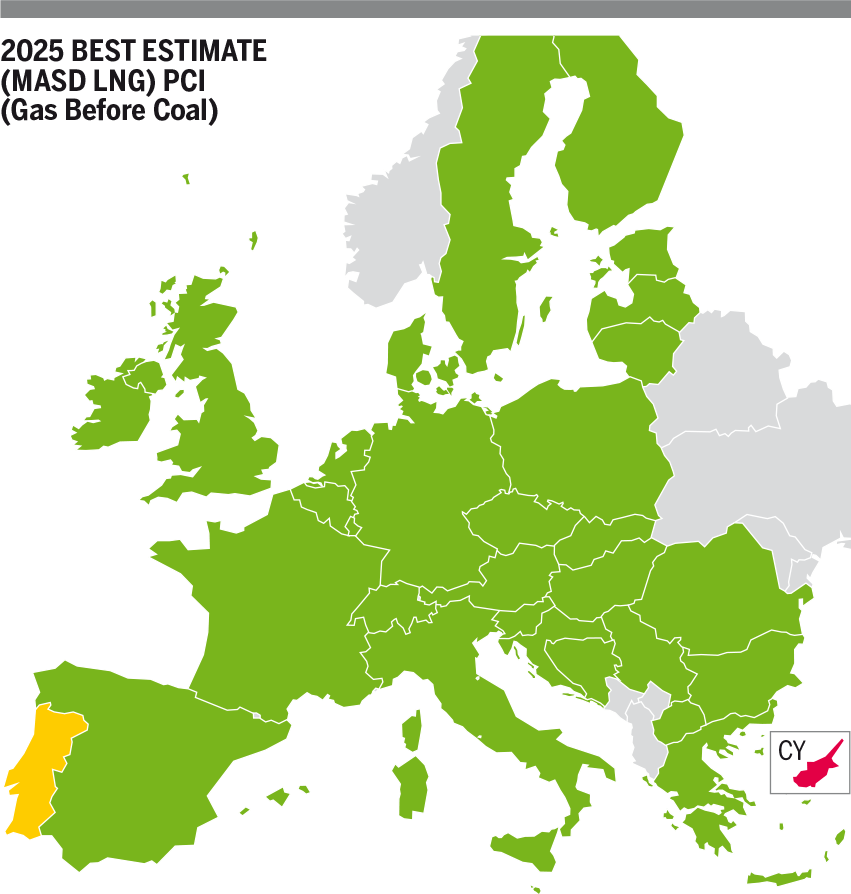

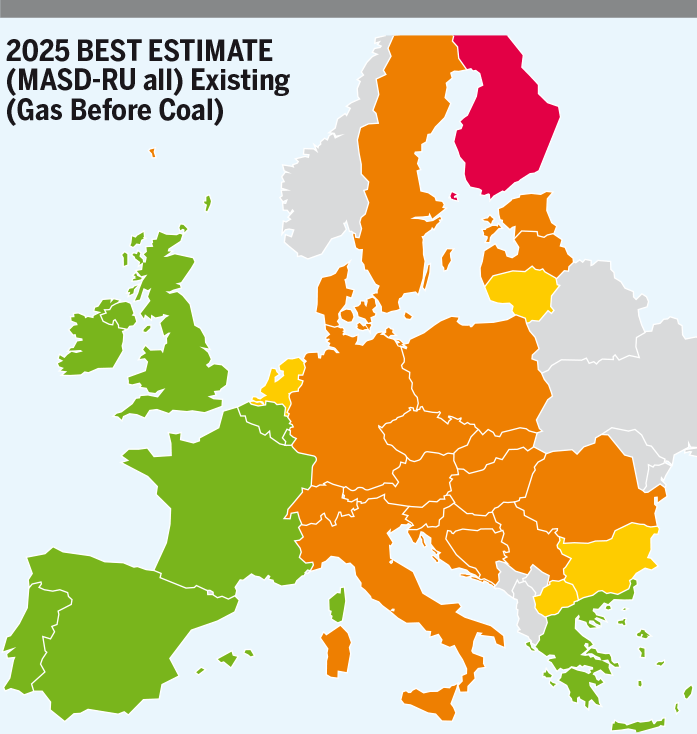

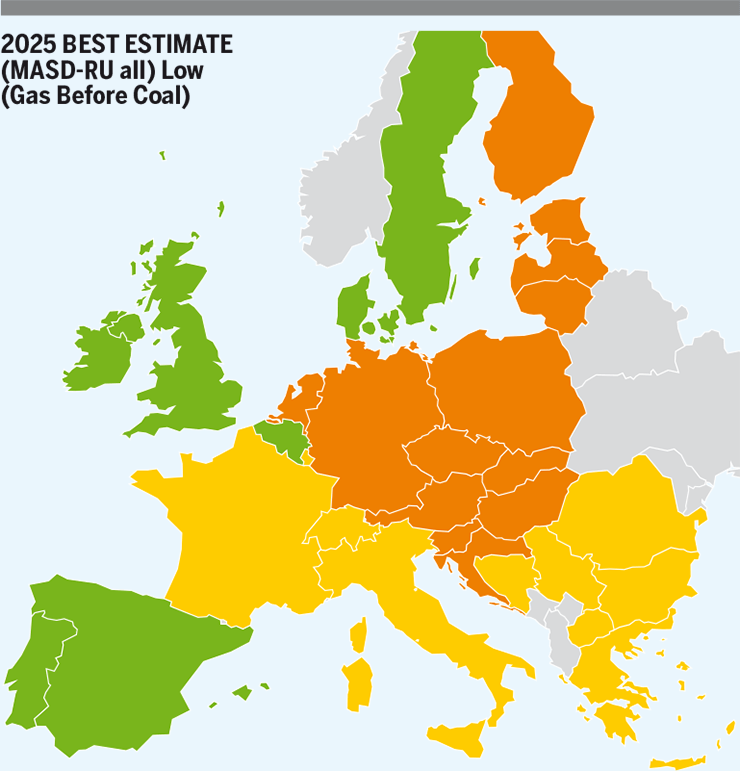

2025

All European countries show a dependence on LNG from 12 % (Coal Before Gas scenario) to 15 % (Gas Before Coal scenario). The existing infrastructure level makes it possible to distribute this dependency evenly across all European countries. Only Portugal faces a higher dependence of + 10 % compared to the rest of the EU due to infrastructure limitation between Portugal and Spain.

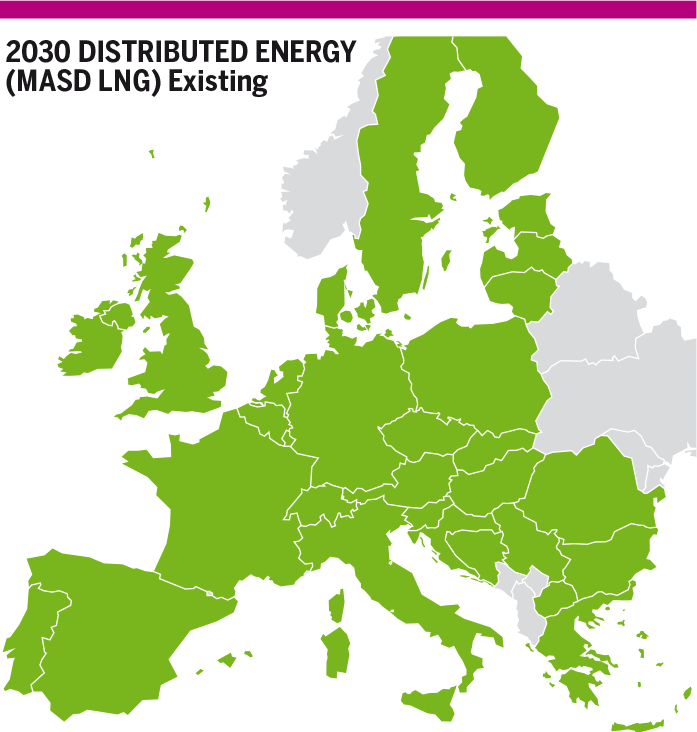

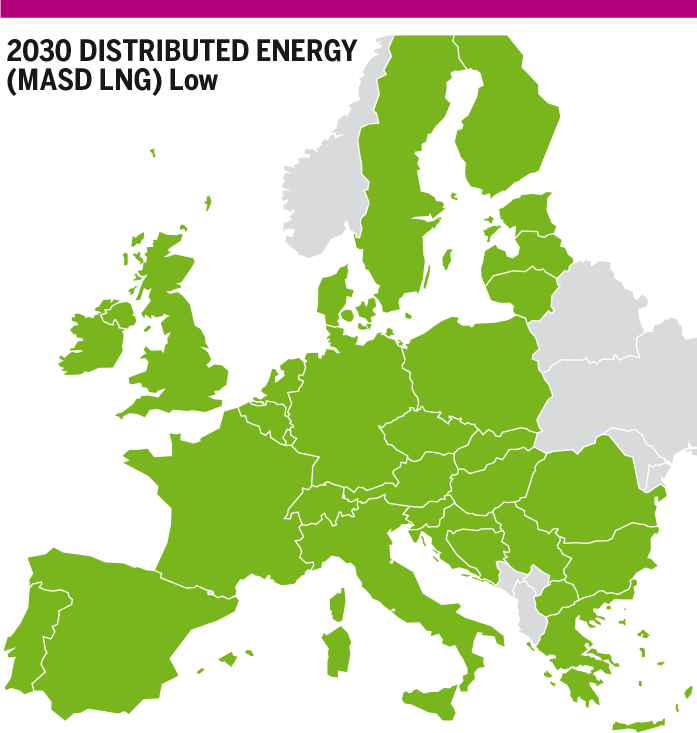

2030

For all scenarios, the dependence is mitigated (from 7 % to 15 %) with a homogenous dependence reflecting the general trend at European level and showing that the existing gas infrastructure level allows for an efficient cooperation between European countries. In 2030, the evolution of the Portuguese demand due to energy efficiency combined with the evolution of renewable gases production mitigates the situation compared to 2025 and the existing infrastructure is not limiting the cooperation between Portugal and Spain any longer.

2040

National Trends

Europe is dependent on LNG to a limited extent since 6 % of the gas demand fully relies on LNG imports. The homogenous dependence in all countries reflect the efficiency of the gas system to distribute the gas supply to all EU countries.

COP 21 scenarios

Distributed Energy

Almost all of the EU does not depend on the LNG supply to satisfy its gas demand, increasing arbitrage possibilities and therefore enhancing competition within the EU market. Only Poland remains dependent on LNG to a very limited extent for 4 % of its average annual demand. This dependence reflects some infrastructure limitation reducing the ability of Poland to align its dependence with the neighbouring countries.

Global Ambition

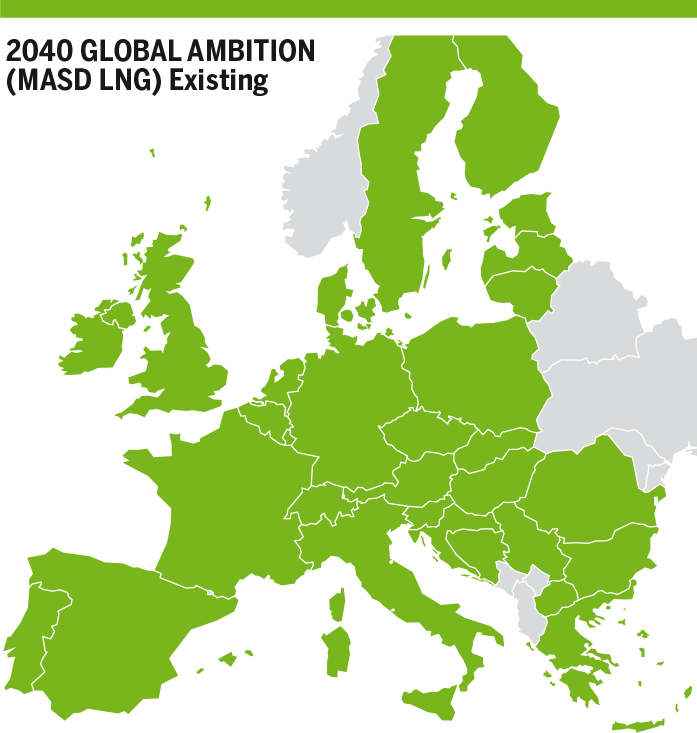

The existing infrastructure allows for an efficient cooperation between Member States so that they all show the same level of dependence that reflects the overall EU dependence. See Figure 5.6.

Figure 5.6: MASD LNG – Scenario and Years – Existing Infrastructure level.

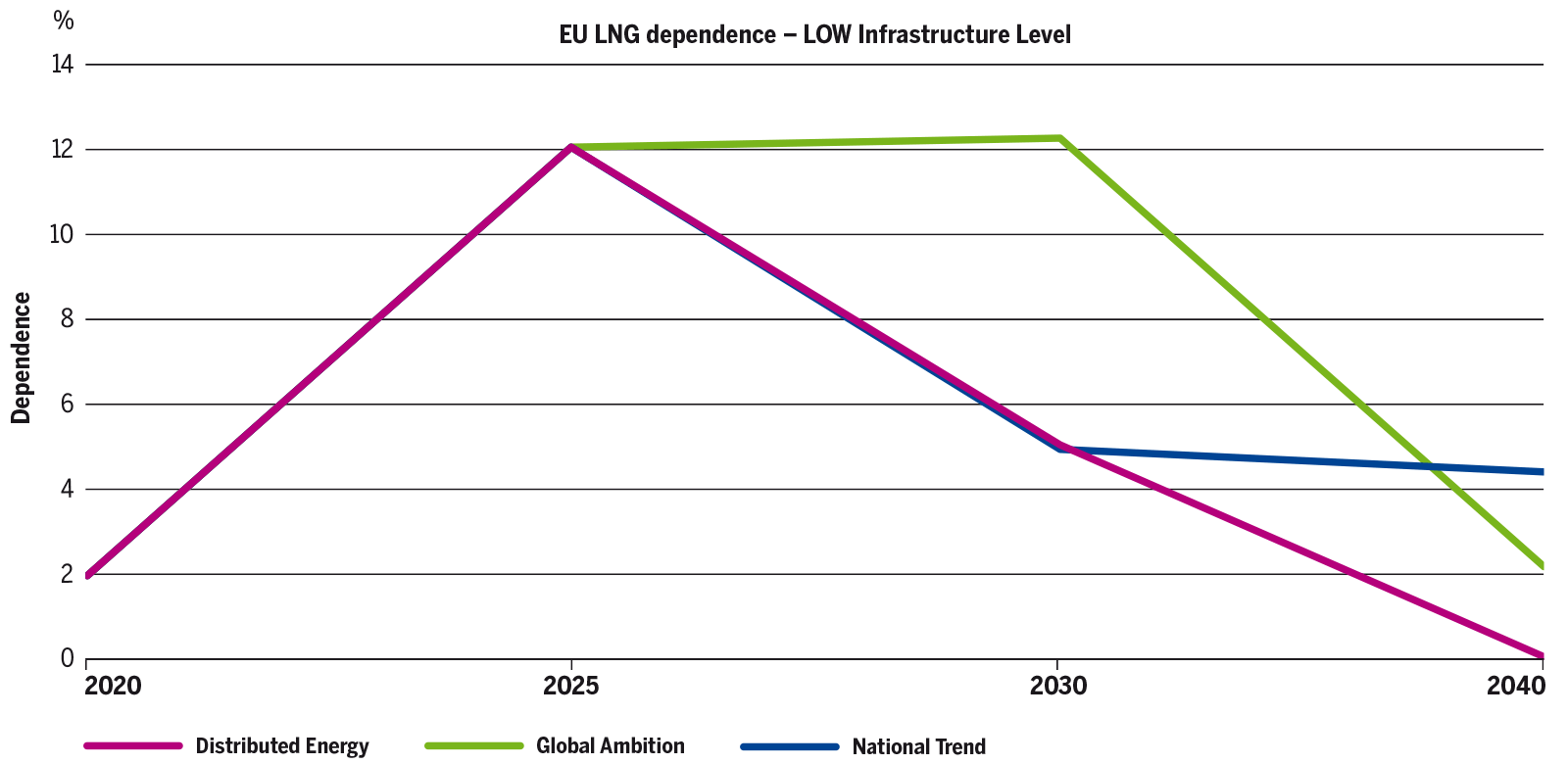

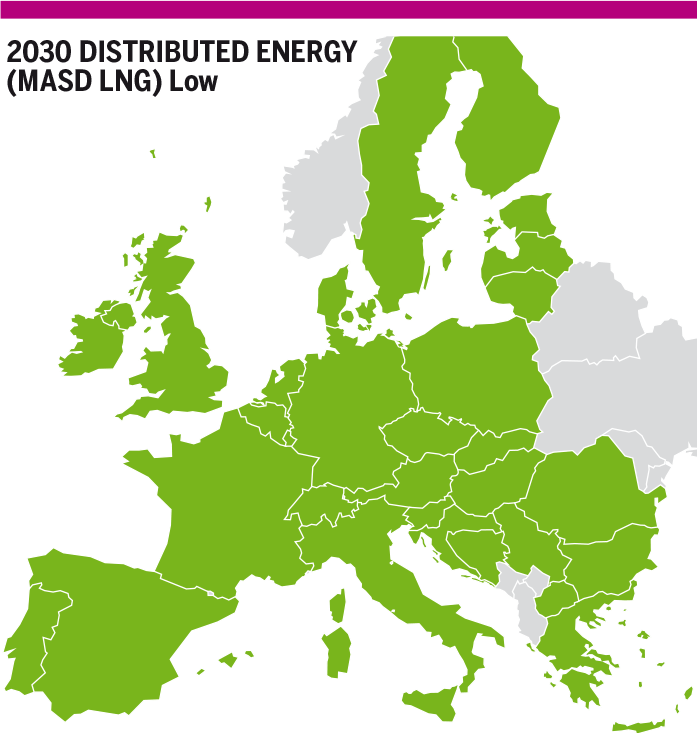

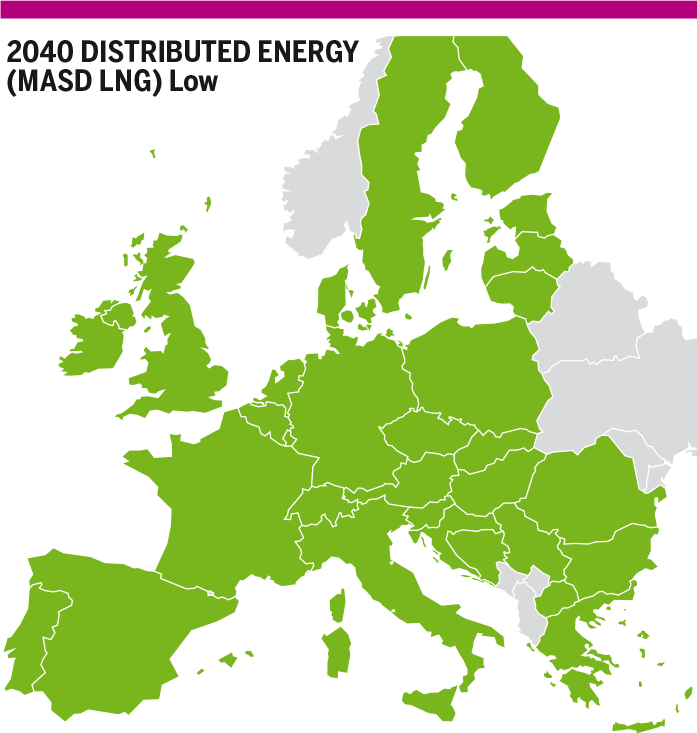

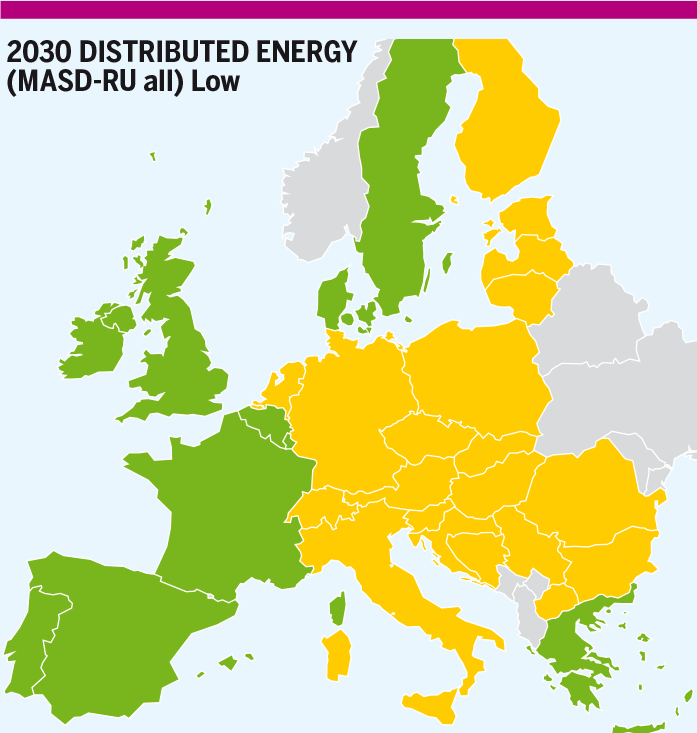

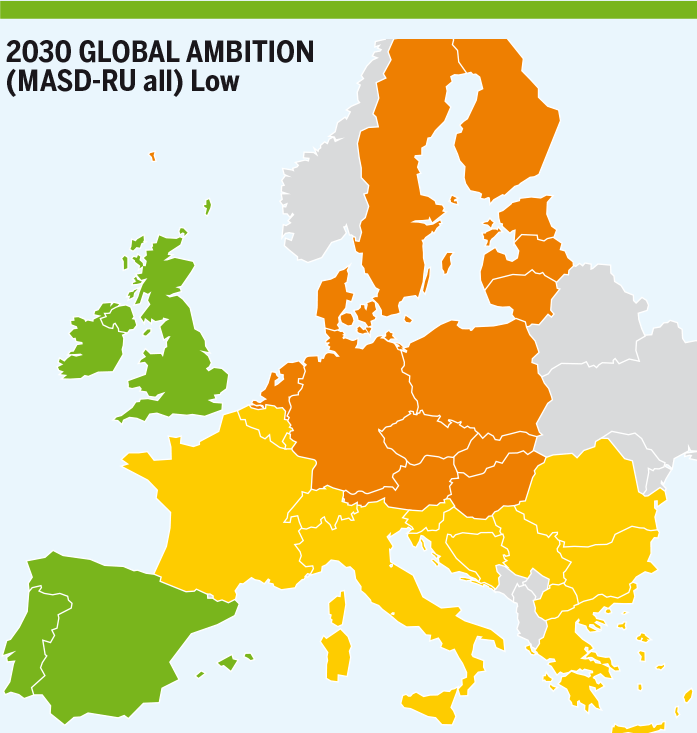

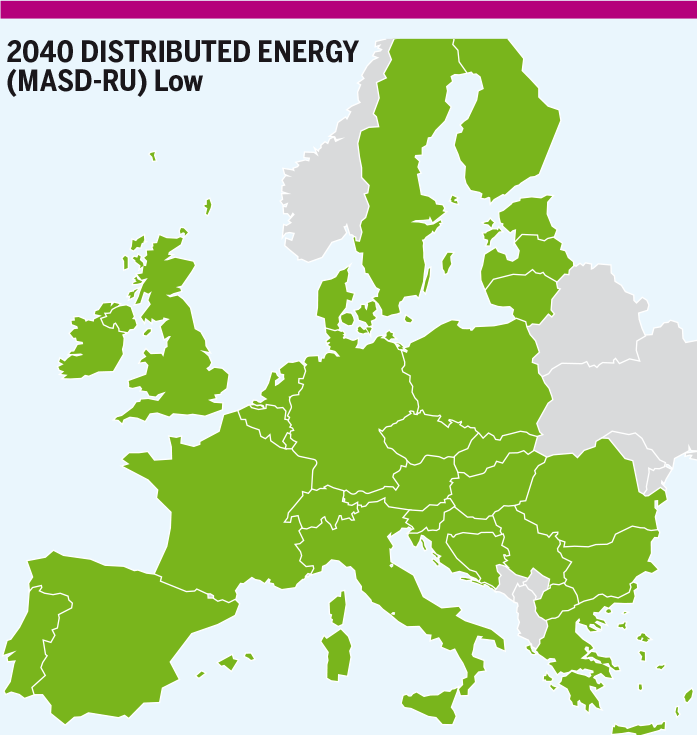

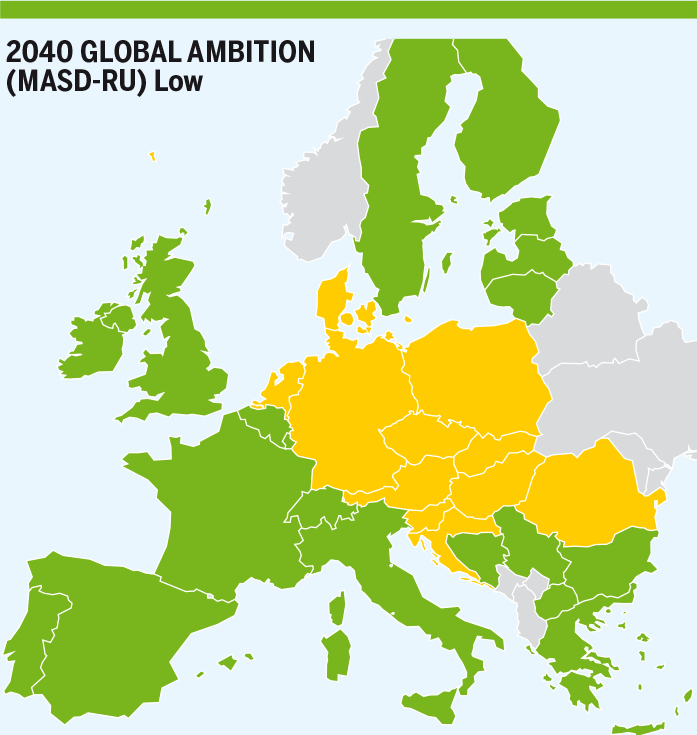

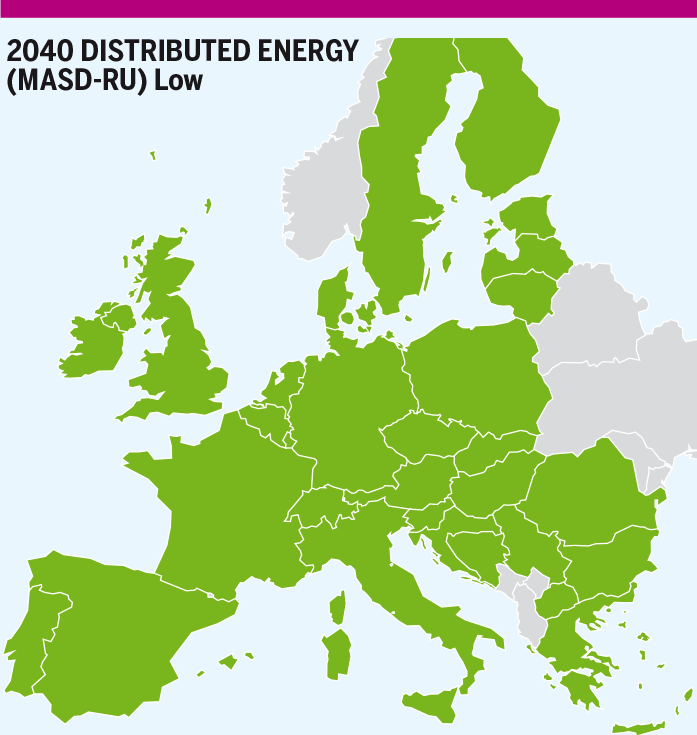

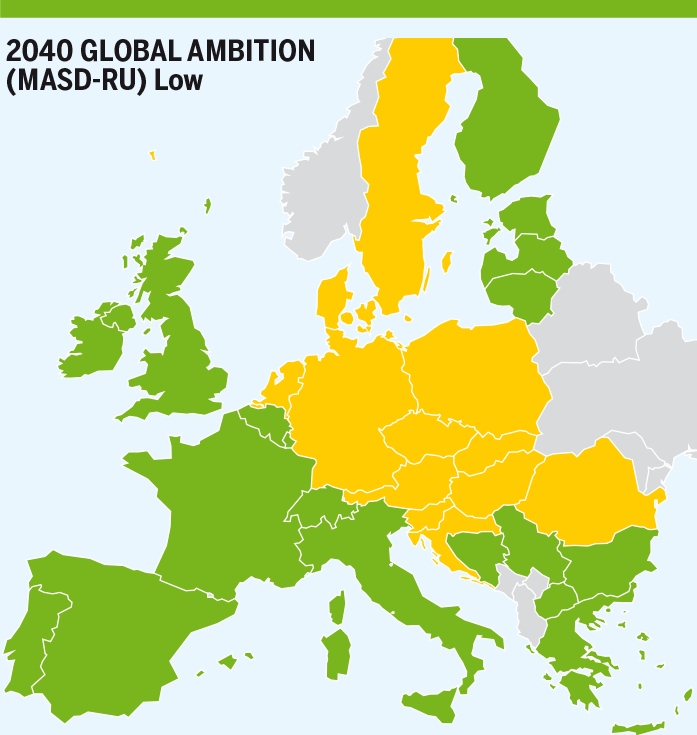

5.2.2.2 Low Infrastructure level

At European level, the Low infrastructure including all the FID projects shows further reduction in the overall dependence on LNG compared to the existing infrastructure (circa 5 % in average). The FID projects allow Europe to be less than 5 % dependent on LNG as of 2030 in National Trends and Distributed Energy scenarios. Furthermore, in Global Ambition in 2040, Europe is only dependent on LNG for 2 % of its supply.

Figure 5.7: Overall EU dependence on LNG supply in the Low infrastructure level.

However, at Country level, the situation is more contrasted:

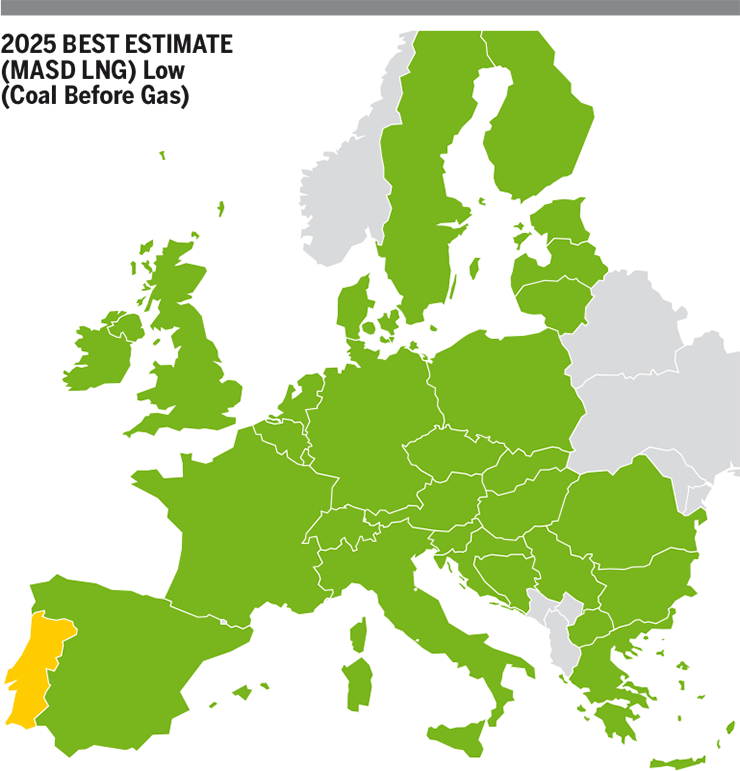

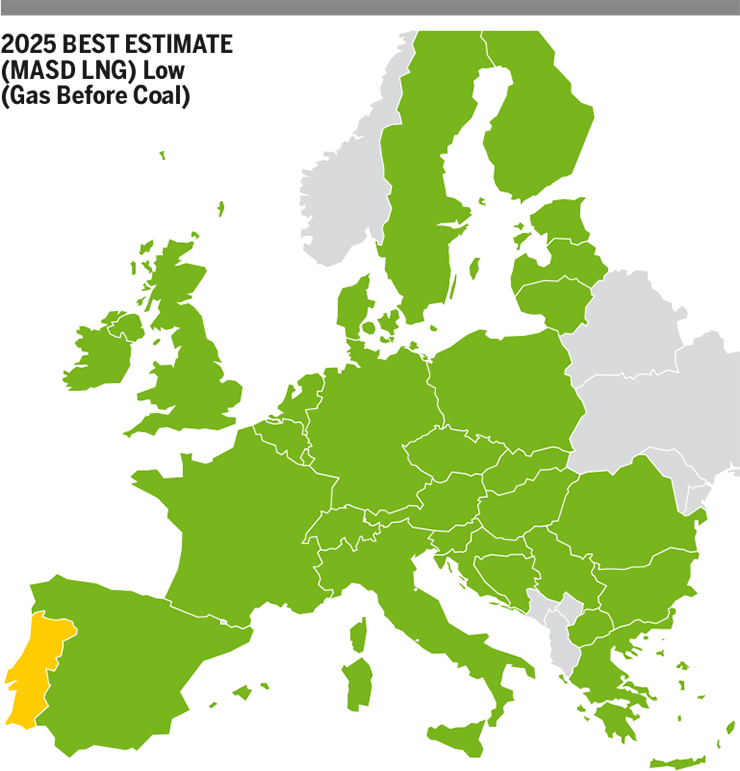

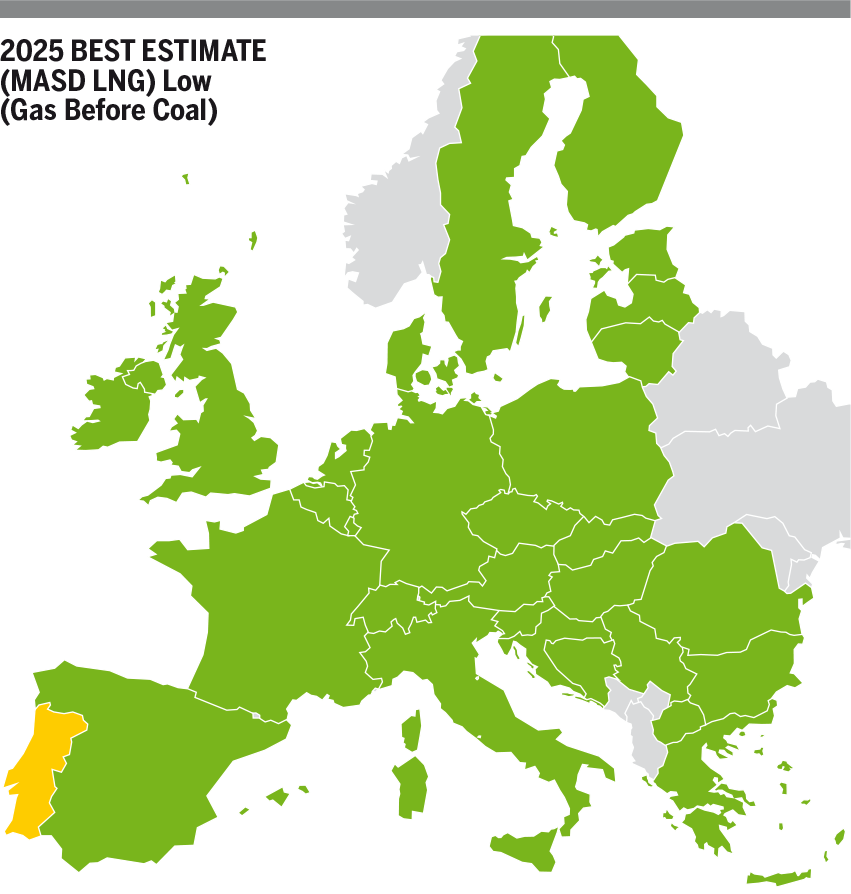

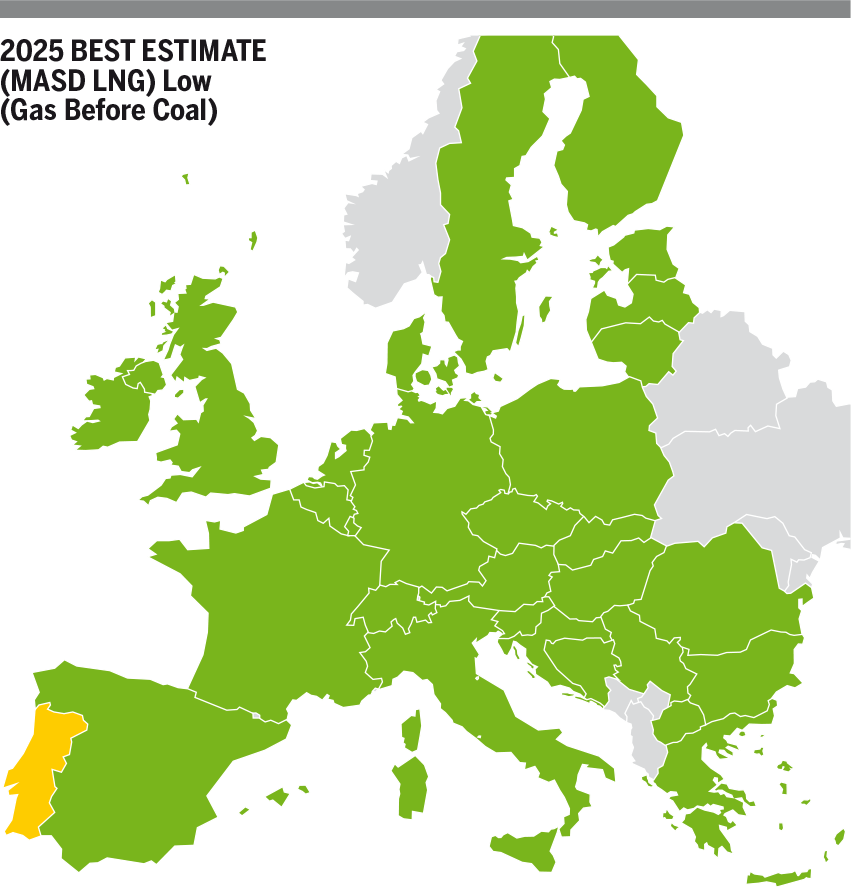

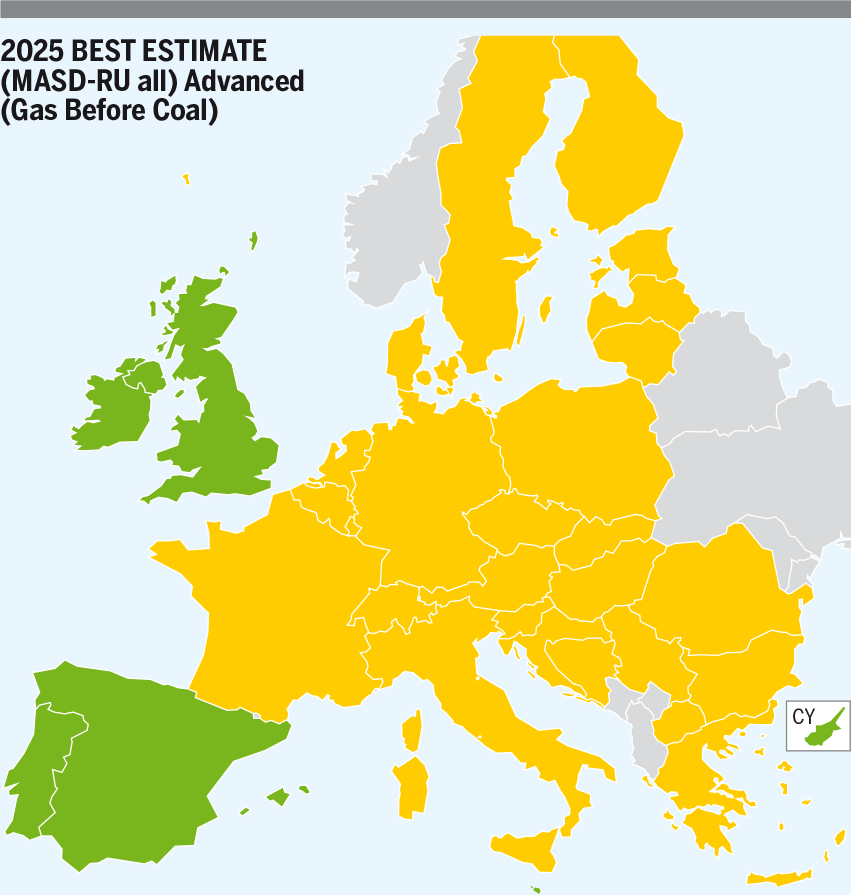

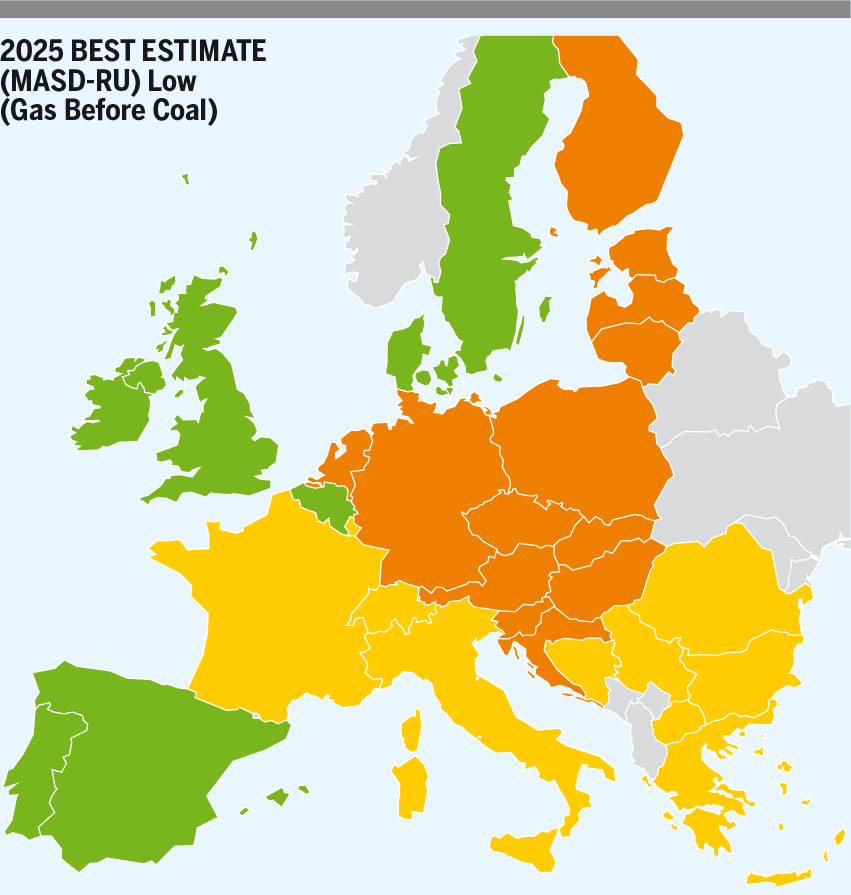

2025

The FID projects allow all the European countries to reduce their dependence on the LNG supply by 3 % in Coal Before Gas and Gas Before Coal scenarios thanks to the increase indigenous production and Trans Adriatic Pipeline which increases the access to Azeri gas. The infrastructure limitation between Portugal and Spain identified in the existing infrastructure level is not alleviated in 2025 by the FID projects.

Furthermore, FID projects allow Denmark and Sweden to fully mitigate their dependence on the LNG supply. However, the Low infrastructure level shows some infrastructure limitations preventing Denmark and Sweden to share those benefits with their neighbouring countries and therefore the rest of the EU. See Figure 5.8.

Figure 5.8: MASD LNG – Gas Before Coal and Coal Before Gas – 2025 – Existing and Low Infrastructure levels

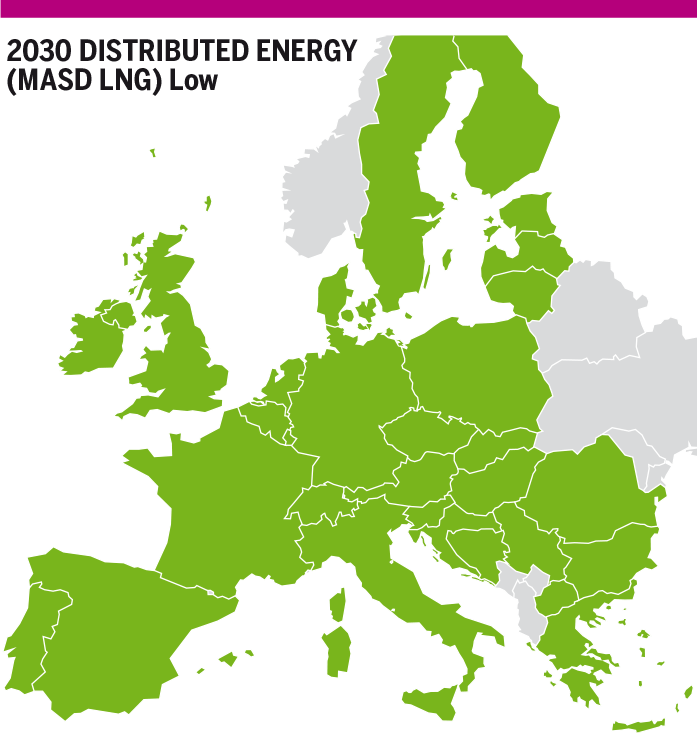

2030

FID projects improve the access to alternative sources to the LNG supply and therefore reduce the dependence of all EU countries by 3 %.

See Figure 5.9.

Figure 5.9: MASD LNG – All scenarios – 2030 – Existing and Low infrastructure levels.

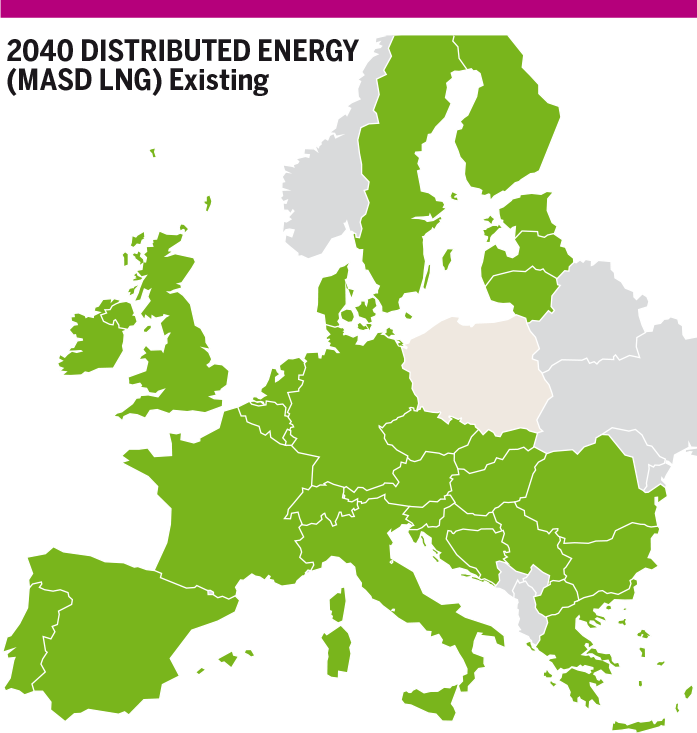

2040

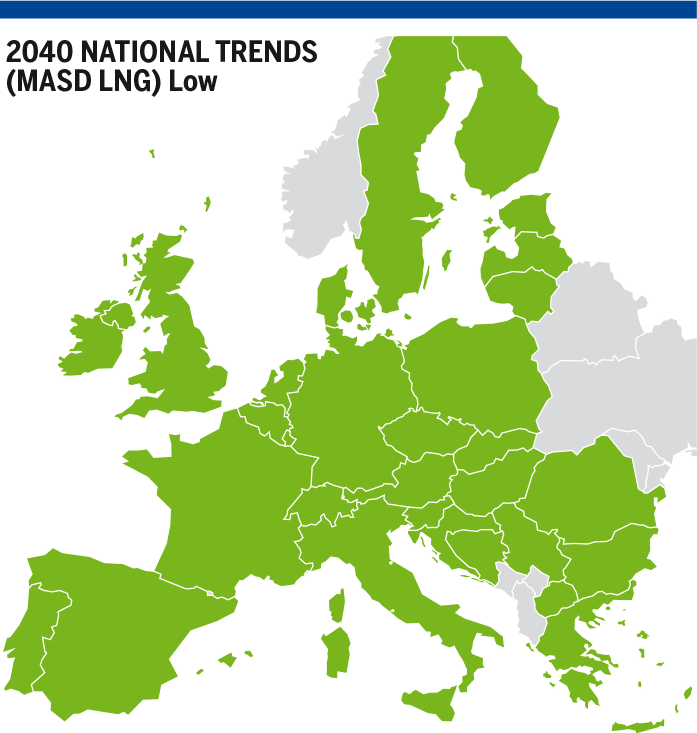

National Trends

FID projects improve the access to alternative sources to the LNG supply and therefore reduce the dependence of all EU countries by 3 %.

COP 21 scenarios

FID projects improve the access to alternative sources to the LNG supply and therefore reduce the dependence of all EU countries by 3 %.

Furthermore, in Distributed Energy scenario, FID projects fully mitigate the remaining infrastructure limitations between Poland and its neighbouring countries. See Figure 5.10.

Figure 5.10: MASD LNG – All scenarios – 2040 – Existing and Low infrastructure levels.

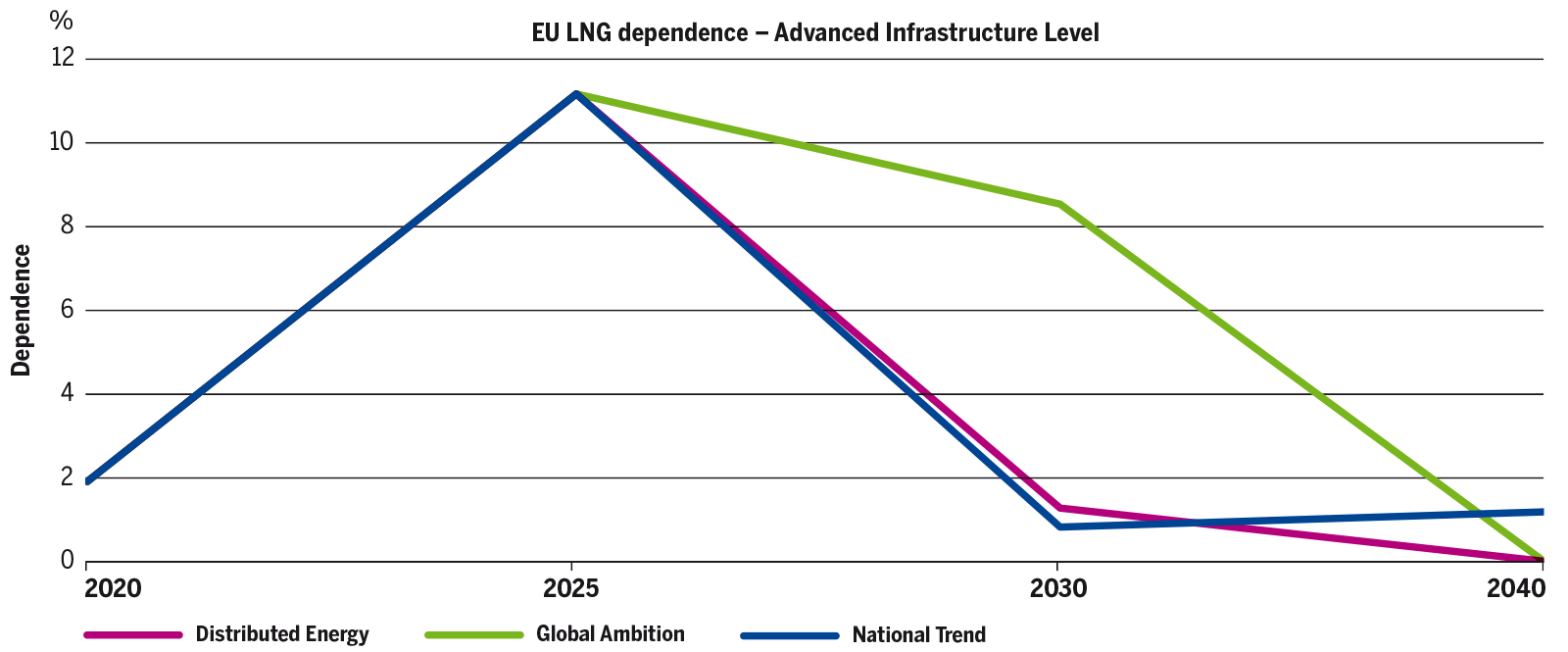

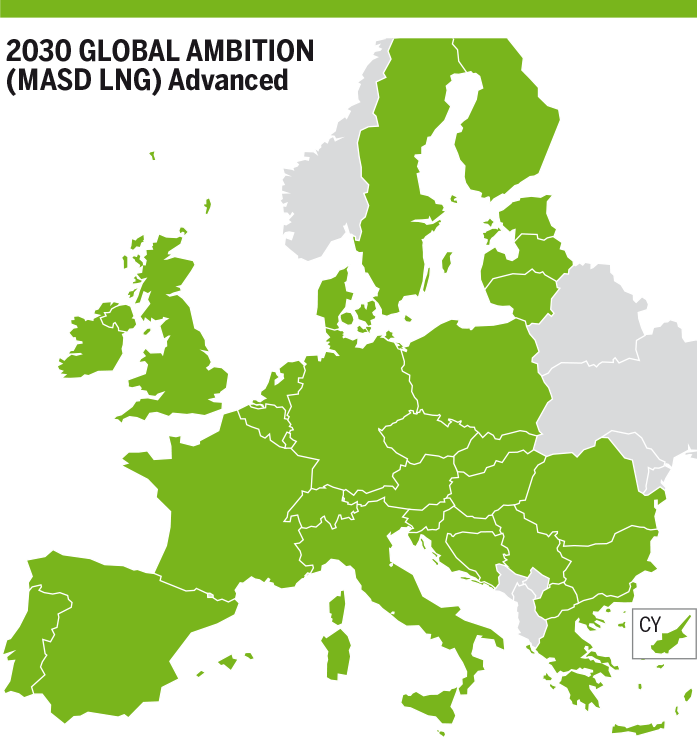

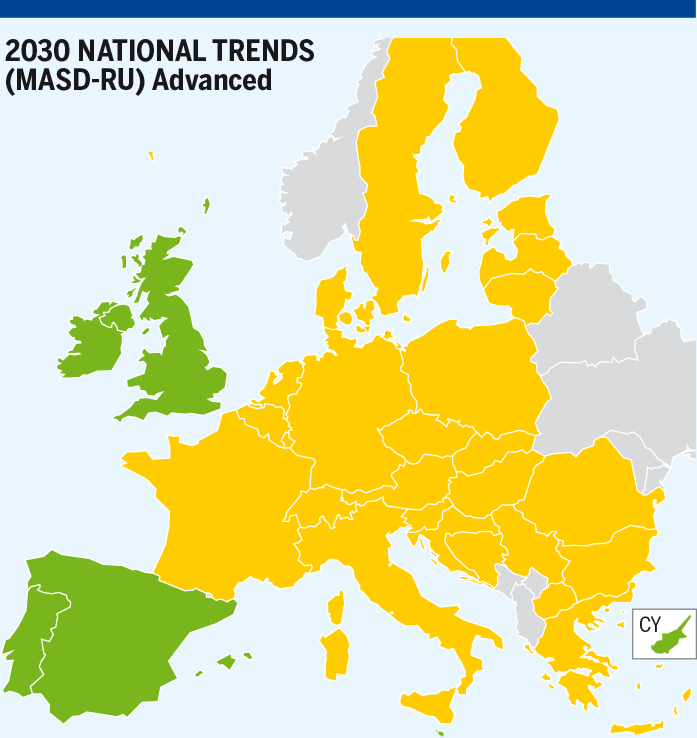

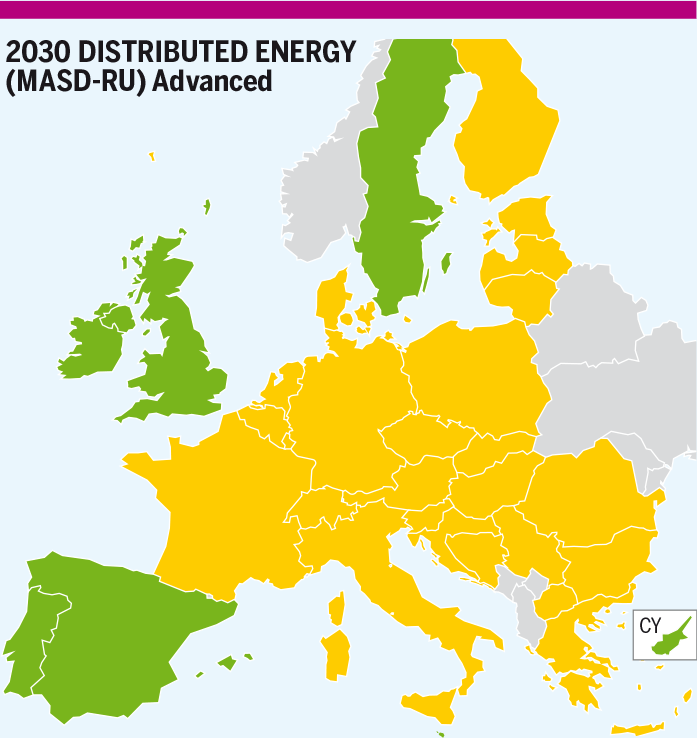

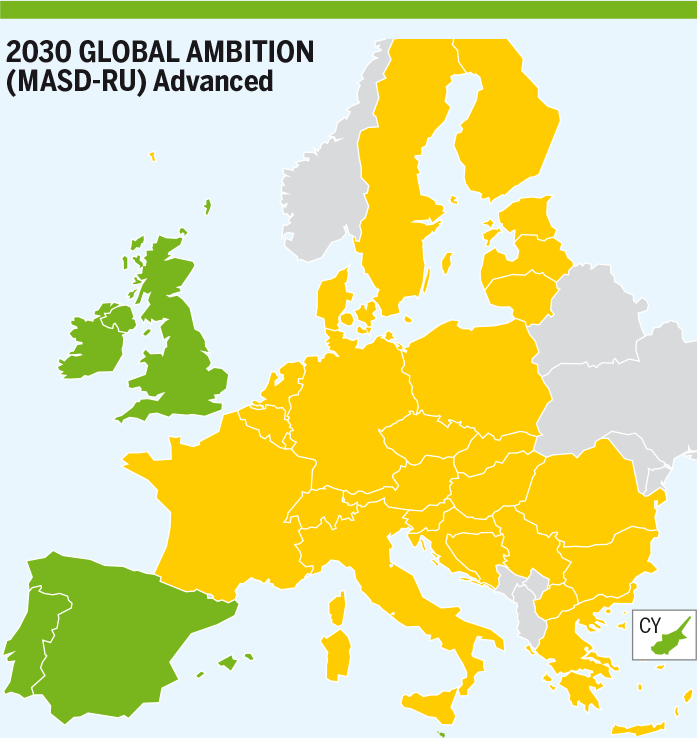

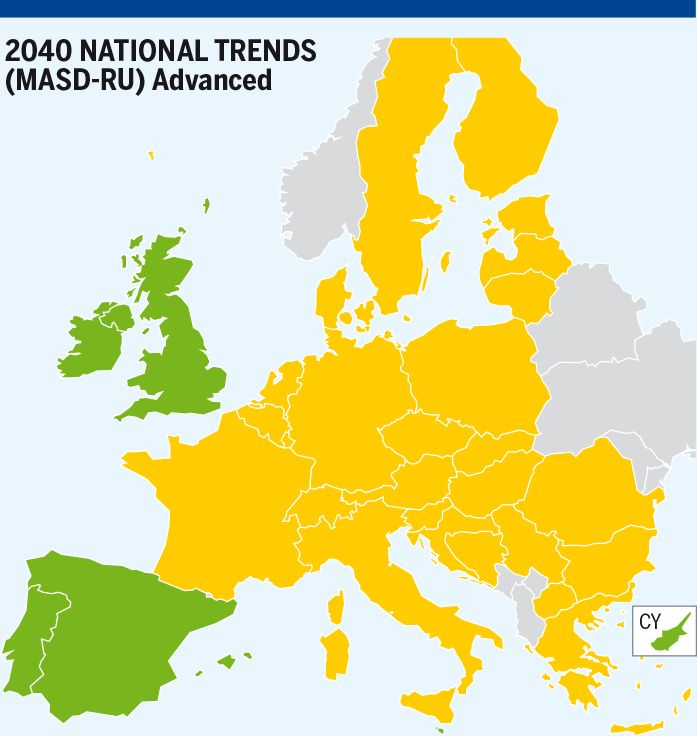

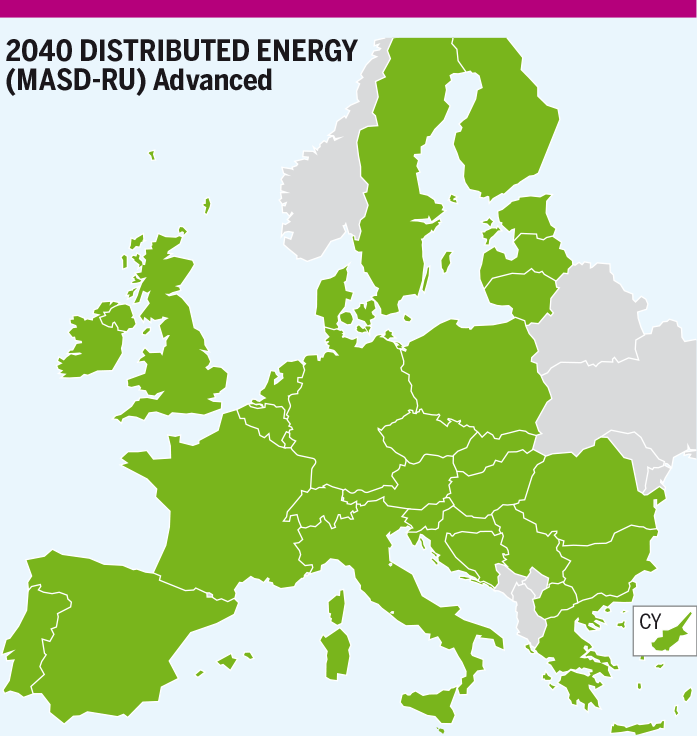

5.2.2.3 Advanced Infrastructure level

At European level, the advanced infrastructure level (FID + advanced projects) almost achieve to mitigate the dependence of the EU on the LNG supply. By 2030 in National Trends and Distributed Energy LNG depends on LNG for 1 % of its supply. Furthermore, in 2040 both COP 21 scenarios, the advanced infrastructure level achieves to fully mitigate EU’s dependence on LNG.

Figure 5.11: Overall EU dependence on LNG supply in the Advanced infrastructure level.

At country level:

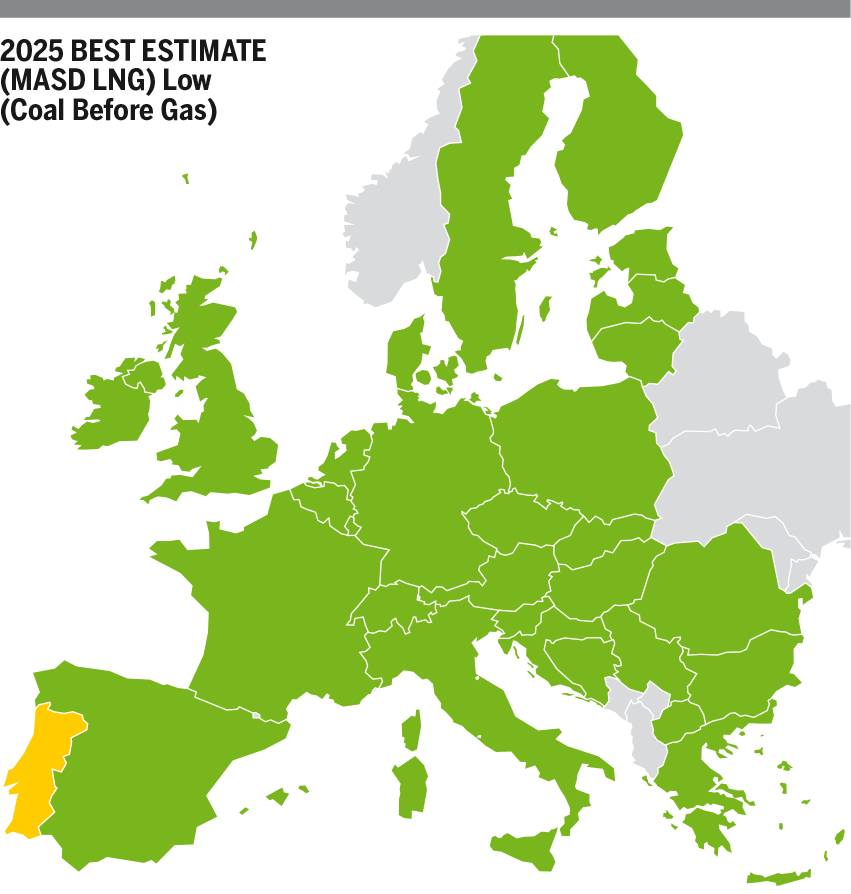

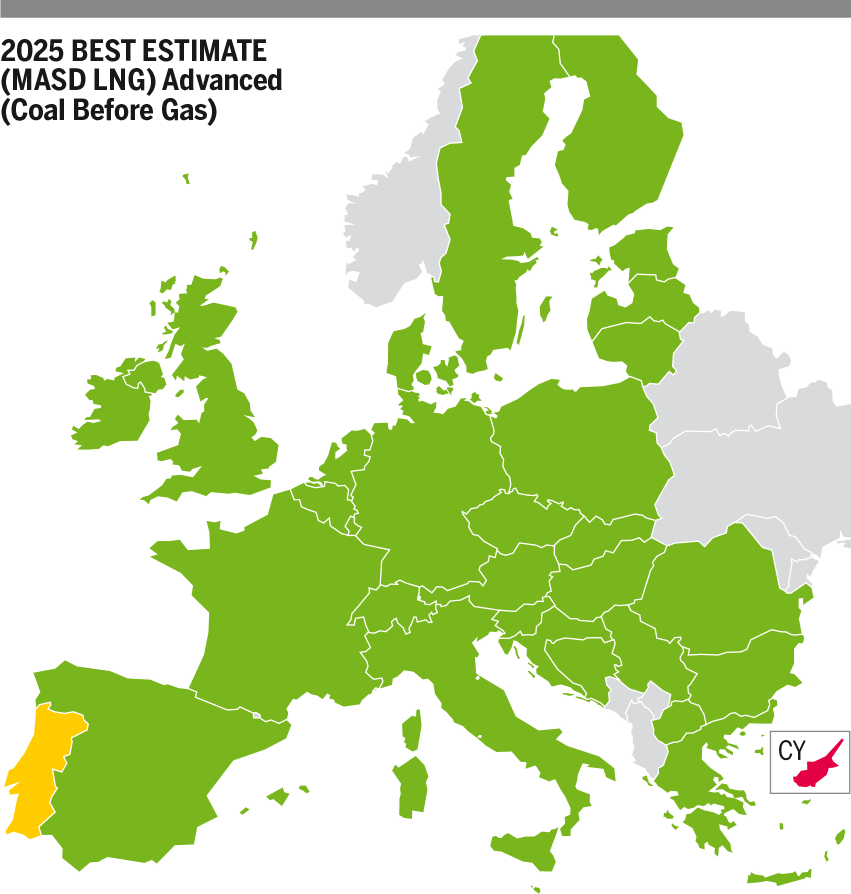

2025

Advanced projects further decrease the overall dependence of EU countries on the LNG supply by 2 % compared to the Low infrastructure level (from 12 % to 10 % in GBC and from 10 % to 8 % in CBG). In particular, the Advanced projects alleviate the infrastructure limitation that was preventing Denmark and Sweden to cooperate with the rest of the EU. In addition, Cyprus shows a 100% dependence on LNG supply driven by the commissioning of the new LNG terminal and no connection to other EU countries.

However, the Advanced projects do not mitigate the infrastructure limitation preventing Portugal to align its dependence to Spain and thus, to the rest of the EU. See Figure 5.12.

Figure 5.12: MASD LNG – Gas Before Coal and Coal Before Gas – 2025 – Low and Advanced infrastructure levels.

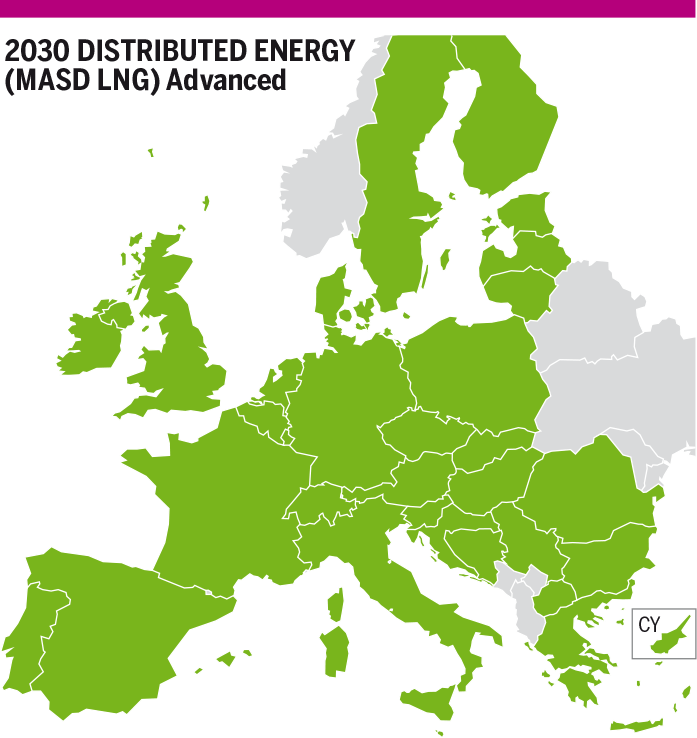

2030

National Trends

Advanced projects almost mitigate the overall dependence of EU countries on the LNG supply, compared to the Low infrastructure level. However, the Advanced projects do not fully mitigate the dependence of Spain (3 %) and Portugal (7 %) reflecting some infrastructure limitations for Spain to fully cooperate with France and Portugal.

Nevertheless, Cyprus mitigates its dependence on LNG supply driven by the commissioning of the EastMed allowing Cyprus to connect with the rest of Europe.

COP 21 scenarios

Distributed Energy

Advanced projects almost fully mitigate the overall dependence of EU countries on the LNG supply, compared to the Low infrastructure level (from 5 % to 1 %).

Global Ambition

Advanced projects almost fully mitigate the overall dependence of EU countries on the LNG supply, compared to the Low infrastructure level (from 12 % to 8 %). See Figure 5.13.

Figure 5.13: MASD LNG – All scenarios – 2030 – Low and Advanced infrastructure levels.

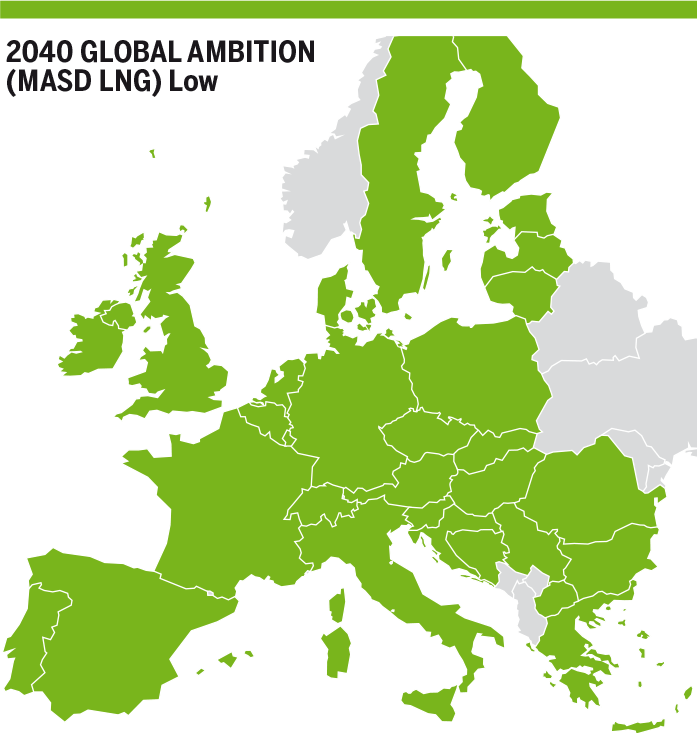

2040

National Trends

Advanced projects almost mitigate the overall dependence of EU countries on the LNG supply, compared to the Low infrastructure level (from 4 % to 1 %).

COP 21 scenarios

Distributed Energy

FID projects already fully mitigate the overall dependence of EU countries on the LNG supply.

Global Ambition

Advanced projects fully mitigate the overall dependence of EU countries on the LNG supply, compared to the Low infrastructure level (2 %).

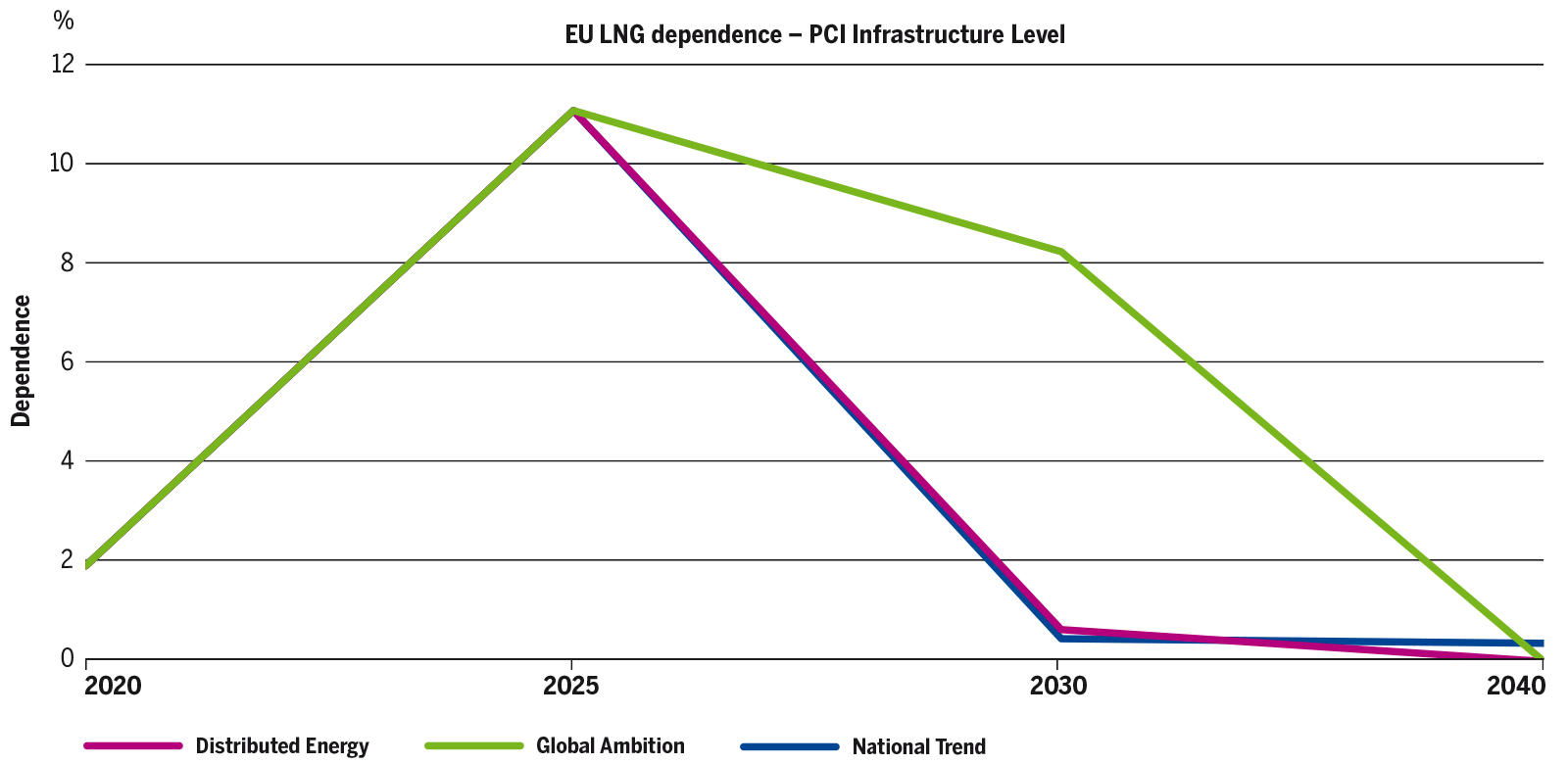

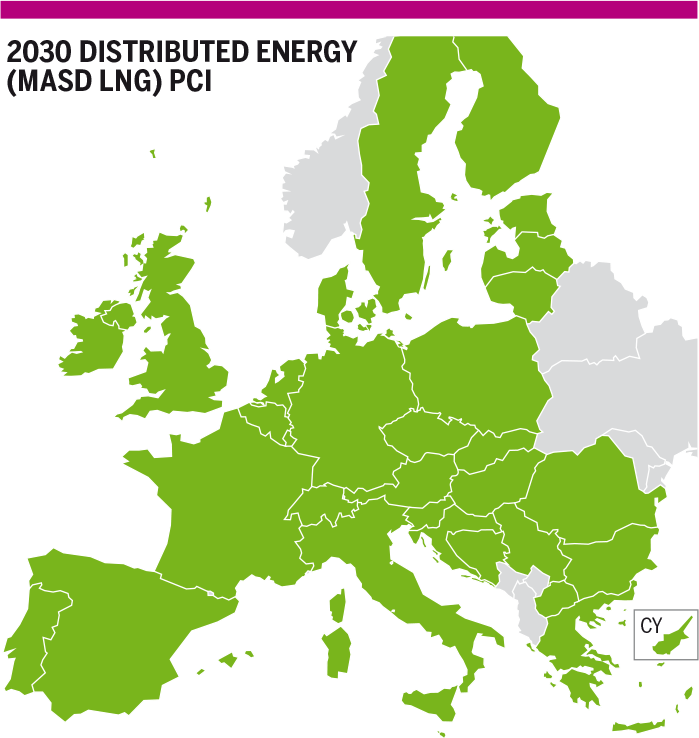

5.2.2.4 PCI Infrastructure level

At European level, the PCI infrastructure level (FID + PCI projects), like the Advanced infrastructure level, almost achieve to mitigate the dependence of the EU on the LNG supply. By 2030 in National Trends and Distributed Energy LNG depends on LNG for 1 % of its supply. Furthermore, in 2040 both COP 21 scenarios, the advanced infrastructure level achieves to fully mitigate EU’s dependence on LNG.

Figure 5.14: Overall EU dependence on LNG supply in the PCI infrastructure level.

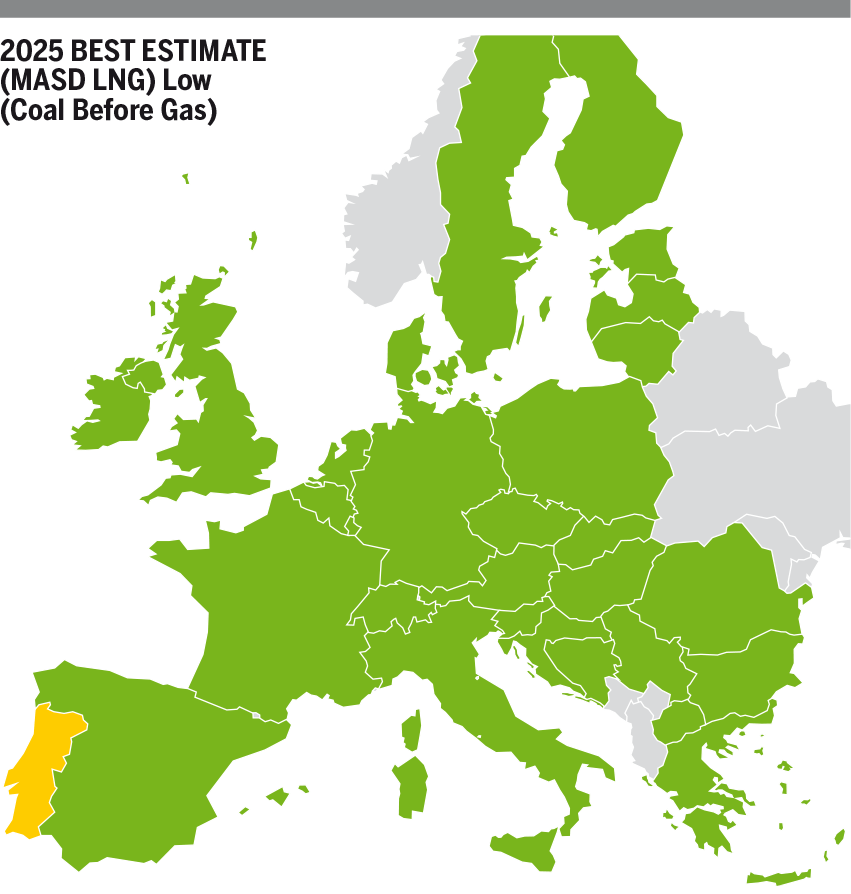

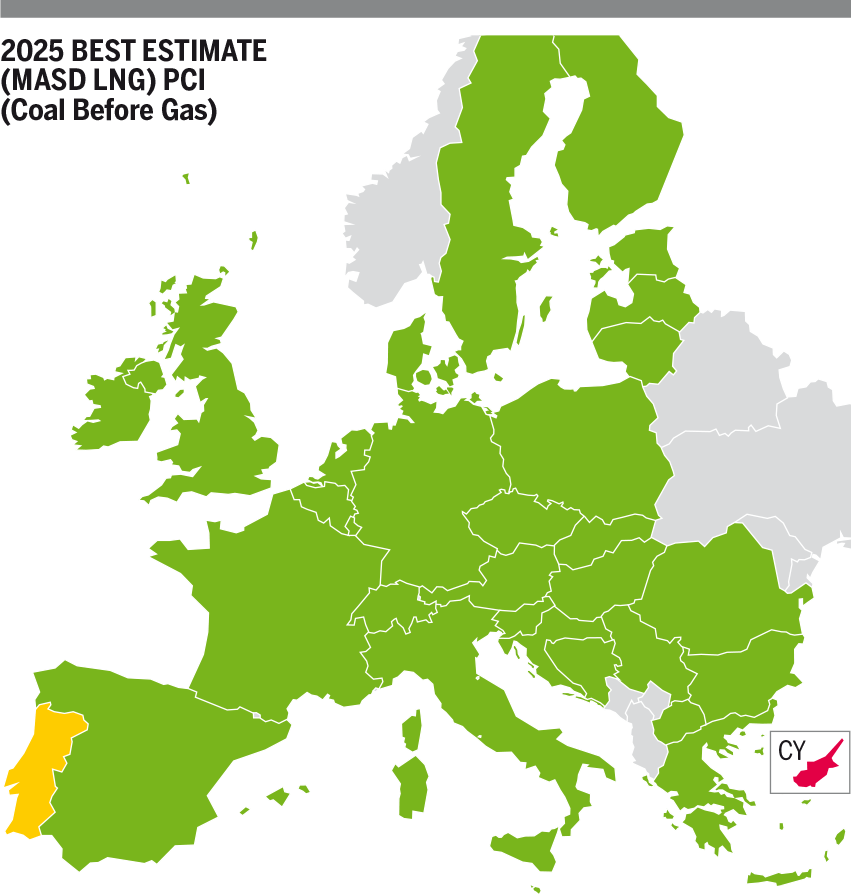

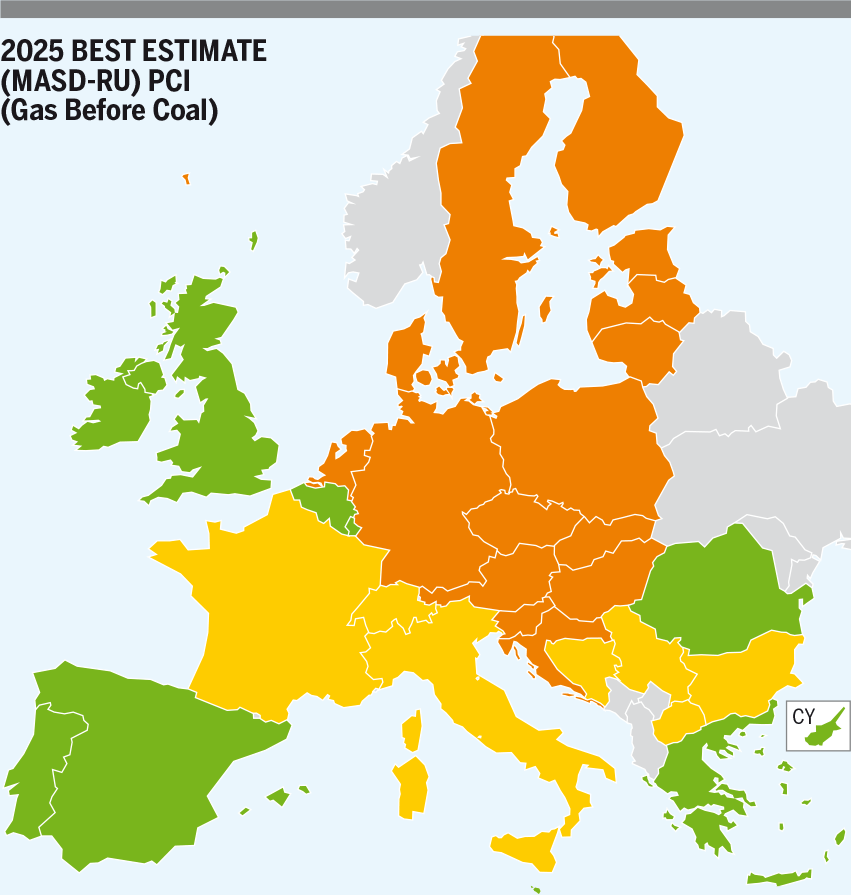

2025

PCI projects allow all the European countries to reduce their dependence on the LNG supply by 5 % in Coal Before Gas and Gas Before Coal scenarios. Compared to the FID projects, PCI projects both reduce the overall dependence on LNG, but also prevent infrastructure limitations between Denmark and Sweden and the rest of the EU. Therefore, all the EU benefits from the decreasing dependence of Denmark and Sweden on LNG.

However, the infrastructure limitation between Portugal and Spain identified in the existing infrastructure level is not alleviated in 2025 by the PCI projects. In addition, Cyprus shows a 100% dependence on LNG supply driven by the commissioning of the new LNG terminal and no connection to other EU countries. See Figure 5.15.

Figure 5.15: MASD LNG – Gas Before Coal and Coal Before Gas – 2025 – Low and PCI infrastructure levels.

2030

National Trends

PCI projects show similar impact as the Advanced infrastructure level and almost mitigate the overall dependence of EU countries on the LNG supply, compared to the Low infrastructure level. However, the Advanced projects do not fully mitigate the dependence of Spain (3 %) and Portugal (7 %) reflecting some infrastructure limitations for Spain to fully cooperate with France and Portugal respectively with Spain.

Nevertheless, Cyprus mitigates its dependence on LNG supply driven by the commissioning of the EastMed allowing Cyprus to connect with the rest of Europe.

COP 21 scenarios

Distributed Energy

PCI infrastructure level projects show similar impact as the Advanced infrastructure level and almost fully mitigate the overall dependence of EU countries on the LNG supply, compared to the Existing infrastructure level (from 7 % to 1 %).

Global Ambition

PCI infrastructure level projects show similar impact as the Advanced infrastructure level and almost fully mitigate the overall dependence of EU countries on the LNG supply, compared to the Existing infrastructure level (from 14 % to 8 %). See Figure 5.16.

Figure 5.16: MASD LNG – All scenarios – 2030 – Low and PCI infrastructure levels.

2040

National Trends

PCI projects fully mitigate the overall dependence of EU countries on the LNG supply.

COP 21 scenarios

PCI projects fully mitigate the overall dependence of EU countries on the LNG supply.

5.2.2.5 Dependence to the largest LNG basin

The LNG market is a global and very diversified market. The assessment of the dependence of Europe on the largest LNG basin (Middle-East LNG supply) with the existing infrastructure confirms that Europe is not dependent on a single LNG basin and can always find alternative LNG supplies.

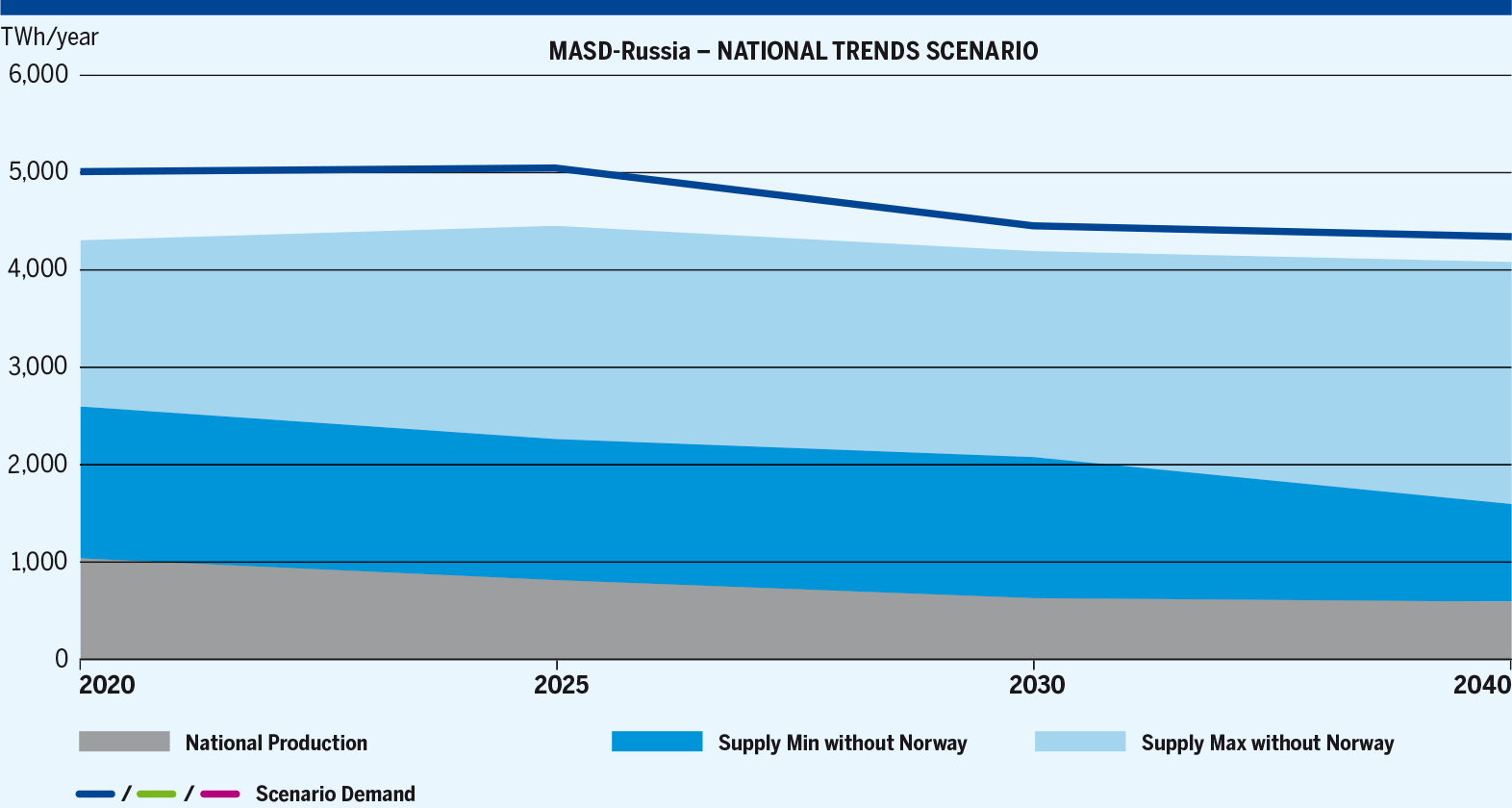

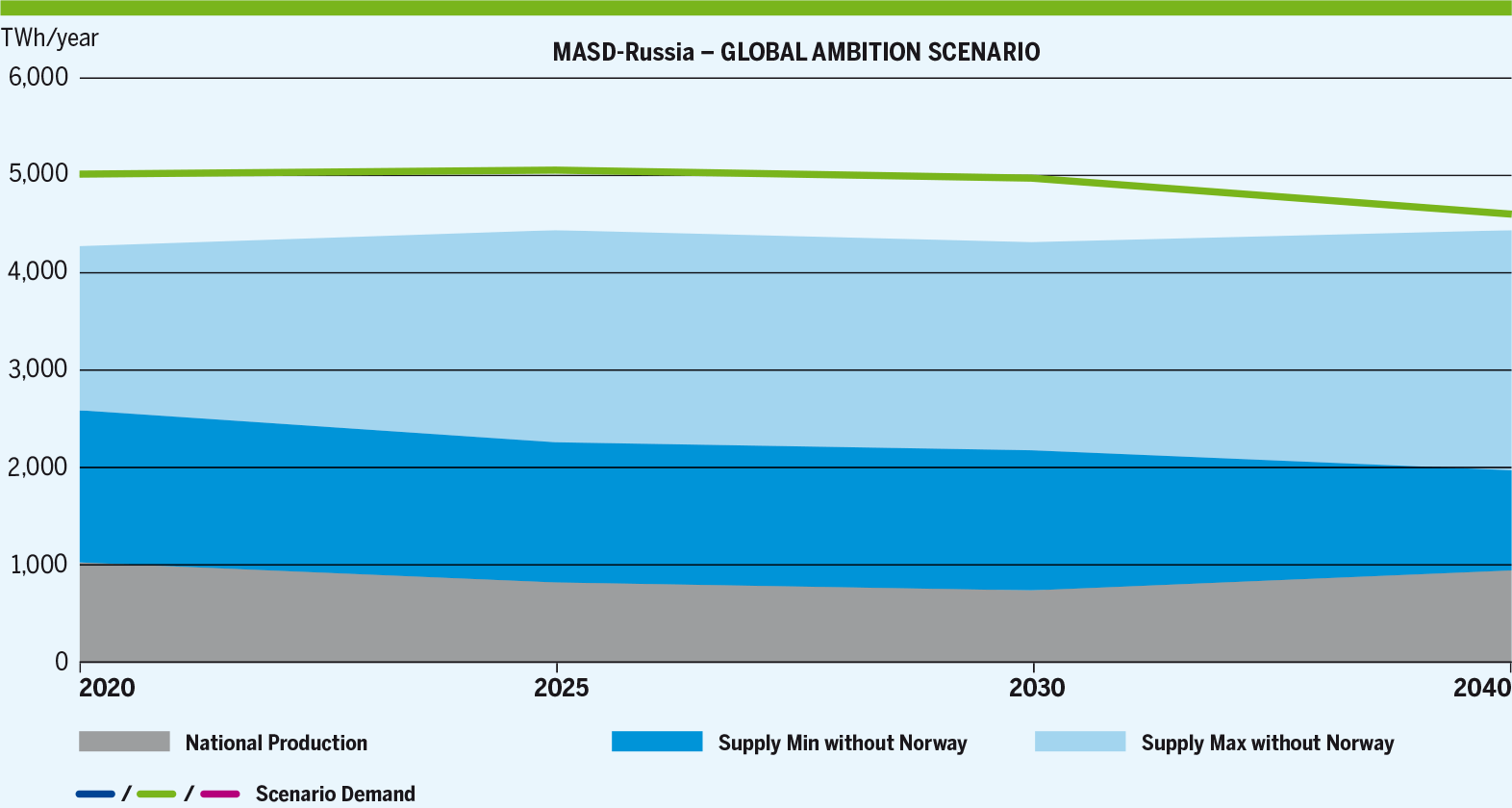

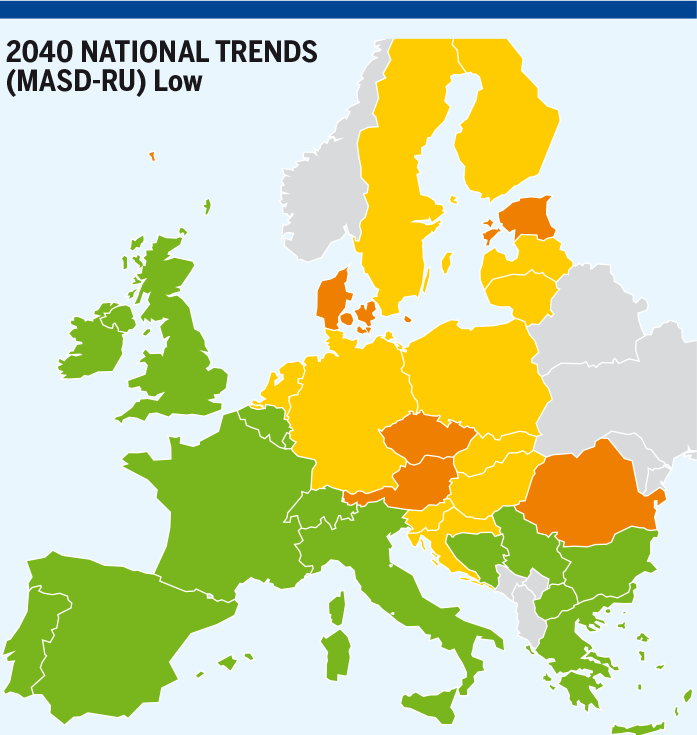

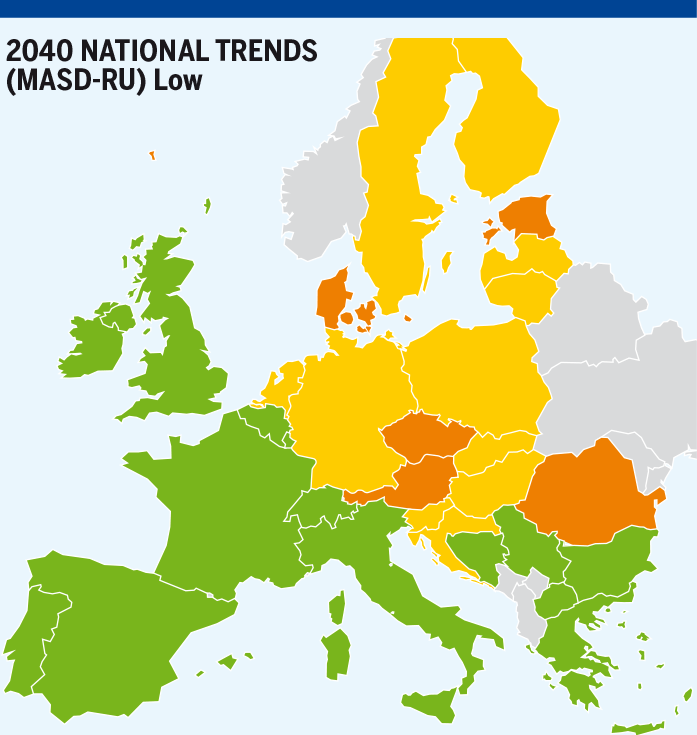

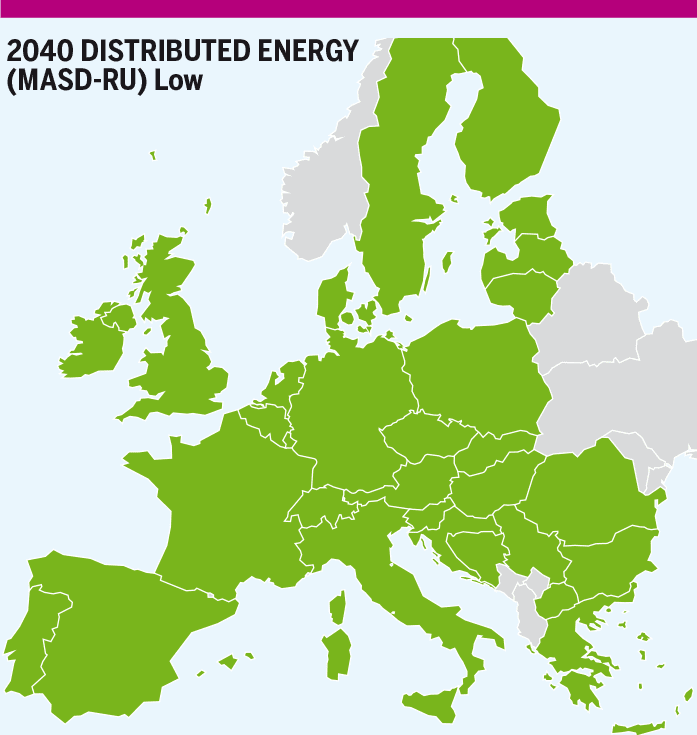

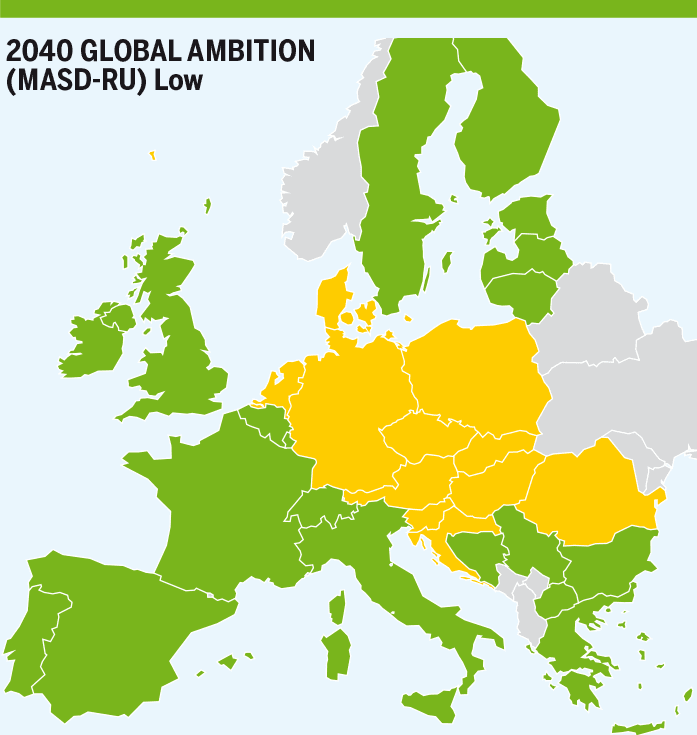

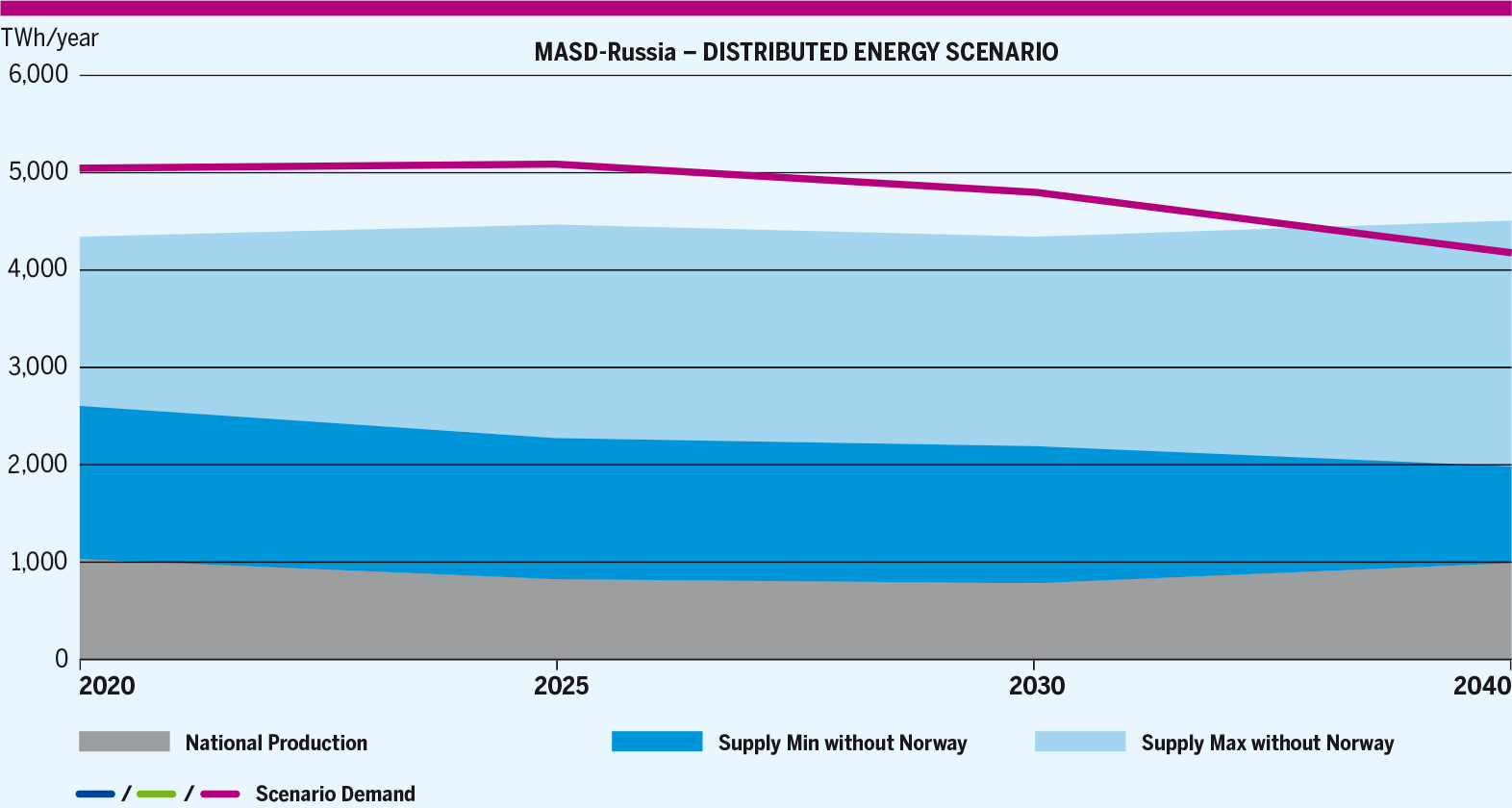

5.2.3 MASD Russia

In all scenarios, Europe depends on Russian gas to satisfy its demand in 2020, 2025 and 2030 and to a lesser extent in 2040. At EU-level, the assessment shows that gas infrastructure allows to make use of the maximum supply potential of all the other gas sources. However, this is not enough to cover the overall EU gas demand. This indicates that Europe relies on Russian gas supply to achieve its balance between supply and demand.

The evolution of the Russian supply dependence generally reflects that the Russian supply has a high potential and therefore can offer a significant level of flexibility to compensate with decline of indigenous conventional production.

The assessment shows that between 2030 and 2040, in Distributed Energy and Global Ambition scenarios, whilst the share of gas demand is increasing in transport and industrial sectors as gas keeps on decreasing its carbon intensity and replaces more carbon intensive alternatives, the combined effect of the development of renewable gases and energy efficiency improvement puts the overall dependence of the EU on imports on a decreasing trend, including Russian imports.

Yet, some country-level limitations exist and are detailed hereafter (see Figure 5.18).

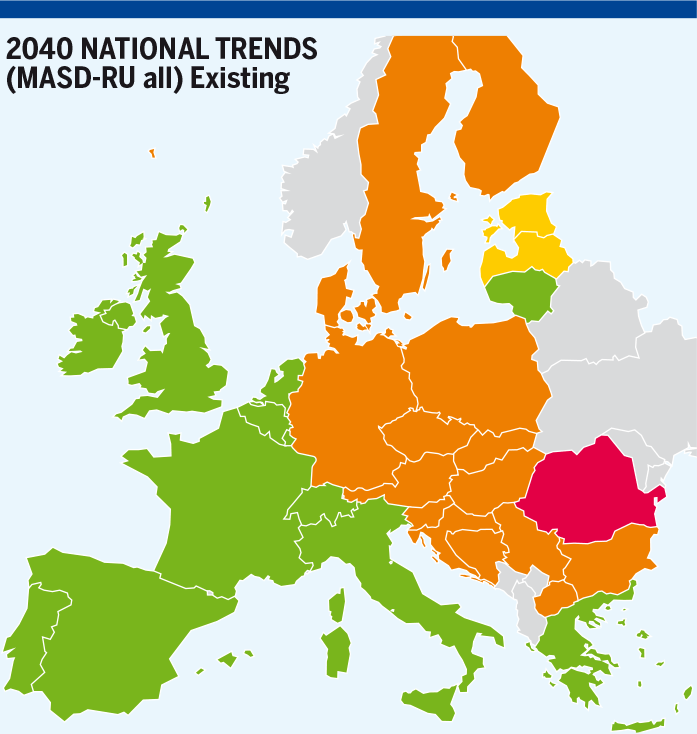

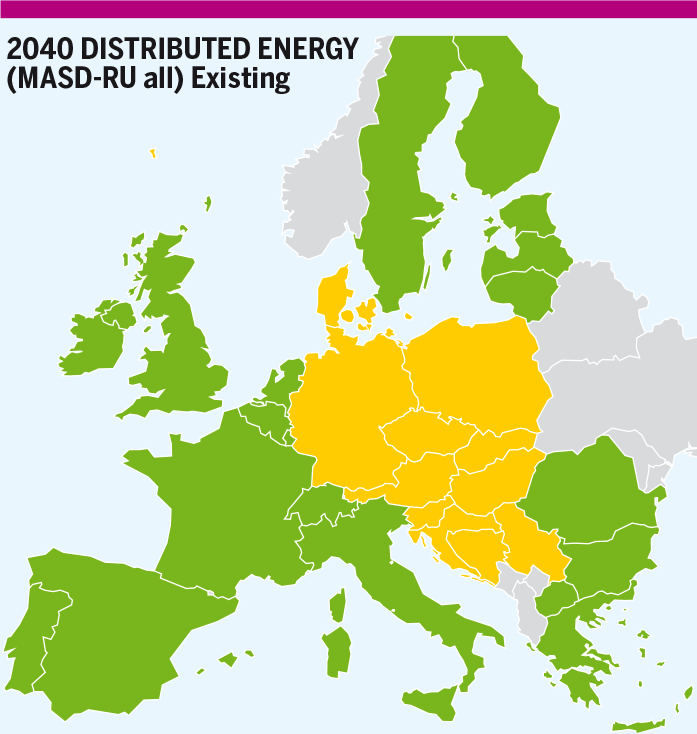

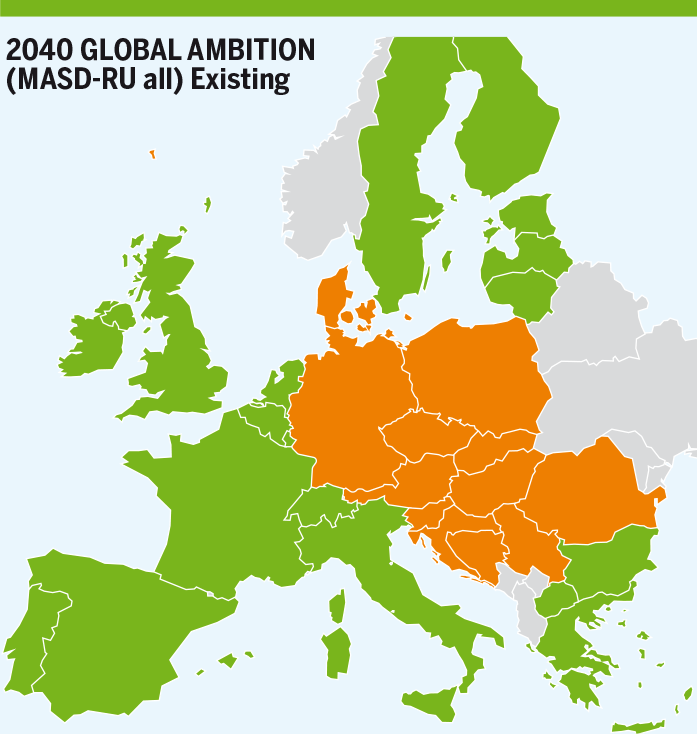

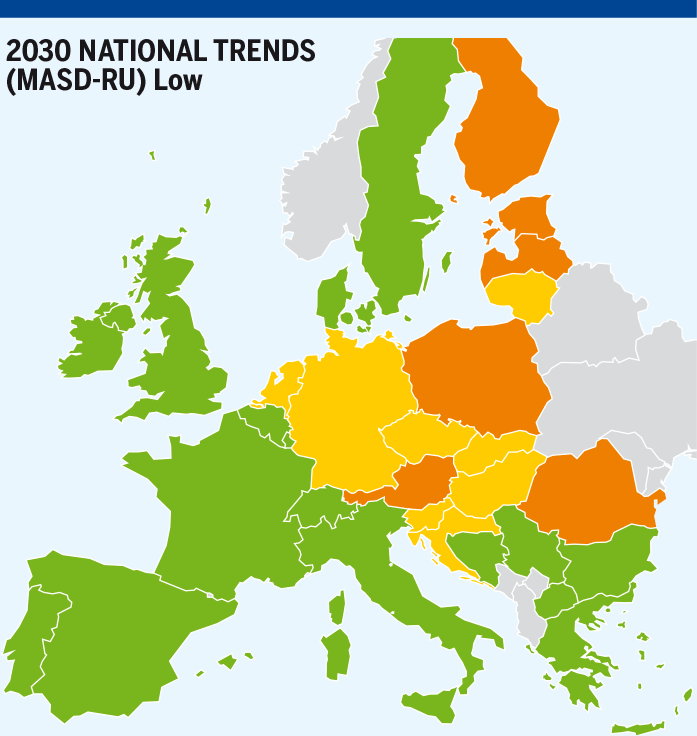

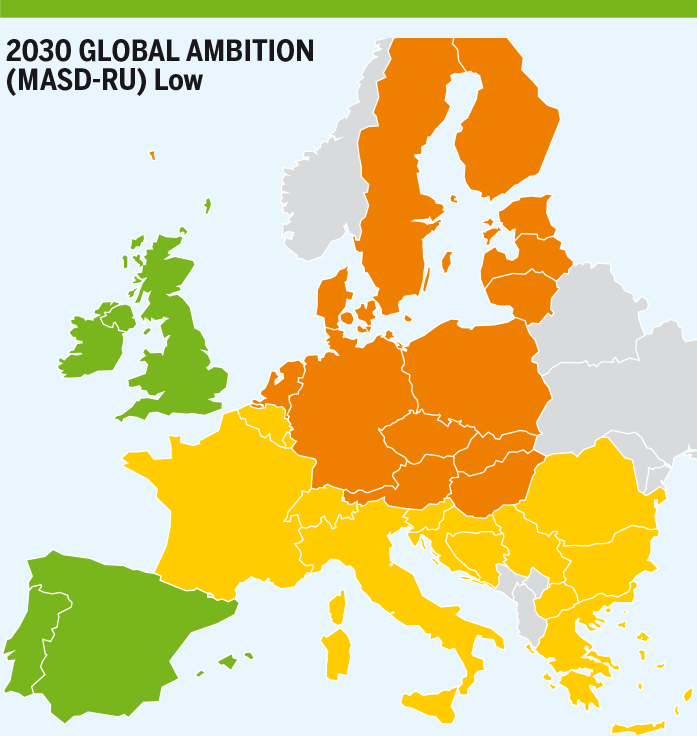

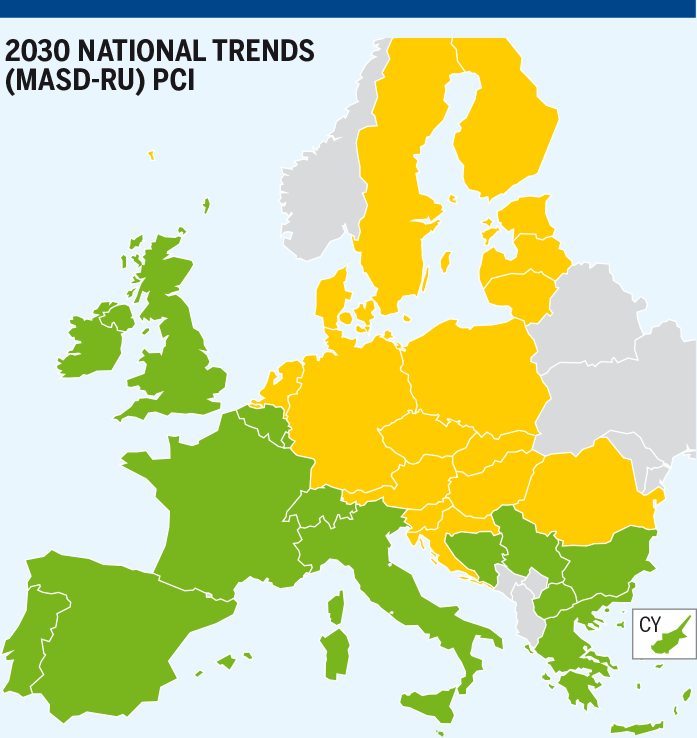

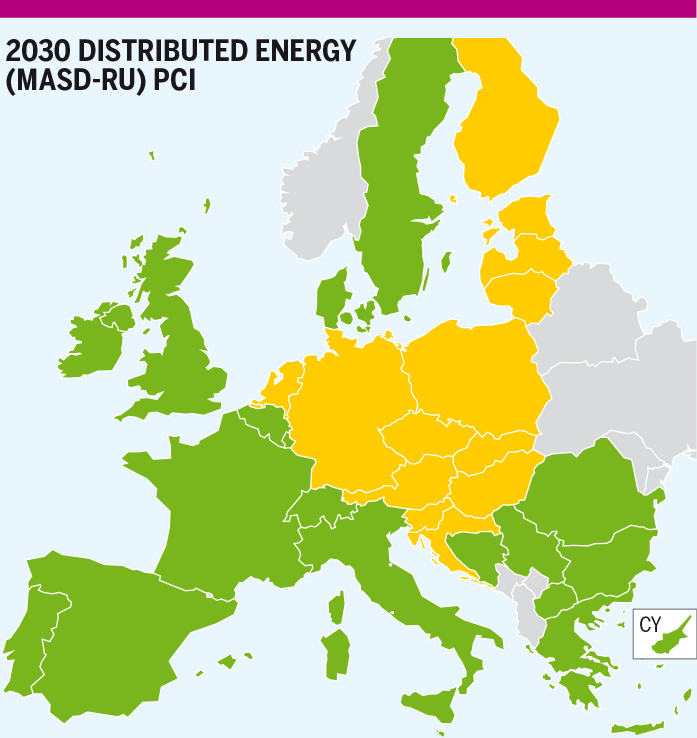

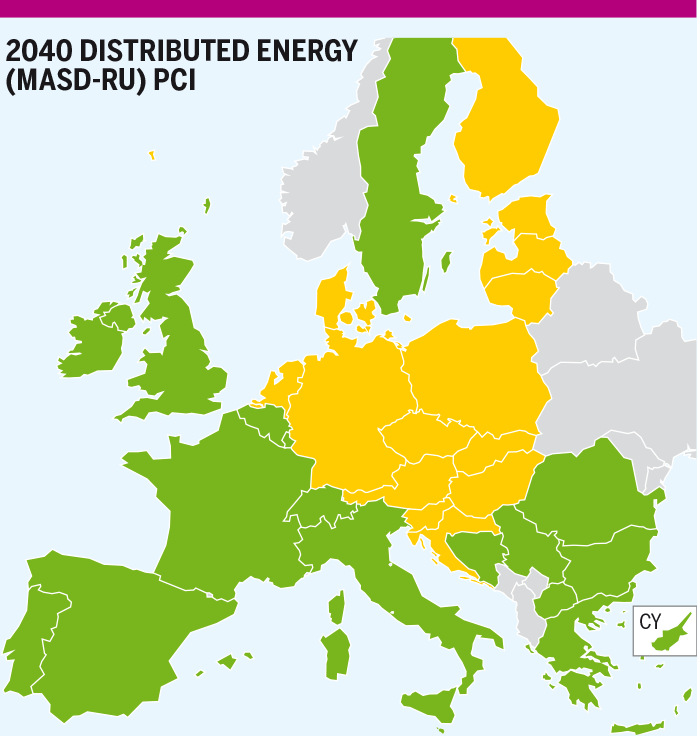

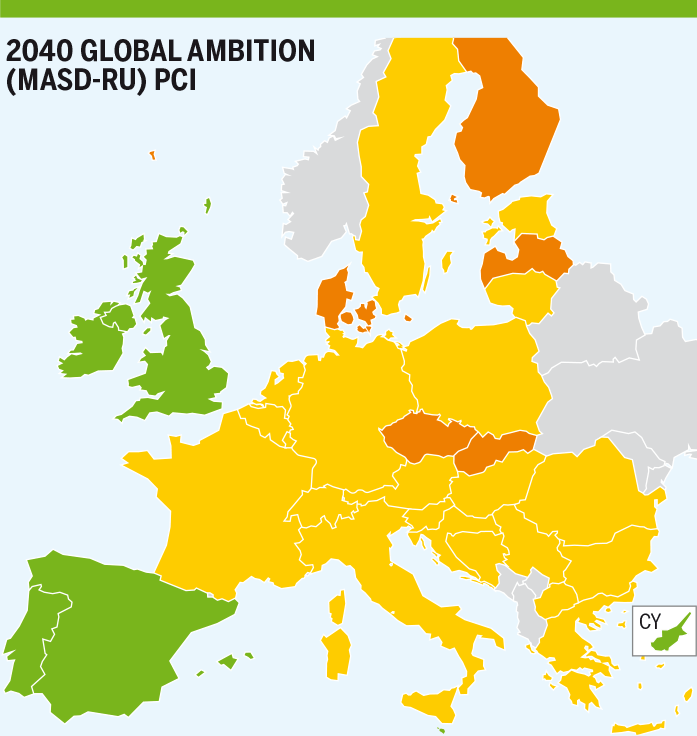

- MASD Russia – NATIONAL TREND SCENARIO

- MASD Russia – GLOBAL AMBITION SCENARIO

- MASD Russia – DISTRIBUTED ENERGY SCENARIO

Figure 5.18: European Level Supply and Demand Adequacy with no supply from Russia.

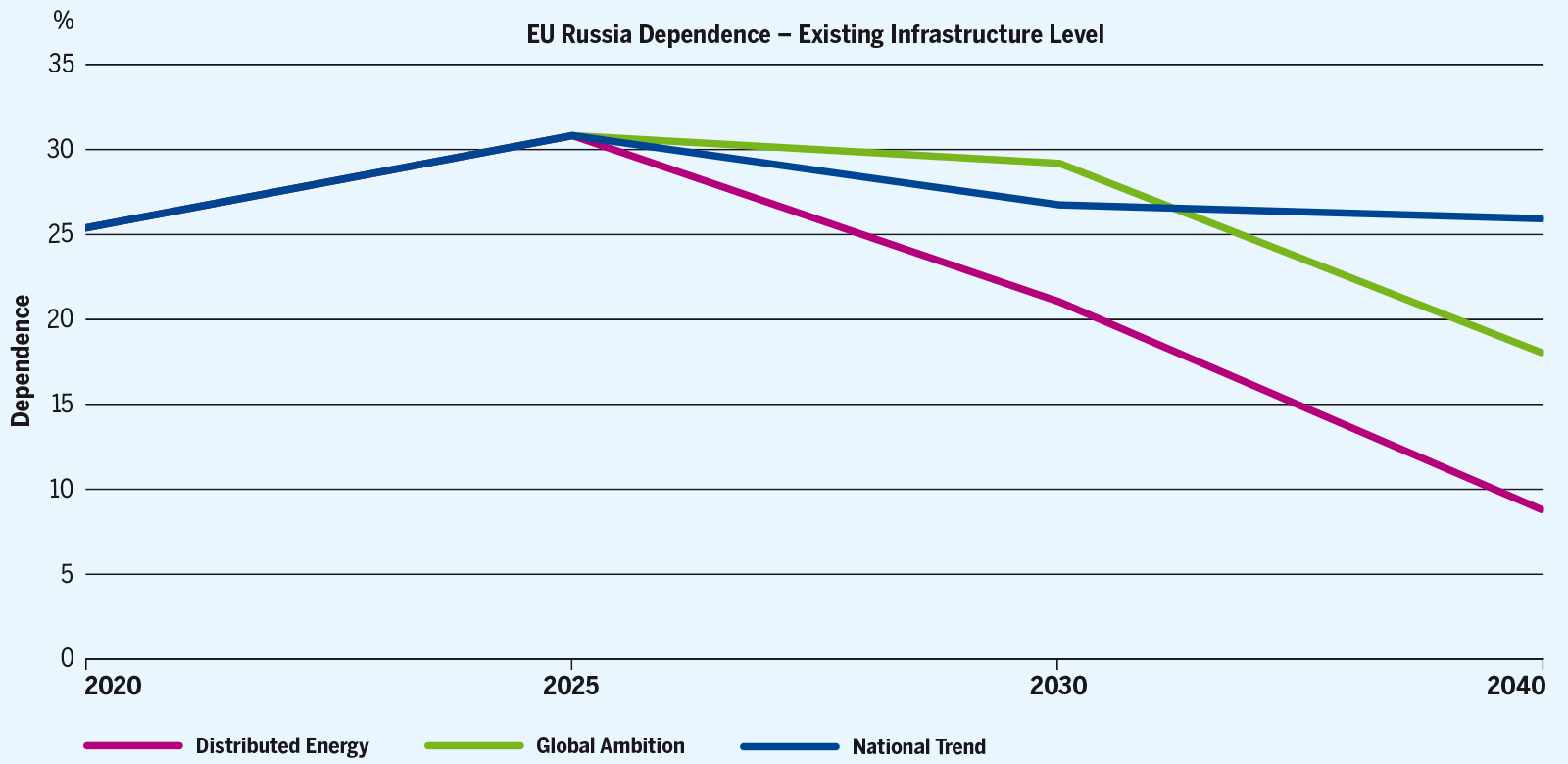

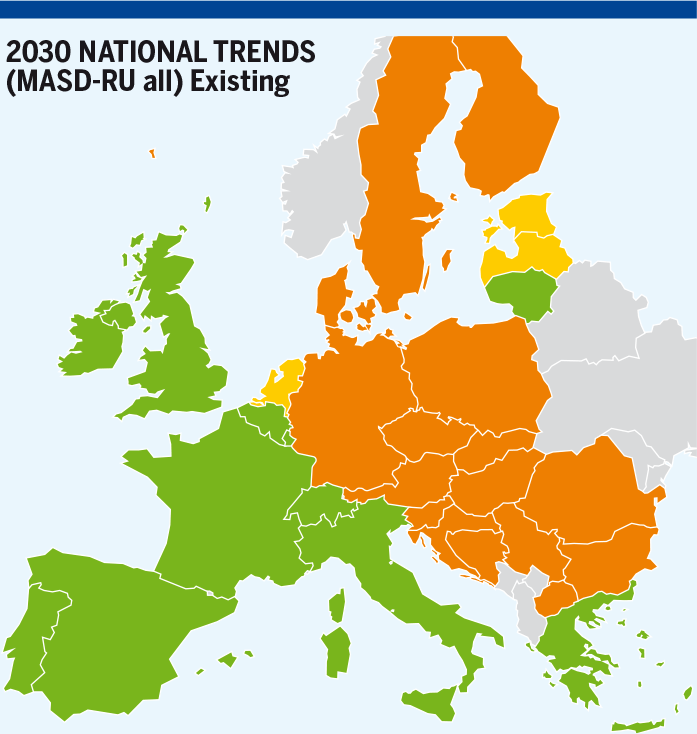

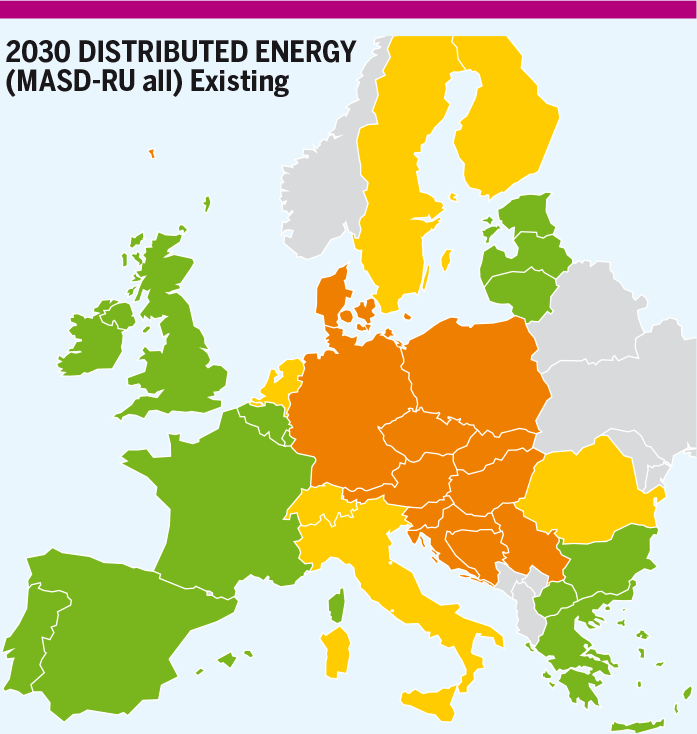

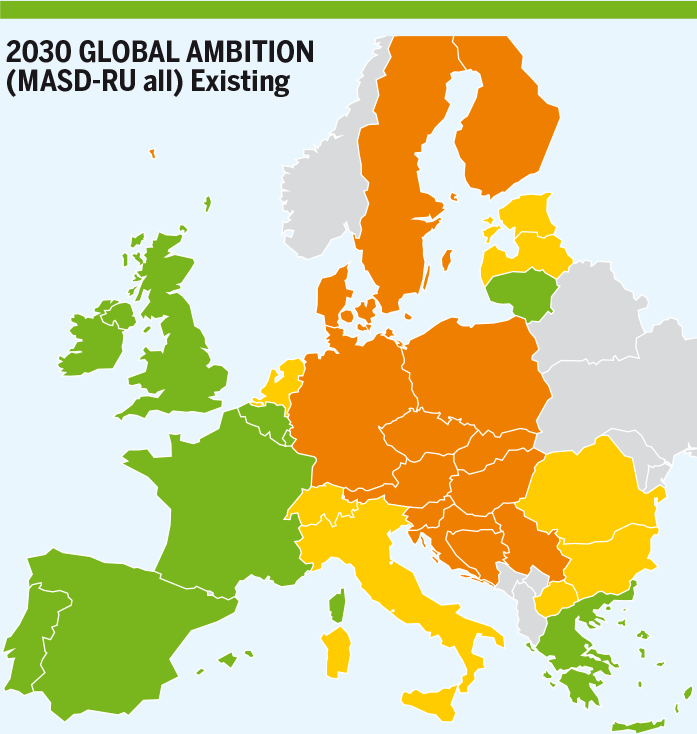

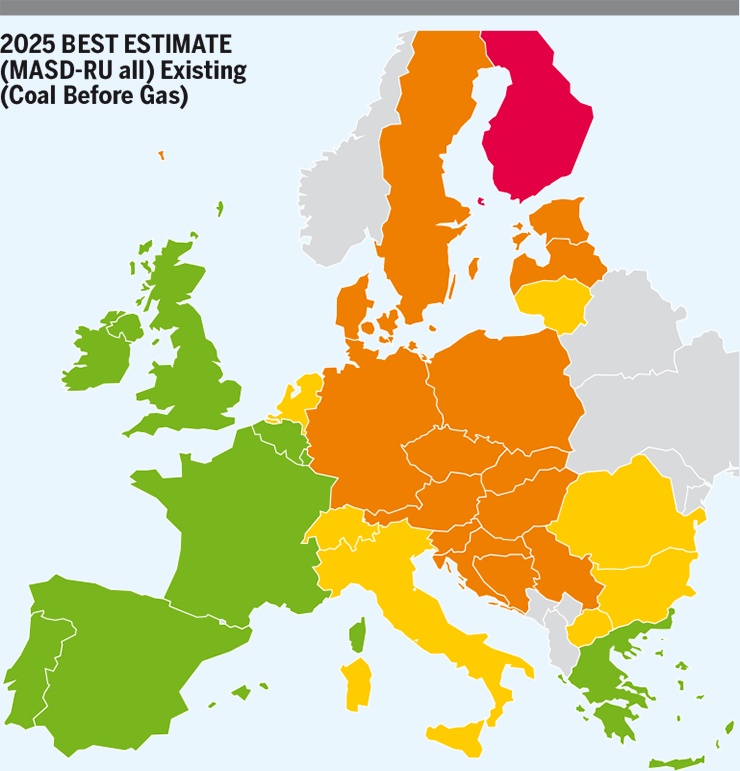

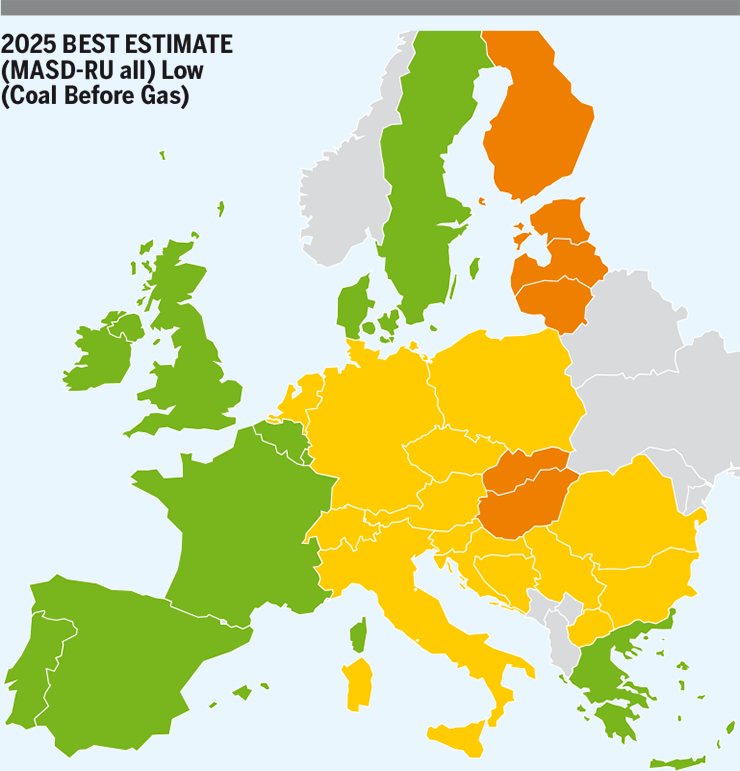

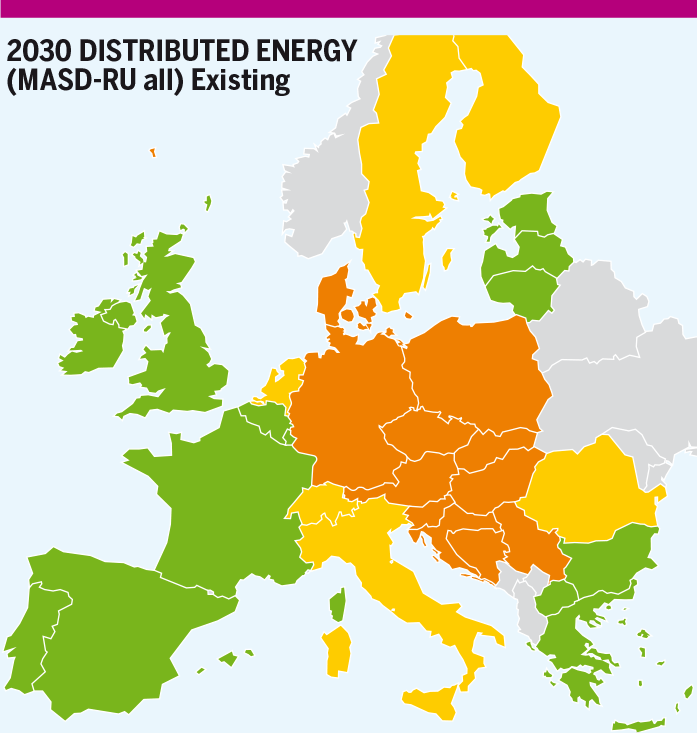

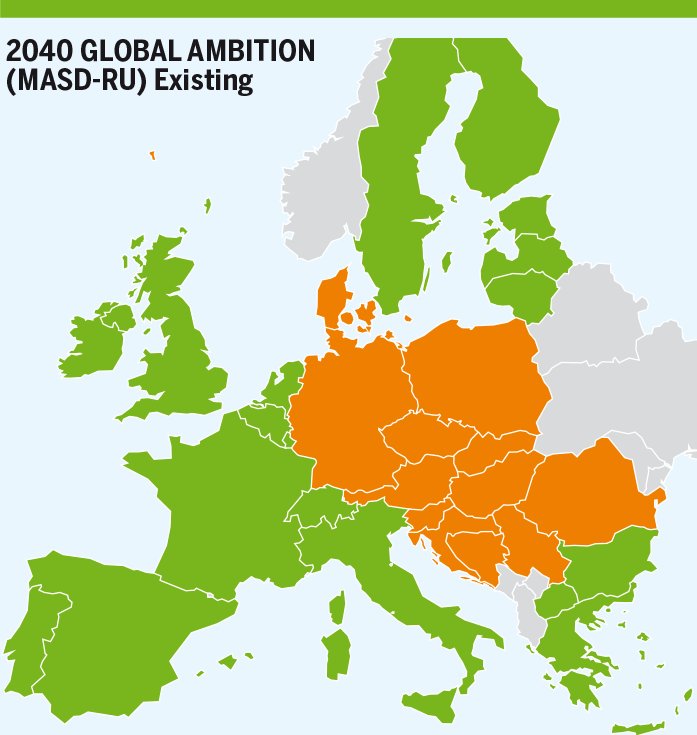

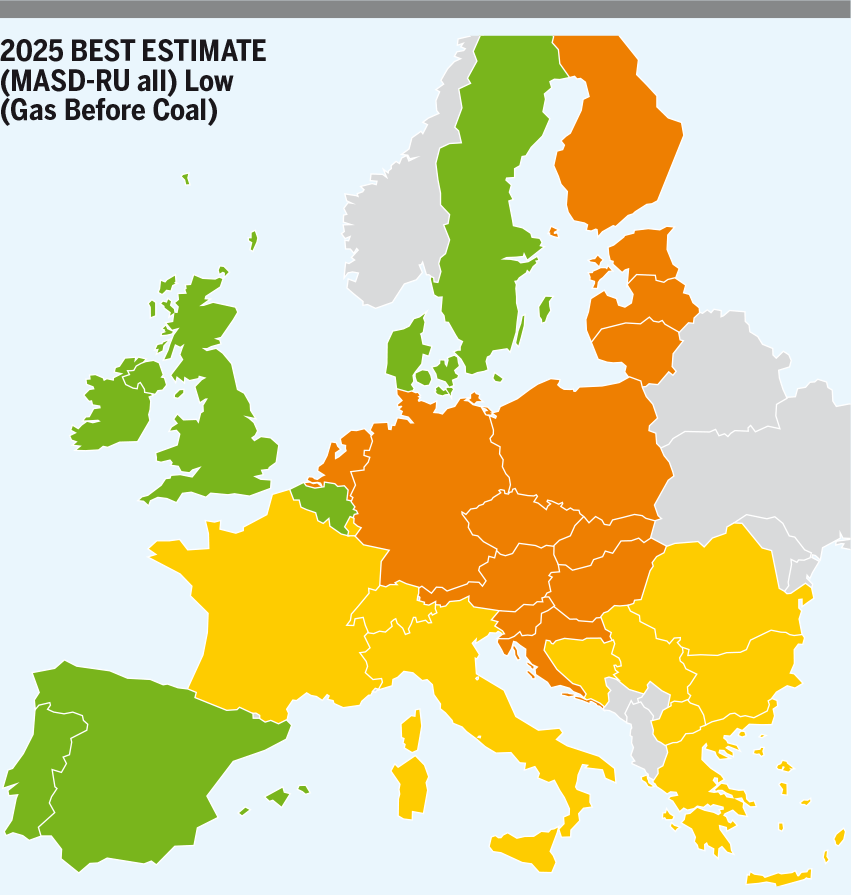

5.2.3.1 Existing Infrastructure level

At European level, the existing infrastructure allows the different countries to benefit from the overall reduction of dependence on the Russian supply. However, if the dependence on Russia can be reduced to 10 % in the Distributed Energy scenario in 2040, in the other scenarios, Europe remains dependent on Russia for around 20 % of its gas supply.

Figure 5.19: European dependence on Russian supply in the Existing infrastructure level.

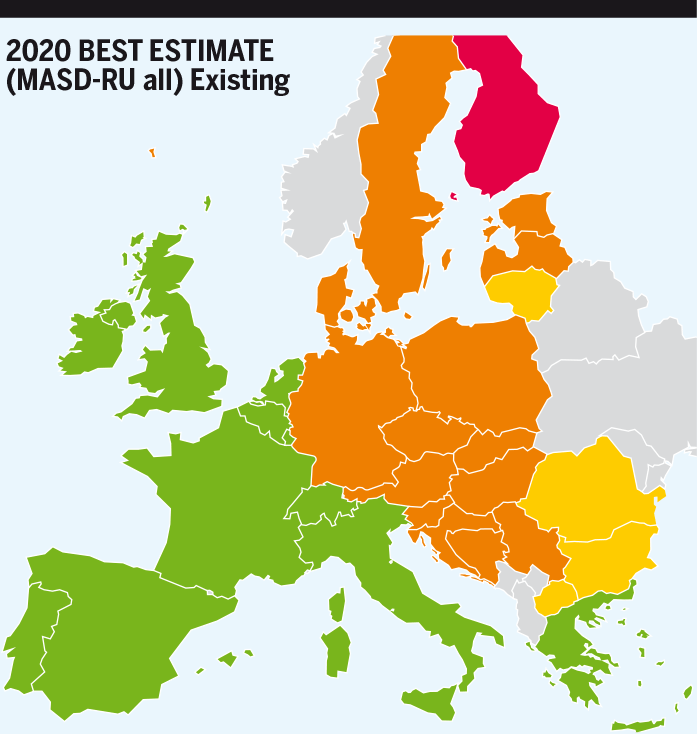

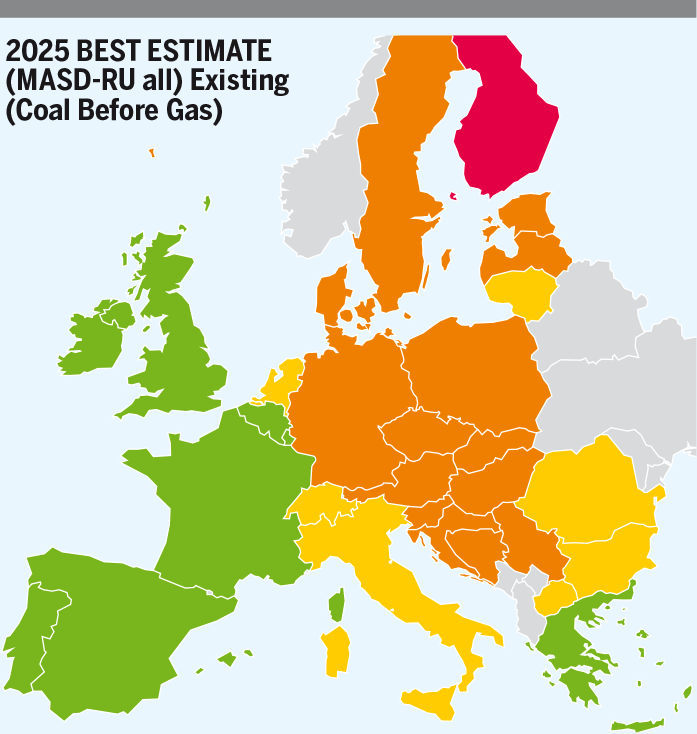

The situation is very different from country to country where some infrastructure limitations persist in Central and Eastern Europe. See Figure 5.20.

2020 – 2025

For the next 5 years, Europe is expected to be dependent on Russia for 15 to 20 % of its annual gas supply. However, the current infrastructure does not allow for a sharing this dependence in a uniform way among all the European countries. Generally, the simulations show contrasted dependence between Eastern European countries (dependence higher than 40 %) and Western Europe (less than 10 % dependence), indicating some infrastructure limitations between Western and Eastern countries.

Specifically, in South-Eastern Europe, the assessment shows different levels of dependence between Central East European countries1 (more than 40 %) and Romania (less than 30 %), Bulgaria (less than 30 %) and Greece (less than 10 %), indicating further infrastructure limitations between South Eastern countries and Central Eastern countries.

Lithuania has alternative supply access than Russia and shows a lower dependence than its neighbouring countries. However, the assessment shows some infrastructure limitations preventing Lithuania to further cooperate with the other Baltic states and Poland to reduce the overall dependence of the region.

Over time, Italy shows an increasing dependence on Russian gas from 10 % in 2020 to 30 % in 2025 in the Gas before coal scenario.

1 Central East European Countries: Germany, Poland, Czech Republic, Slovakia, Austria, Hungary, Croatia, Serbia, Bosia and Herzegovina and Slovenia

Figure 5.20: MASD RUSSIA – Scenario and Years – Existing Infrastructure level.

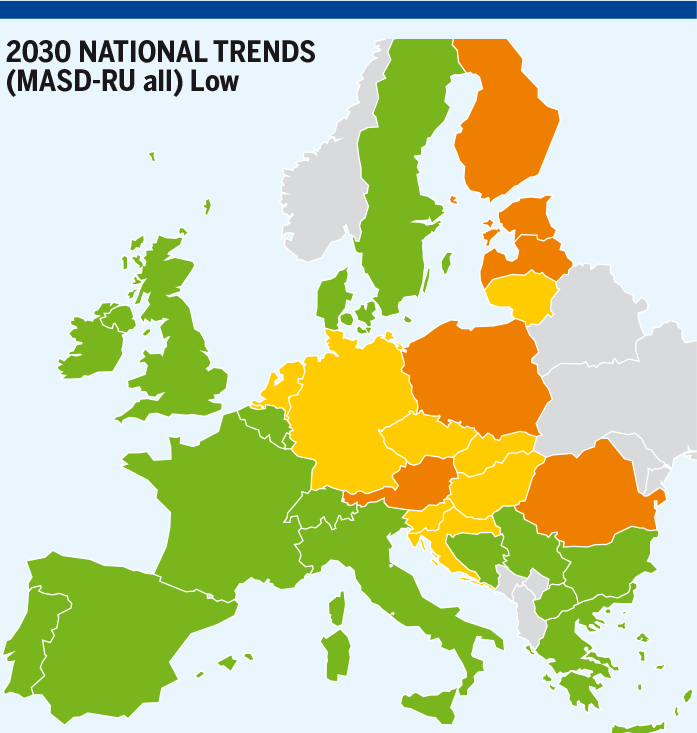

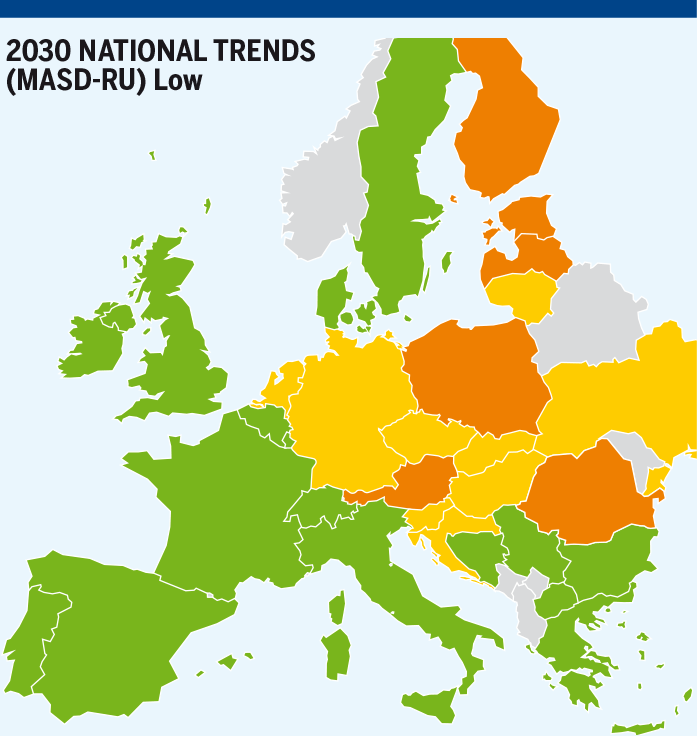

2030

National Trends

The assessment shows some infrastructure limitations preventing:

- Western (MASD < 15 %) and Eastern Europe, including Germany (MASD > 30 %) to cooperate and reduce the overall EU dependence.

- The Baltic states to share their lower dependence (15 % to 25 %) with Poland (43 %) and Finland (49 %).

- Lithuania to share its lower dependence (15 %) with Poland and the other Baltic states (25 %).

- Greece to share its lower dependence (5 %) with Bulgaria (30 %) and the other Balkan countries (45 %).

COP 21 scenarios

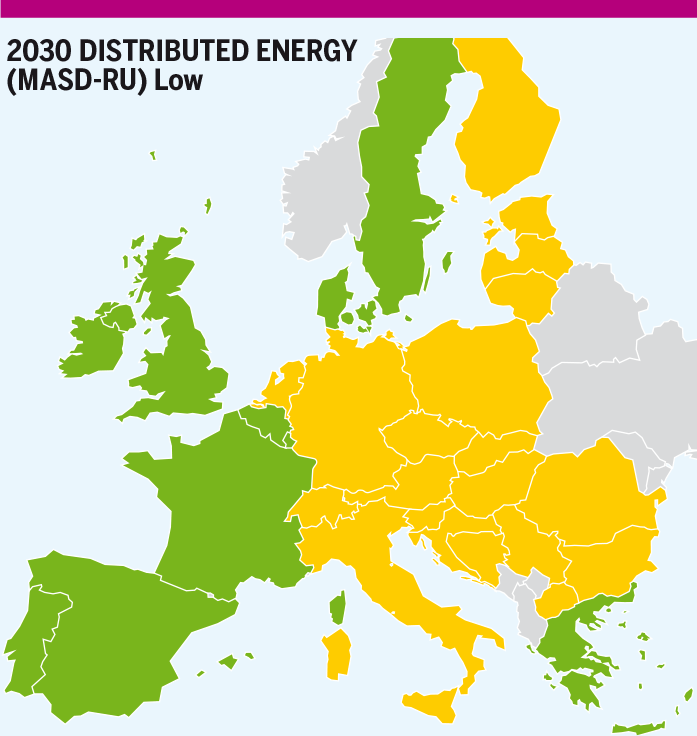

Distributed Energy

The uptake of indigenous renewable gases production generally reduces the overall dependence of the EU on imports. Additionally, those renewables further reduce the carbon intensity of the gas mix and demand in industry and transport enabling the shift from carbon intensive fuels to gas. However, the combination of those two elements still shows some improvement in the reduction of the EU dependence towards the Russian supply compared to National Trends. In particular:

- Development of biomethane and Power-to-Gas in Sweden and Finland significantly reduces in their dependence on Russian supply (– 20 %).

- Following the further penetration of biomethane and the development of Power-to-Gas capacities, the Baltic states show a significant decrease in their dependence (– 10 %) and are further aligned with Lithuania.

- Greece shows no dependence on Russia and Bulgaria is dependent to a very limited extent (3 %).

- Romania shows a significant decrease in its dependence on Russia (from 43 % to 17 %).

However, those improvements also reveal some remaining infrastructure limitations:

- between Western Europe (0 % dependence) and Germany (41 %),

- between the Baltic states, Finland and Poland,

- between Lithuania and Latvia,

- in the Balkan region between Romania and its neighbouring countries and between Bulgaria and Serbia,

- in Italy where the development of renewable gases (compared to National Trends) sustains the gas demand with additional fuel switch from other sectors.

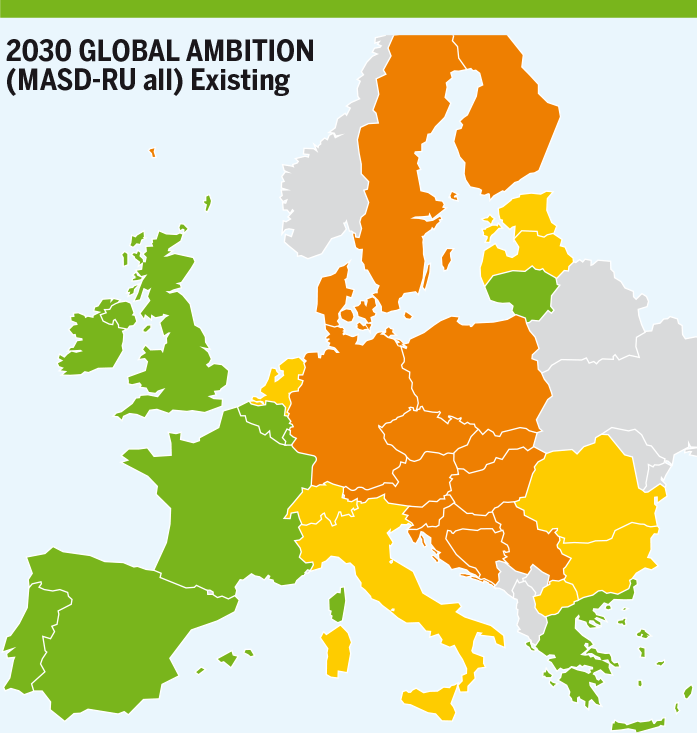

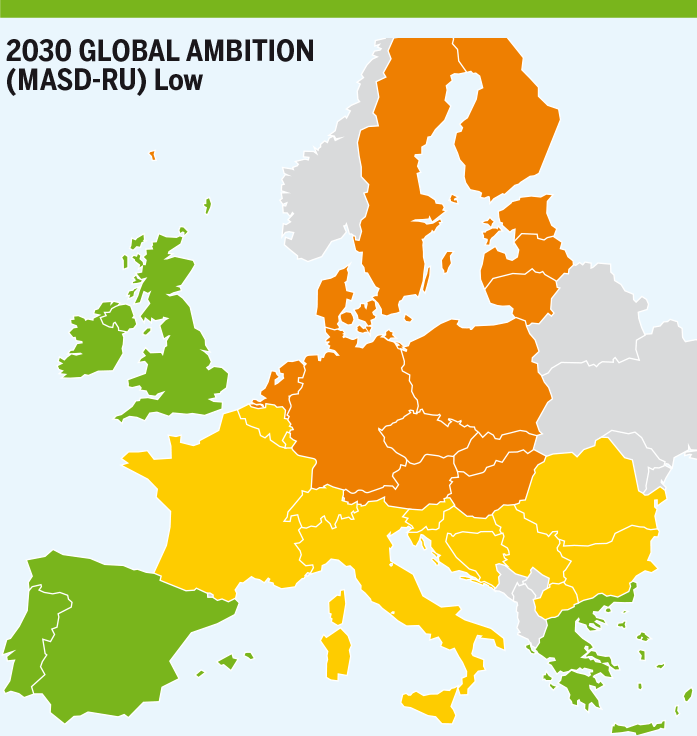

Global Ambition

The uptake of indigenous renewable gases production generally limits the overall increasing dependence of the EU on imports caused by the decline of the conventional indigenous production. Equally, the global approach towards tackling climate change enhances the production of renewable and decarbonised gases outside the EU and sustains a global and decarbonised gas market. Consequently, the production and imports of renewable and decarbonised gases reduce the carbon intensity of the gas mix and demand in industry and transport further shifts from carbon intensive fuels to gas compared to National Trends.

However, the combination of those two elements shows comparable EU dependence towards the Russian supply compared to National Trends except for Romania and Bulgaria showing a significant decrease in their dependence (– 25 %).

Those improvements also reveal some remaining infrastructure limitations:

- Between the UK and Ireland (0 %) and continental Europe.

- Between the Iberian Peninsula (0 %) and the rest of Europe.

- Between Western Europe (0 % dependence) and Germany (41 %).

- Between Western (MASD < 15 %) and Eastern Europe, including Germany (MASD > 40 %).

- The Baltic states cannot share their lower dependence (15 % to 25 %) with Poland (48 %) and Finland (47 %).

- Lithuania cannot share its lower dependence (15 %) with Poland and the other Baltic states (25 %).

- In the Balkan region between Romania and its neighbouring countries and between Bulgaria and Serbia.

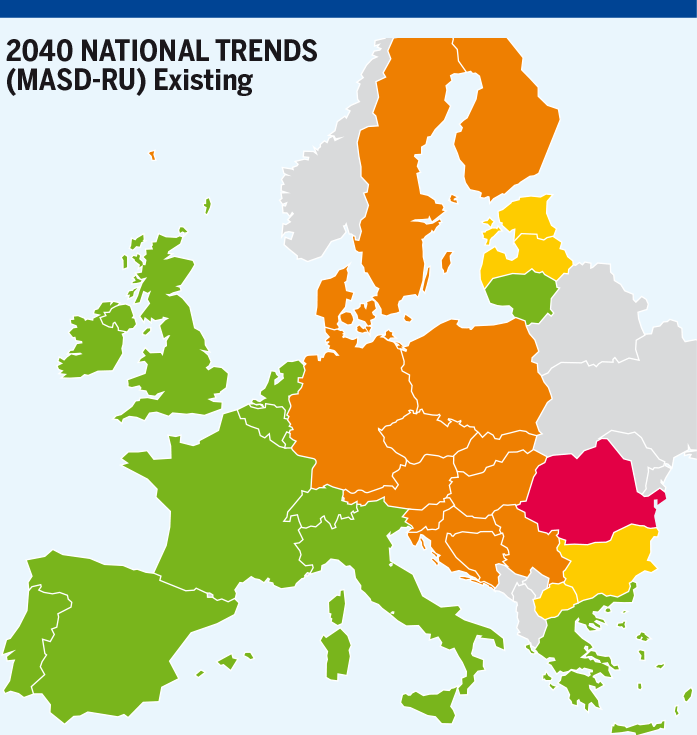

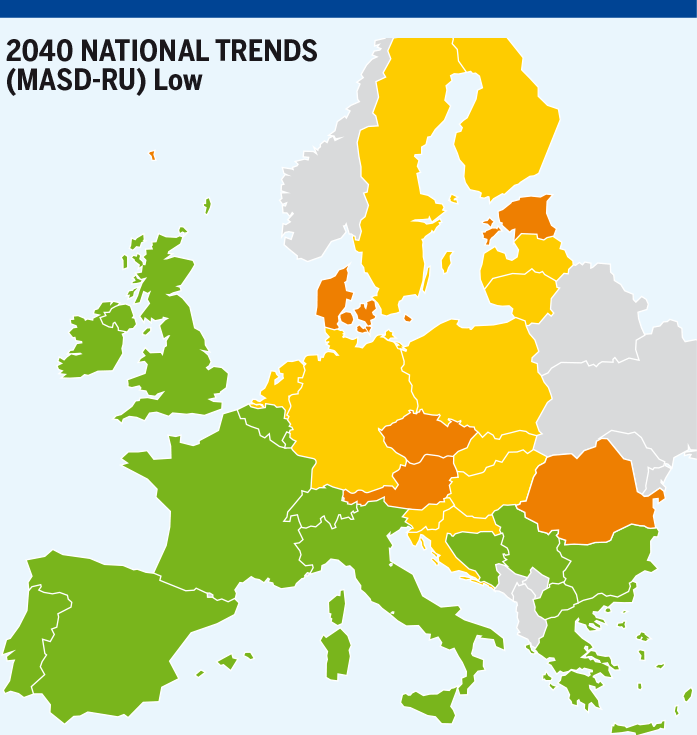

2040

National Trends

With the further decline of the conventional indigenous production and the very limited development of renewable gases, the EU is increasingly dependent on imports and more specifically on the Russian supply.

The assessment shows some infrastructure limitations preventing:

- Western (MASD < 11 %) and Eastern Europe, including Germany (MASD > 40 %) to cooperate and reduce the overall EU dependence.

- The Baltic states to share their lower dependence (10 % to 15 %) with Poland (45 %) and Finland (45 %).

- Lithuania to share its lower dependence (10 %) with Poland and the other Baltic states (15 %).

- Greece (not dependent) to help Bulgaria (30 %) and the other Balkan countries (45 %).

- Romania (55 %) to cooperate with Bulgaria (31 %) or Hungary (45 %).

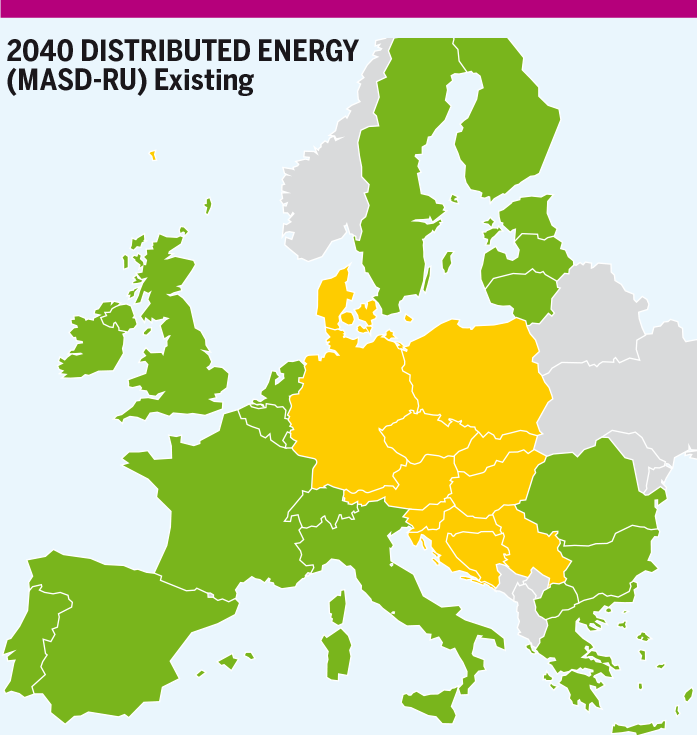

COP 21 scenarios

Distributed Energy

The overall improvement in energy efficiency and the significant development of renewable gases (biomethane and power-to-gas) compensate the decline of the conventional natural gas production and the increasing gas demand for power generation due to increasing electrification.

Europe in general could satisfy its demand with alternative supply sources of gas and show no dependence on Russian gas supply. However, Central-Eastern Europe (DK, DE, PL, CZ, SK, AT, HU, HR, SI, BA and RS) shows a dependence close to 25 % revealing some infrastructure limitation between this group of countries and their neighbours:

- In the West between Germany with the Netherlands, Belgium, France, Switzerland and Italy.

- In the North-East between Poland and Lithuania.

- In the East between Hungary and Romania; and between Bulgaria and Serbia.

- In the South between Austria and Slovenia with Italy.

Global Ambition

The further development of indigenous renewable gases production participates to decreasing the overall dependence of the EU on imports and fully compensate the decline of the conventional indigenous production. Equally, the global approach towards climate change enhances the production of renewable and decarbonised gases outside the EU and sustains a global and decarbonised gas market. Consequently, the production and imports of renewable and decarbonised gases reduces the carbon intensity of the gas mix and demand in industry and transport further shifting from carbon intensive fuels to gas compared to National Trends.

In 2040, as in the Distributed Energy scenario, Europe in general could satisfy its demand with alternative supply sources of gas and show close to no dependence on Russian gas supply.

However, if most of the EU countries show no dependence at all on Russian supply, Central-Eastern Europe (Denmark, Germany, Poland, Slovakia, Austria, Czech Republic, Croatia, Slovenia, Bosnia and Herzegovina and Serbia) shows a dependence close to 40 % revealing some infrastructure limitation between this group of countries and their neighbours:

- In the West between Germany with the Netherlands, Belgium, France, Switzerland and Italy.

- In the North-East between Poland and Lithuania.

- In the East between Hungary and Romania, between Romania and Bulgaria, and between Bulgaria and Serbia.

- In the South Between Austria and Slovenia with Italy.

Figure 5.21: Demand and production evolution in the Baltic states and Finland in Distributed Energy scenario.

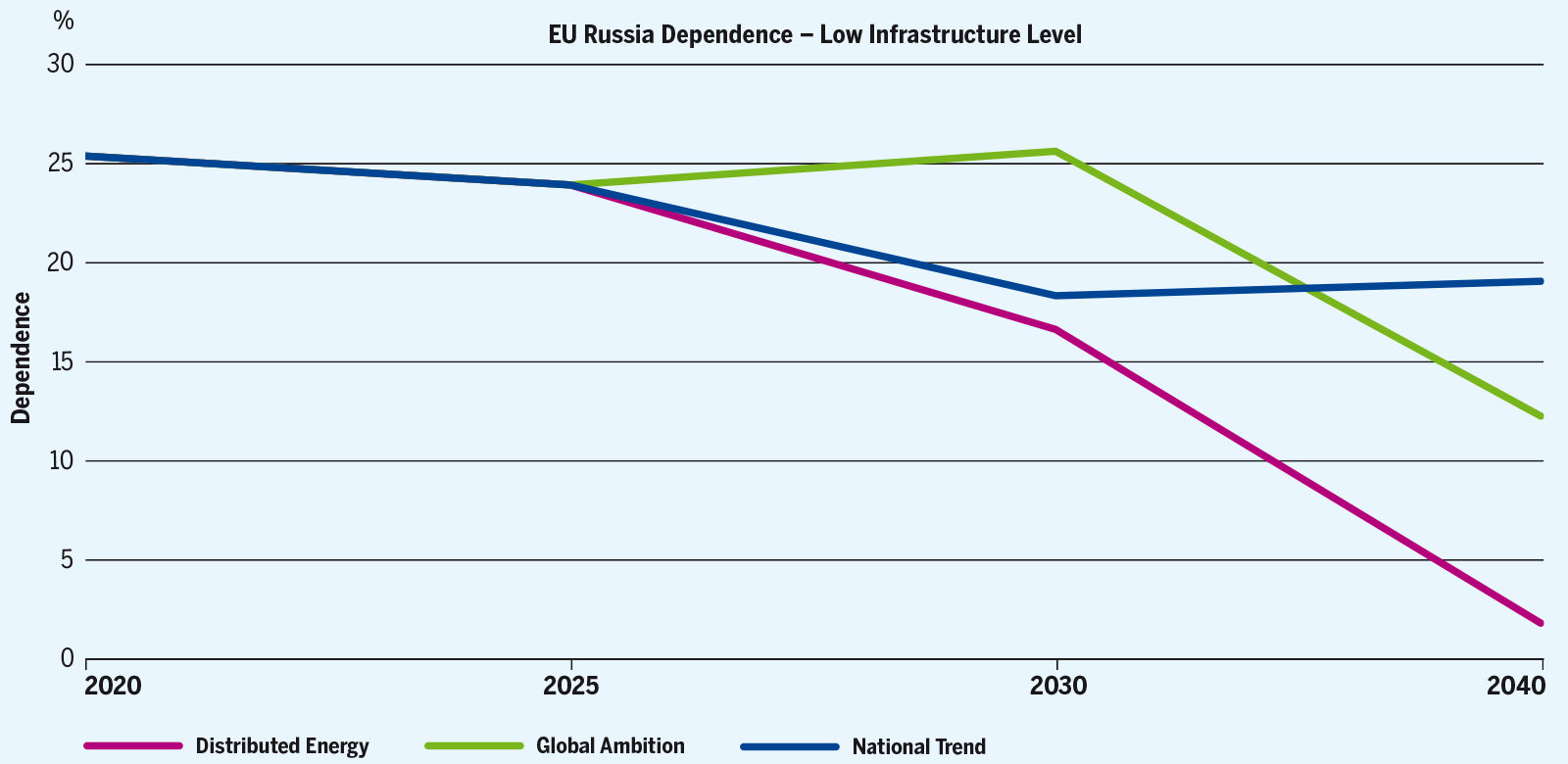

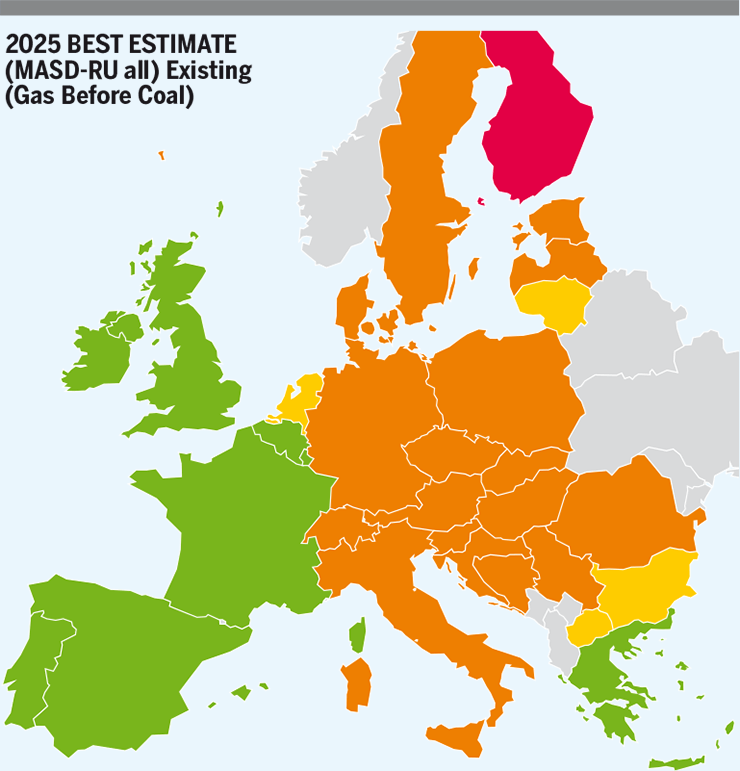

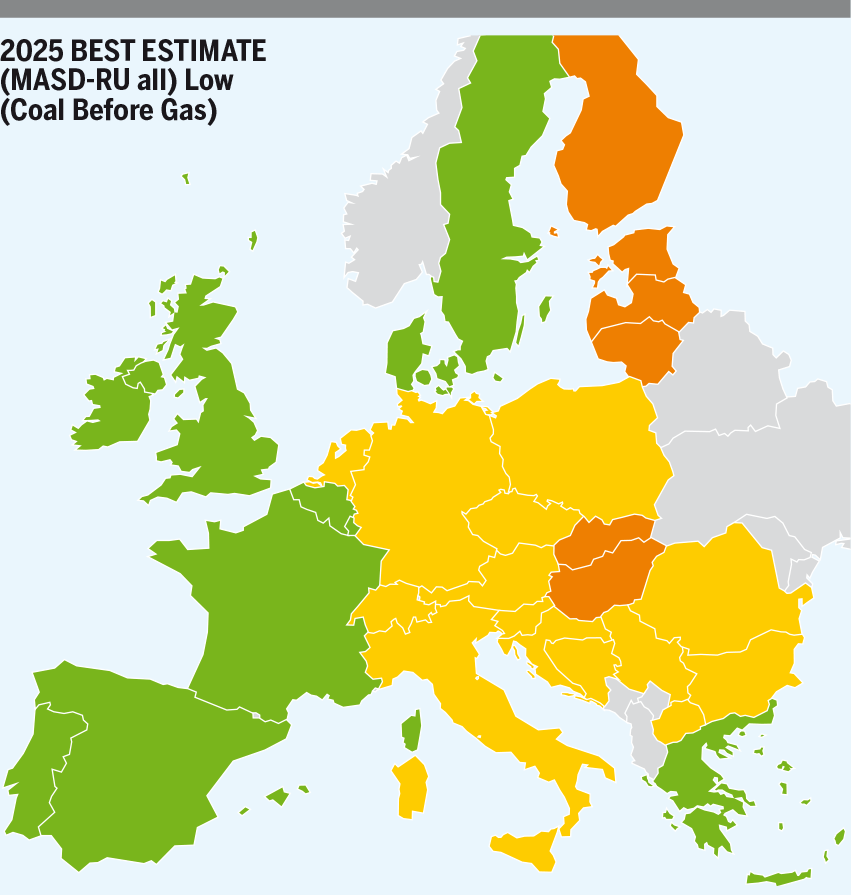

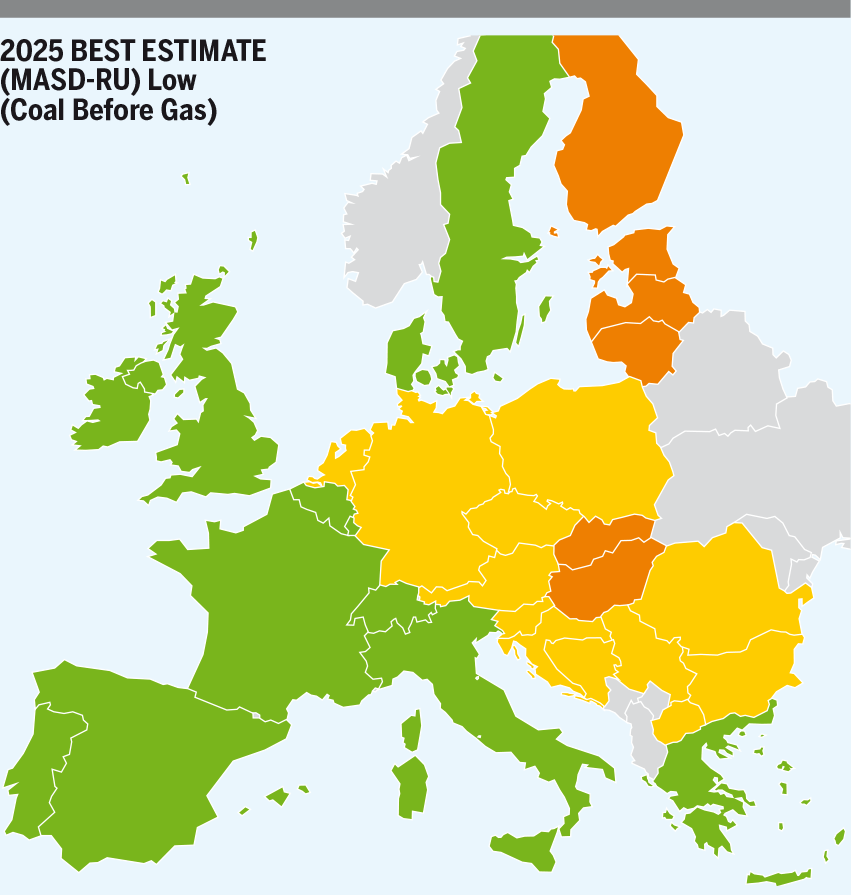

5.2.3.2 Low Infrastructure level

At European level, the Low infrastructure including all the FID projects shows further reduction in the overall dependence on Russia compared to the existing infrastructure. FID projects allow Europe to reduce the dependence on Russian gas by 5 % as of 2030 in all scenarios. Furthermore, in Distributed Energy in 2040, the FID projects almost fully mitigate the dependence of Europe on Russian supply (3 % dependence).

Figure 5.22: European dependence on Russian supply in the Low infrastructure level.

However, the situation can be different from country to country.

2025

FID projects partially mitigate the situation in Central-Eastern Europe with a general decrease of the Russian dependence by 10 %, and a total mitigation for Denmark and Sweden. FID projects additionally enhance the cooperation between the Baltic states and Finland: they all show the same level of dependence on Russian supply (40 % in Coal Before Gas scenario).

However, some infrastructure limitations remain:

- The improvement in Denmark and Sweden cannot be fully shared with the other Member States due to limited interconnections,

- Germany and the Netherlands cannot benefit from the limited dependence of their western neighbours (UK, Belgium and France),

- Lithuania interconnections with Poland and Latvia are limited and prevent from spreading and decreasing the lower dependence of CEE further North.

- In the Balkan region, Romania and Bulgaria remain isolated since their dependence cannot either benefit to Central-Eastern Europe (because of infrastructure limitations between Romania and Hungary, Serbia and Croatia-Hungary) or take advantage of the low dependence of Greece on Russian supply due to the limited interconnection with Bulgaria.

See Figure 5.23.

Figure 5.23: MASD RUSSIA – Gas Before Coal and Coal Before Gas – 2025 – Existing and Low infrastructure levels.

2030

National Trends

FID projects improve significantly the dependence of Central and Eastern Europe on Russian supply (– 10 % to – 15 %). In some areas, the impact of the FID projects is even more visible:

- In Denmark and Sweden the dependence on Russia decreases from 42 % to 13 %.

- In the Balkans, Bulgaria, Serbia and Bosnia reduce their dependence by 15 % to 20 %.

However, some infrastructure limitations still prevent all EU countries to fully cooperate to mitigate further their dependence:

- Denmark and Sweden cannot make their neighbouring countries benefiting from their lower dependence,

- Eastern European countries cannot benefit from the lower dependence of Western Europe due to some limitations between the Netherlands and Belgium-UK, Germany and Belgium-France, Austria and Italy,

- Central-Eastern countries cannot entirely benefit from the lower dependence of the Balkan region due to infrastructure limitations between Bulgaria and Romania, and between Serbia-Bosnia and Croatia-Hungary.

COP 21 scenarios

Distributed Energy

FID projects significantly reduce the dependence of Central-Eastern Europe on Russian supply from 42 % down to 28 %. Furthermore, FID projects improve the cooperation in the Balkan region that reduces its dependence with all countries aligned on a 16 % dependence on Russian supply compared to a range between 3 % to 42 % in the Existing infrastructure level.

However, some infrastructure limitations remain:

- Between the UK-Belgium-France and their Eastern neighbouring countries (The Netherlands, Germany, Switzerland and Italy) with a 18 % dependence on the Russian supply.

- Between Greece (7 %) and Bulgaria (15 %) where infrastructure bottlenecks prevent the region to benefit from Greece’s low dependence.

- Between the South-East region and Central Europe, where bottlenecks prevent Germany, Austria and Hungary (28 %) to further align their dependence with the South of Europe (16 %).

- Between Denmark-Sweden (7 %) and their neighbouring countries where FID projects do not allow for further cooperation and alignment of the dependence on Russian supply in the region.

Global Ambition

FID projects, improve the cooperation of European countries so that:

- Central and North Eastern Europe show a homogenous dependence of 33 % (–14 % compared to the Existing infrastructure level).

- The Balkan region, from Bulgaria to Italy shows a homogenous dependence of 28 % compared to a range of dependence from 16 % to 47 % in the Existing infrastructure level.

However, some infrastructure limitations remain:

- Between the UK and Ireland (0 %) and continental Europe.

- Between the Iberian Peninsula (0 %) and the rest of Europe.

- Between the UK-Belgium-France and their Eastern neighbouring countries (Germany, Switzerland and Italy), with a gap of 15 % in their dependence on the Russian supply.

- Between the South-East region and Central Europe, where bottlenecks prevent Germany, Austria and Hungary (33 %) to further align their dependence with the South of Europe (28 %).

See Figure 5.24.

Figure 5.24: MASD RUSSIA – All scenarios – 2030 – Existing and Low infrastructure levels.

2040

National Trends

FID projects improve significantly the dependence of Central and Eastern Europe on Russian supply (– 15 %). In some areas, the impact of the FID projects is even more visible:

- The Baltic states and Finland can fully cooperate with the rest of the EU and share the same dependence (30 %), contributing to the overall reduction.

- Italy and Switzerland can fully align their dependence with France and Belgium (5 %).

- In the Balkans, Bulgaria, Serbia and Bosnia reduce their dependence to 13 %.

However, some infrastructure limitations still prevent all EU countries to fully cooperate to mitigate further their dependence:

- Eastern European countries cannot benefit from the lower dependence of Western Europe due to some limitations between the Netherlands and Belgium-UK, Germany and Belgium-France, Austria and Italy.

- Central-Eastern countries cannot entirely benefit from the lower dependence of the Balkan region due to infrastructure limitations between Bulgaria and Romania, and between Serbia-Bosnia and Croatia-Hungary.

COP 21 scenarios

Distributed Energy

FID projects almost fully alleviate the dependence of the EU on Russian gas supply.

However, some infrastructure limitations prevent from a total independence:

- Between the UK-Belgium-France (0 %) and their Eastern neighbouring countries (The Netherlands, Germany, Switzerland and Italy) with a 7 % dependence on the Russian supply.

- Between the South-East region and Central Europe, where bottlenecks prevent Germany, Austria and Hungary (7 %) to further align their dependence with the South of Europe (0 %).

- Between Denmark-Sweden (0 %) and their neighbouring countries (7 %) where FID projects do not allow for further cooperation and alignment of the dependence on Russian supply in the region.

- In the Baltic region between Lithuania (0 %) and Poland (7 %).

Global Ambition

FID projects, improve the cooperation of European countries so that:

- Western and Eastern European countries align further their dependence by halving gap between those countries (from 42 % difference to 21 %), benefiting the whole EU to reduce its dependence on Russian supply from 20 % to 14 %.

- Central-Eastern Europe shows a homogenous dependence of 26 % (–16 % compared to the Existing infrastructure level).

- In the Balkan region, Bulgaria Serbia and Bosnia show a homogenous dependence of 7 % similar to Western Europe and reduced compared to the Existing infrastructure level (range from 1 % to 42 %).

However, some infrastructure limitations remain:

- Between the UK and Ireland (0 %) and continental Europe.

- Between the Iberian Peninsula (0 %) and the rest of Europe.

- In the Baltics between Lithuania (6 %) and Poland (26 %).

- Between the UK-Belgium-France and their Eastern neighbouring countries (Germany, Switzerland and Italy), with a gap of more than 20 % in their dependence on the Russian supply.

- Between the South-East region and Central Europe, where bottlenecks prevent Germany, Austria, Slovenia, Croatia, Hungary and Romania (26 %) to further align their dependence with the South of Europe (6 %).

See Figure 5.25.

Figure 5.25: MASD RUSSIA – All scenarios – 2040 – Existing and Low infrastructure levels.

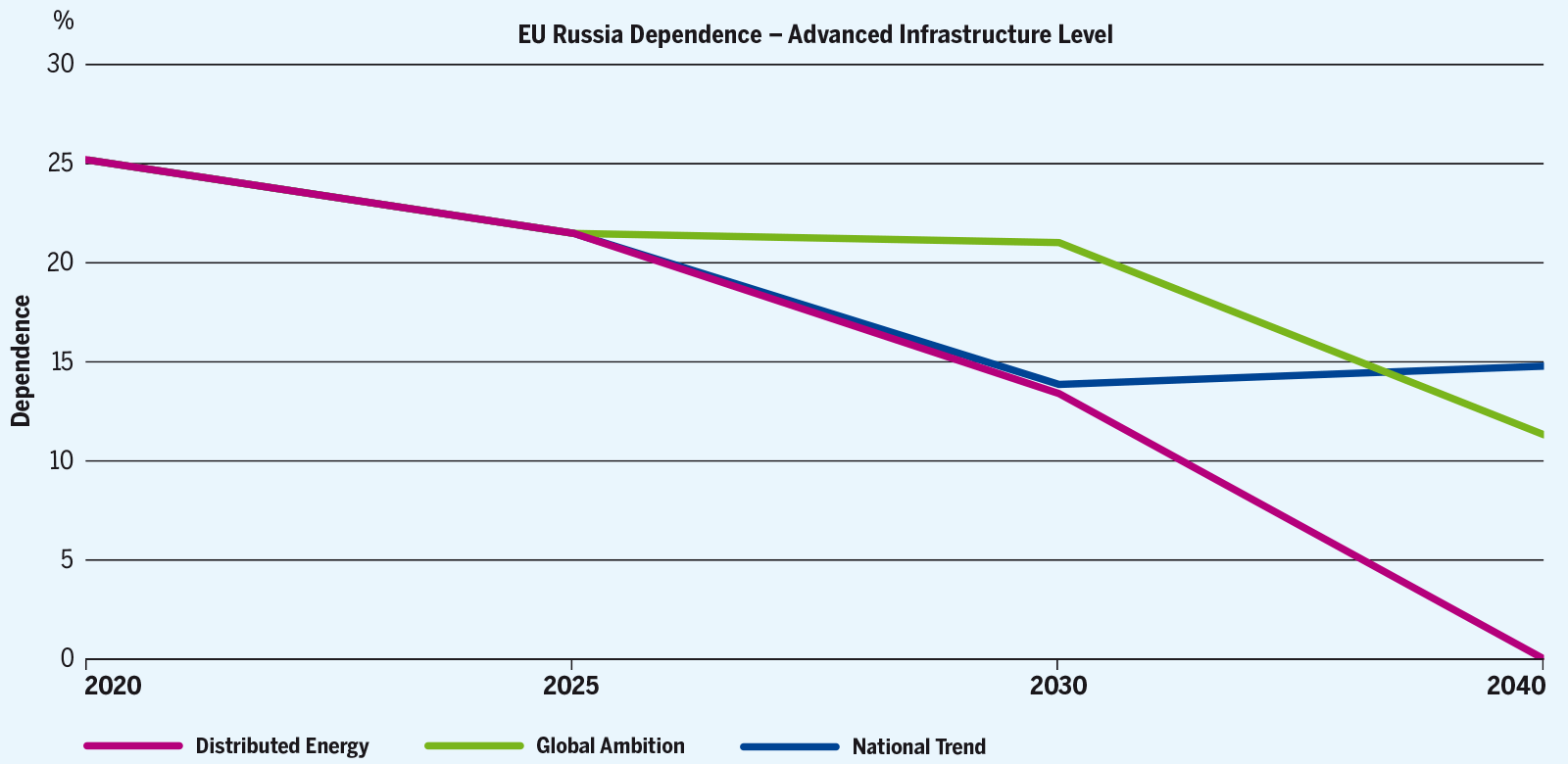

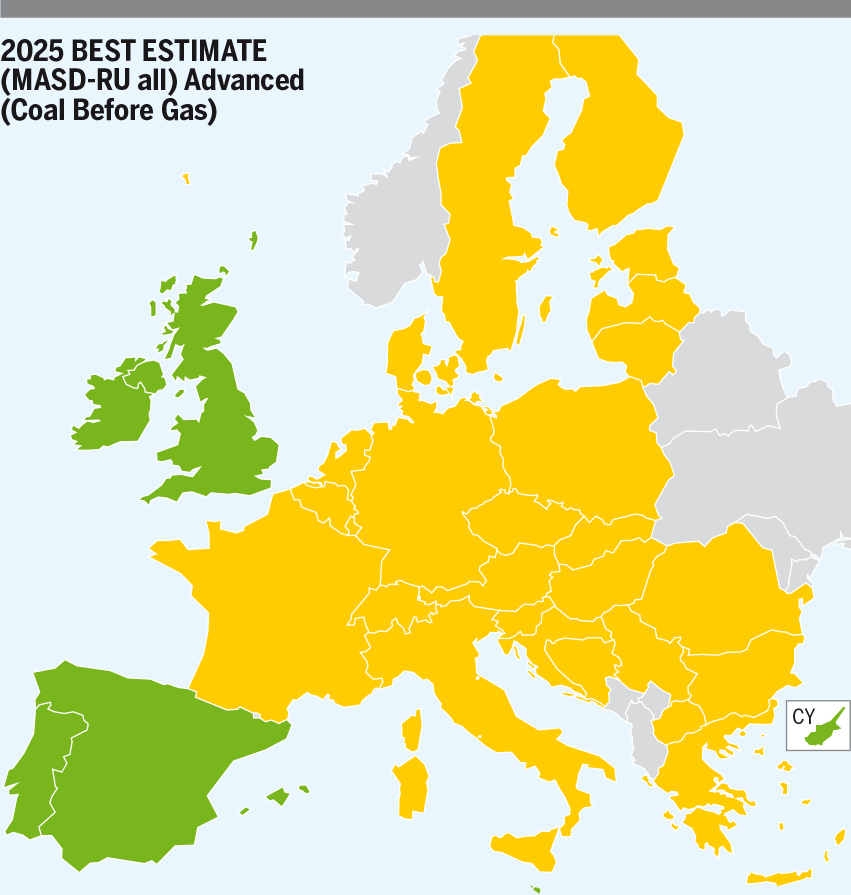

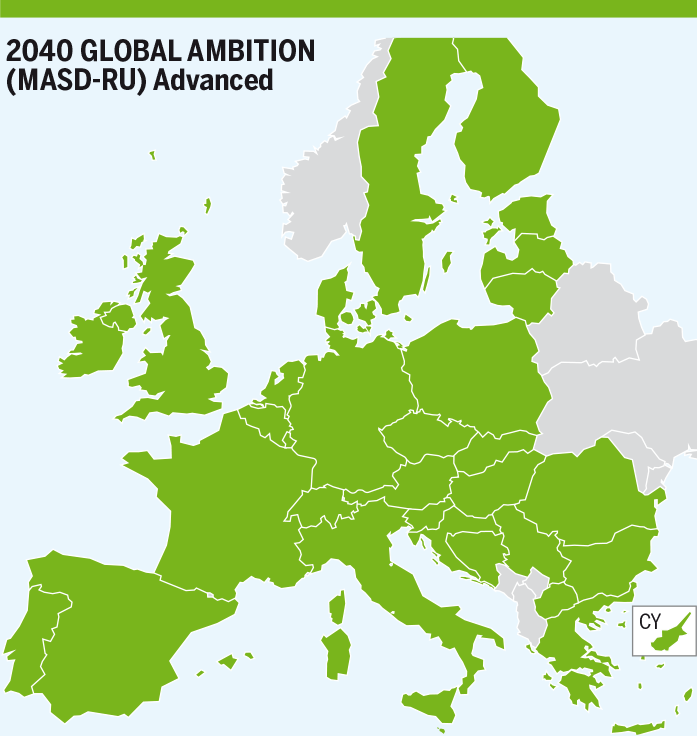

5.2.3.3 Advanced Infrastructure level

At European level, the advanced infrastructure level (FID + advanced projects) achieve to mitigate the dependence of the EU on the Russian supply by 2040 in Distributed Energy scenario. Furthermore, in National Trends and Global Ambition Advanced infrastructure projects further reduce the dependence of Europe on Russian supply by 3%, with a dependence of 10% in 2040 in Global Ambition.

Figure 5.26: European dependence on Russian supply in the Advanced infrastructure level.

2025

Coal Before Gas/Gas Before Coal

Advanced projects achieve to enable a full and efficient cooperation of EU countries which can reduce to the minimum the dependence of the EU on Russian supply (20 %).

Figure 5.27: MASD RUSSIA – Gas Before Coal and Coal Before Gas – 2025 – Low and Advanced infrastructure levels.

2030

Advanced projects achieve to enable a full and efficient cooperation of EU countries which can reduce to the minimum the dependence of the EU on Russian supply in all scenarios (16 % in National Trends, 16 % in Distributed Energy and 25 % in Global Ambition).

Figure 5.28: MASD RUSSIA – All scenarios – 2030 – Low and Advanced infrastructure levels.

2040

Advanced projects achieve to enable a full and efficient cooperation of EU countries which can reduce to the minimum the dependence of the EU on Russian supply in all scenarios (17 % in National Trends, 0 % in Distributed Energy and 13 % in Global Ambition).

Figure 5.29: MASD RUSSIA – All scenarios – 2040 – Low and Advanced infrastructure levels.

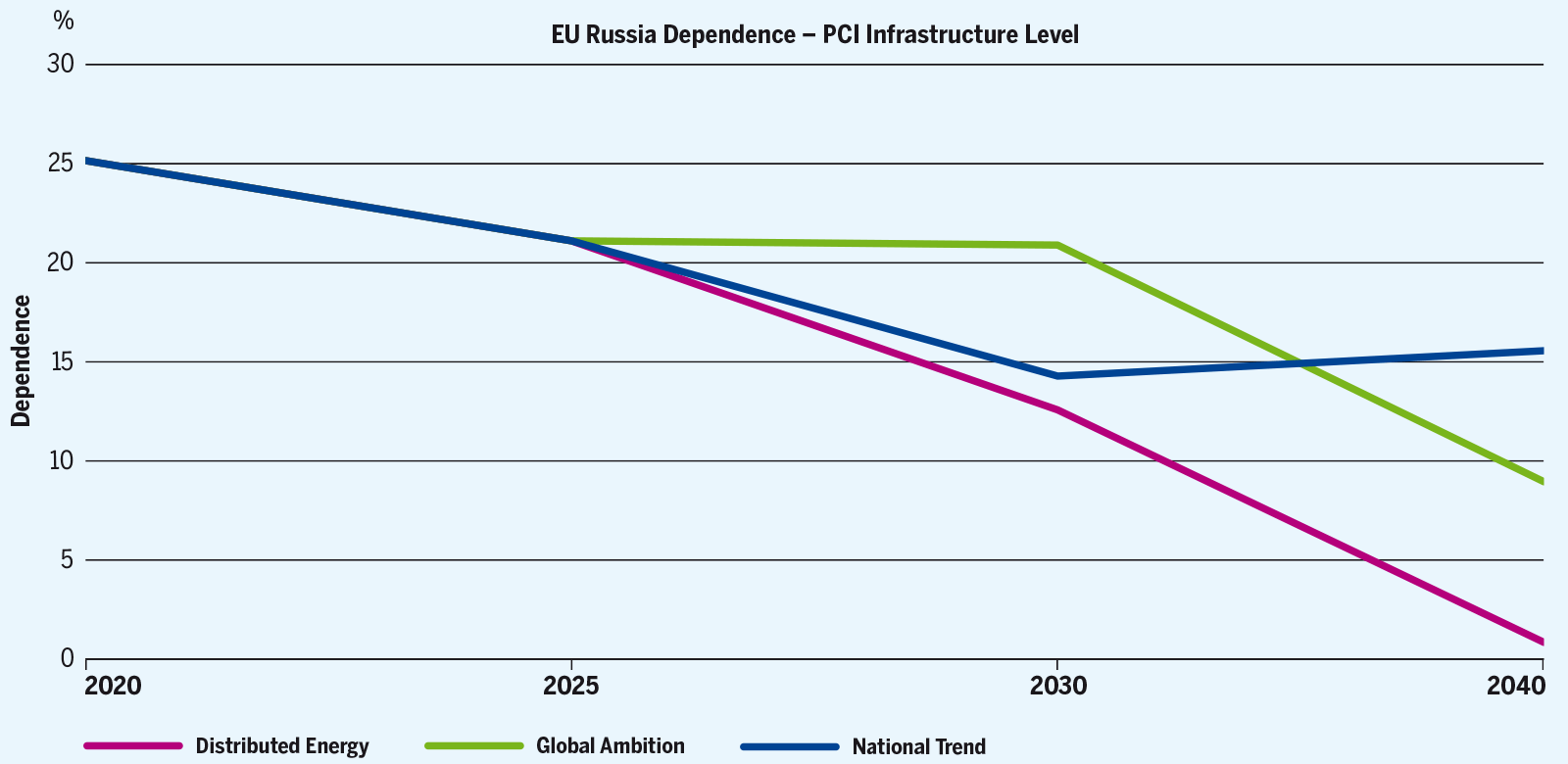

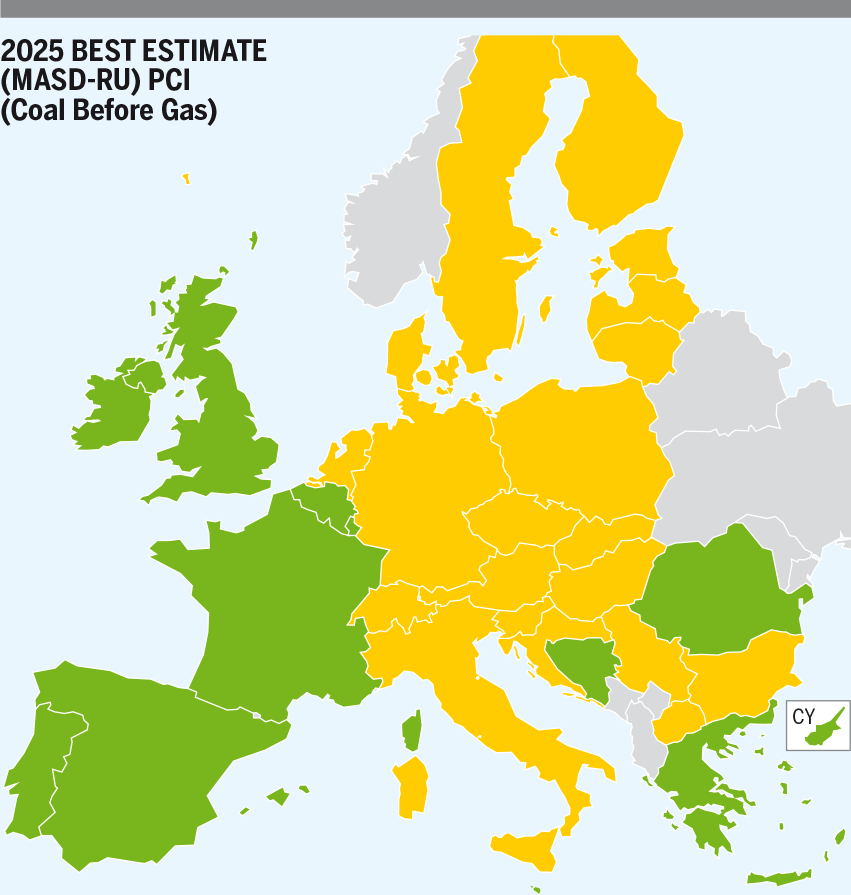

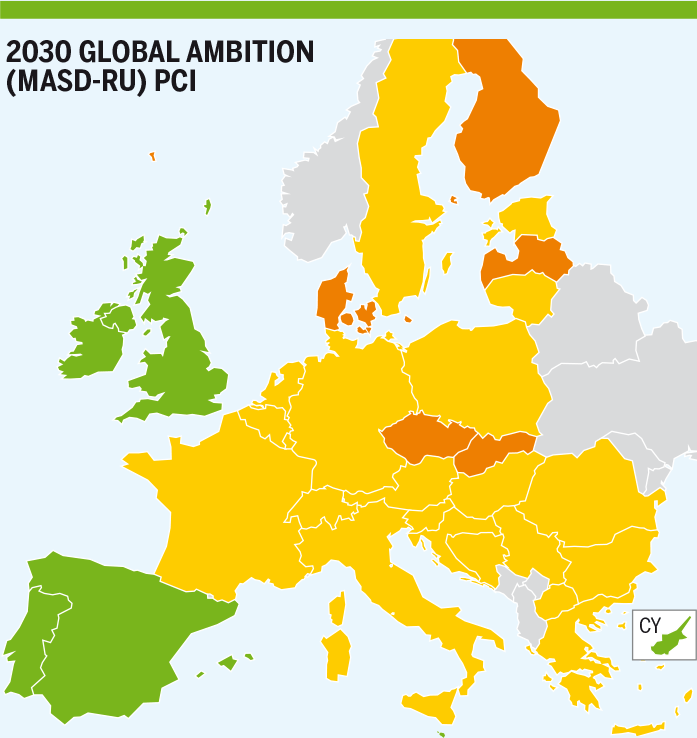

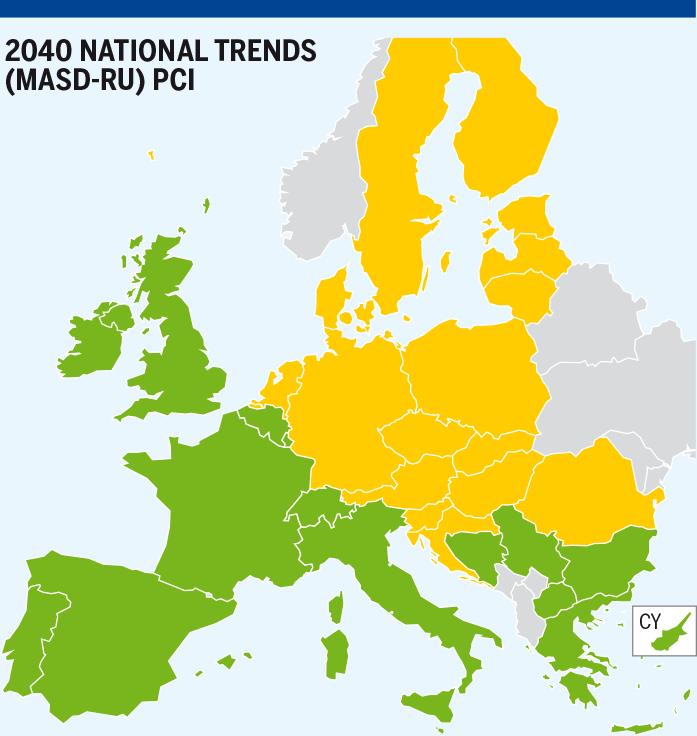

5.2.3.4 PCI Infrastructure level

At European level, the PCI infrastructure level (FID + PCI projects) shows very similar impact than the Advanced infrastructure level. PCI infrastructure level projects achieve to mitigate the dependence of the EU on the Russian supply by 2040 in Distributed Energy scenario. Furthermore, in National Trends and Global Ambition PCI infrastructure projects further reduce the dependence of Europe on Russian supply by 3 %, with a dependence of 10 % in 2040 in Global Ambition.

Figure 5.30: European dependence on Russian supply in the PCI infrastructure level.

However, at country level, the situation can remain more contrasted:

2025

PCI projects partially mitigate the situation in Central-Eastern Europe with a general decrease of the Russian dependence by 13 %. PCI projects additionally enhance:

- The cooperation between Denmark-Sweden and their neighbouring countries all showing the same level of dependence on Russian supply (28 % in Coal Before Gas scenario).

However, some infrastructure limitations remain:

- Germany and the Netherlands cannot benefit from the limited dependence of their western neighbours (UK, Belgium and France),

- In the Balkan region, Romania and Bulgaria-Serbia remain isolated since their dependence cannot either benefit to Central-Eastern Europe because of infrastructure limitations between Romania and Hungary and between Serbia and Croatia-Hungary. Additionally, Bulgaria cannot take advantage of the low dependence of Greece on Russian supply due to the limited interconnection.

See Figure 5.31.

Figure 5.31: MASD RUSSIA – Gas Before Coal and Coal Before Gas – 2025 – Low and PCI infrastructure levels.

2030

PCI projects mitigate (not totally but the overall dependence is close to 5 %) the risk of dependence from Russia for all the West and South East European countries thanks to the significant increase renewable and decarbonized gas production in Distributed Energy scenario which allows these countries to mitigate their dependence. Eastern European countries still show higher dependence, but if we compare to other infrastructure levels, this is mitigated thanks to projects which allow a better cooperation with the other countries. The infrastructure shows limitations that cannot allow Western European countries to increase their cooperation with Eastern countries.

National Trends

PCI projects significantly improve the dependence of Central and Eastern Europe on Russian supply (–10 % in average). In some areas, the impact of the PCI projects is even more visible:

- In the Balkans, Bulgaria, Serbia and Bosnia reduce their dependence down to 6 %.

However, some infrastructure limitations still prevent all EU countries to fully cooperate to mitigate further their dependence:

- Eastern European countries cannot benefit from the lower dependence of Western Europe due to some limitations between the Netherlands and Belgium-UK, between Germany and Belgium-France and between Austria and Italy,

- Central-Eastern countries cannot entirely benefit from the lower dependence of the Balkan region due to infrastructure limitations between Bulgaria and Romania, and between Serbia-Bosnia and Croatia-Hungary.

COP 21 scenarios

Distributed Energy

PCI projects significantly reduce the dependence of Central-Eastern Europe on Russian supply from 42 % down to 23 %. Furthermore, PCI projects improve the cooperation in some regions:

- In the Balkan region that reduces its dependence down to 3 % by cooperating further with Greece.

However, some infrastructure limitations remain:

- Between the UK-Belgium-France and their Eastern neighbouring countries (The Netherlands, Germany, Switzerland and Italy) with a gap of 18 % in their dependence on the Russian supply.

- Romania remains isolated and cannot benefit from the lower dependence of the Balkan region, neither can help the more dependent Central and Eastern Europe region because of its limited interconnection with Bulgaria and Hungary.

Global Ambition

PCI projects significantly improve the cooperation of European countries so that:

- Central and North Eastern Europe show a homogenous dependence of 30 % (– 17 % compared to the Existing infrastructure level).

- The Balkan region, from Bulgaria to Croatia shows a homogenous dependence of 18 % compared to a range of dependence from 16 % to 47 % in the Existing infrastructure level.

- Italy and Switzerland can cooperate efficiently with their Western neighbours to share the same dependence (18 %).

However, some infrastructure limitations remain:

- Between the UK and Ireland (0 %) and continental Europe.

- Between the Iberian Peninsula (0 %) and the rest of Europe.

- Between the UK-Belgium-France-Switzerland-Italy (19 %) and their Eastern neighbouring countries (the Netherlands, Germany and Austria), with a gap of 10 % in their dependence on the Russian supply.

- Between the South-East region and Central Europe, where bottlenecks prevent Germany, Austria, Slovenia and Hungary (30 %) to further align their dependence with the South of Europe (18 %).

- Romania remains isolated and cannot benefit from the lower dependence of the Balkan region, neither can help the more dependent Central and Eastern Europe region because of its limited interconnection with Bulgaria and Hungary.

Figure 5.32: MASD RUSSIA – All scenarios – 2030 – Low and PCI infrastructure levels.

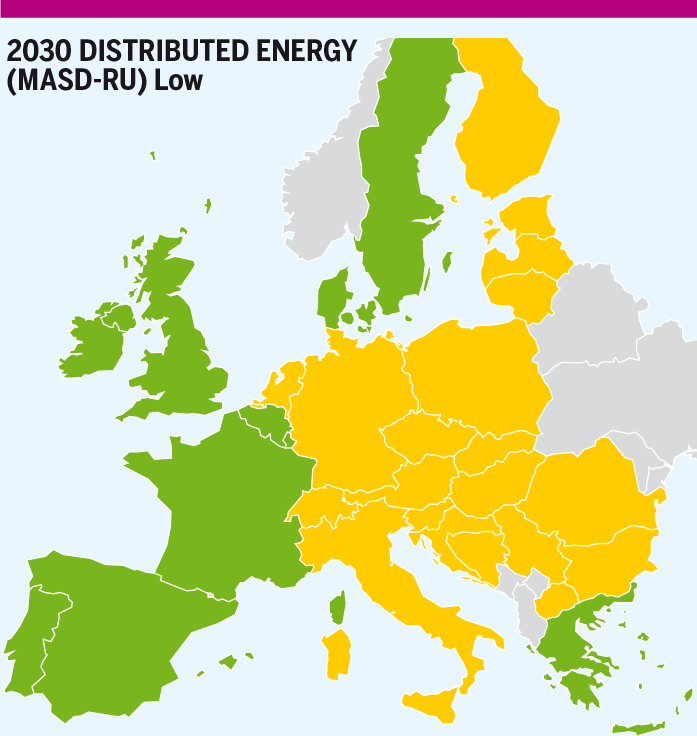

2040

National Trends

PCI projects reduce significantly the dependence of Central and Eastern Europe on Russian supply (– 17 %). In some areas, the impact of the PCI projects is even more visible:

- Italy and Switzerland can better cooperate with France and Belgium and fully mitigate their dependence on Russian supply.

- In the Balkans, Bulgaria, Serbia and Bosnia reduce their dependence to 10 %.

However, some infrastructure limitations still prevent all EU countries to fully cooperate to mitigate further their dependence:

- Eastern European countries cannot benefit from the lower dependence of Western Europe due to some limitations between the Netherlands and Belgium-UK, Germany and Belgium-France, and between Austria and Italy,

- Central-Eastern countries cannot entirely benefit from the lower dependence of the Balkan region due to infrastructure limitations between Bulgaria and Romania, and between Serbia-Bosnia and Croatia-Hungary.

COP 21 scenarios

Distributed Energy

PCI projects achieve to fully mitigate the dependence of Europe on Russian gas supply in 2040. No infrastructure limitation is identified.

Global Ambition

PCI projects significantly improve the cooperation of European countries so that:

- Western Europe (Ireland, the UK, Belgium, France, Switzerland, Italy and the Iberian Peninsula) are no longer dependent on Russian supply.

- The South Eastern countries (Greece, Bulgaria, Serbia and Bosnia) is no longer dependent on the Russian supply in 2040.

- Central-Eastern European countries align further their dependence by compared to the Low infrastructure level (from 26 % to 23 %), benefiting the whole EU to reduce its dependence on Russian supply from 14 % to 11 %.

- The Balkan region (Greece, Bulgaria, Serbia and Bosnia) is no longer dependent on the Russian supply in 2040.

However, some infrastructure limitations remain:

- In the Baltics between Lithuania (0 %) and Poland (24 %).

- Between the UK-Belgium-France-Switzerland-Italy and their Eastern neighbouring countries (the Netherlands, Germany, Austria and Slovenia), with a gap of 23 % in their dependence on the Russian supply.

- Between the South-East region and Central Europe, where bottlenecks prevent Germany, Austria, Slovenia, Croatia, Hungary and Romania (24 %) to further align their dependence with the South of Europe (0 %).

See Figure 5.33.

Figure 5.33: MASD RUSSIA – All scenarios – 2040 – Low and PCI infrastructure levels.